Columbia Sportswear 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

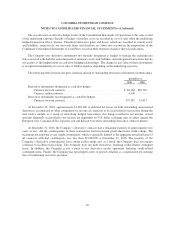

The classification of effective hedge results in the Consolidated Statements of Operations is the same as that

of the underlying exposure. Results of hedges of product costs are recorded in cost of sales when the underlying

hedged transaction affects income. Unrealized derivative gains and losses, which are recorded in current assets

and liabilities, respectively, are non-cash items and therefore are taken into account in the preparation of the

Condensed Consolidated Statements of Cash Flows based on their respective balance sheet classifications.

The Company uses derivative instruments not formally designated as hedges to manage the exchange rate

risk associated with both the remeasurement of monetary assets and liabilities and anticipated transactions that do

not qualify as the hedged items in cash flow hedging relationships. The change in fair value of these instruments

is recognized immediately in cost of sales or SG&A expense, depending on the underlying exposure.

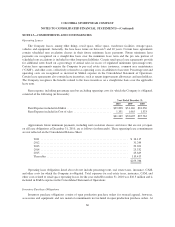

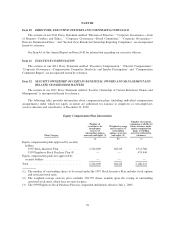

The following table presents the gross notional amount of outstanding derivative instruments (in thousands):

December 31,

2010 2009

Derivative instruments designated as cash flow hedges:

Currency forward contracts ....................................... $ 86,260 $82,730

Currency option contracts ........................................ 4,500 —

Derivative instruments not designated as cash flow hedges:

Currency forward contracts ....................................... 179,382 61,017

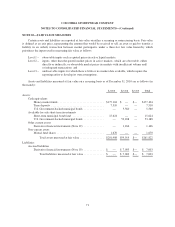

At December 31, 2010, approximately $1,349,000 of deferred net losses on both outstanding and matured

derivatives accumulated in other comprehensive income are expected to be reclassified to net income during the

next twelve months as a result of underlying hedged transactions also being recorded in net income. Actual

amounts ultimately reclassified to net income are dependent on U.S. dollar exchange rates in effect against the

European euro, Canadian dollar, Japanese yen and Korean won when outstanding derivative contracts mature.

At December 31, 2010, the Company’s derivative contracts had a remaining maturity of approximately two

years or less. All the counterparties to these transactions had investment grade short-term credit ratings. The

maximum net exposure to any single counterparty, which is generally limited to the aggregate unrealized gain of

all contracts with that counterparty, was less than $1,000,000 at December 31, 2010. The majority of the

Company’s derivative counterparties have strong credit ratings and, as a result, the Company does not require

collateral to facilitate transactions. The Company does not hold derivatives featuring credit-related contingent

terms. In addition, the Company is not a party to any derivative master agreement featuring credit-related

contingent terms. Finally, the Company has not pledged assets or posted collateral as a requirement for entering

into or maintaining derivative positions.

69