Costco 2001 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2001 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COSTCO WHOLESALE CORPORATION

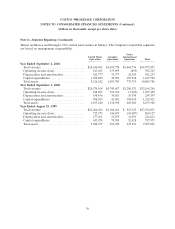

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

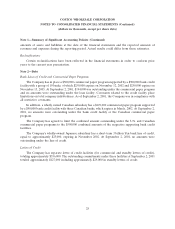

Note 2—Debt (Continued)

Maturities of long-term debt during the next five fiscal years and thereafter are as follows:

2002 ................................................... $ 16,677

2003 ................................................... 3,880

2004 ................................................... 1,218

2005 ................................................... 301,344

2006 ................................................... 1,486

Thereafter ............................................... 551,465

Total ............................................... $876,070

Note 3—Leases

The Company leases land and/or warehouse buildings at 71 of the 345 warehouses open at Septem-

ber 2, 2001, and certain other office and distribution facilities under operating leases with remaining terms

ranging from 1 to 30 years. These leases generally contain one or more of the following options which the

Company can exercise at the end of the initial lease term: (a) renewal of the lease for a defined number of

years at the then fair market rental rate; (b) purchase of the property at the then fair market value; or

(c) right of first refusal in the event of a third party purchase offer. Certain leases provide for periodic

rental increases based on the price indices and some of the leases provide for rents based on the greater of

minimum guaranteed amounts or sales volume. Contingent rents have not been material.

Additionally, the Company leases certain equipment and fixtures under short-term operating leases

that permit the Company to either renew for a series of one-year terms or to purchase the equipment at

the then fair market value.

Aggregate rental expense for fiscal 2001, 2000, and 1999, was $70,394, $67,886, and $59,263, respec-

tively. Future minimum payments during the next five fiscal years and thereafter under non-cancelable

leases with terms in excess of one year, at September 2, 2001, were as follows:

2002 ................................................... $ 70,936

2003 ................................................... 69,329

2004 ................................................... 67,380

2005 ................................................... 66,331

2006 ................................................... 65,827

Thereafter ............................................... 639,547

Total minimum payments ................................. $979,350

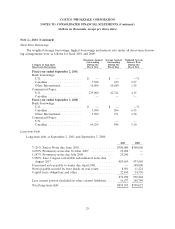

Note 4—Stock Options

The Company’s 1993 Combined Stock Grant and Stock Option Plan (the New Stock Option Plan)

provides for the issuance of up to 60 million shares of its common stock upon the exercise of stock options

and up to 3,333,332 shares through stock grants. Prior to the merger of The Price Company and Costco

Wholesale Corporation, various incentive and non-qualified stock option plans existed which allowed

certain key employees and directors to purchase or be granted common stock of The Price Company and

31