Columbia Sportswear 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS

AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is listed on the NASDAQ Global Select Market and trades under the symbol “COLM.”

At February 25, 2011, we had approximately 440 shareholders of record.

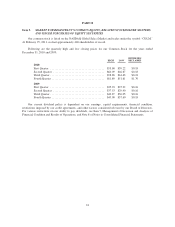

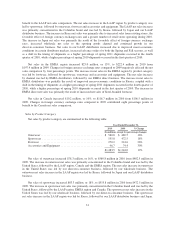

Following are the quarterly high and low closing prices for our Common Stock for the years ended

December 31, 2010 and 2009:

HIGH LOW

DIVIDENDS

DECLARED

2010

First Quarter ...................................... $53.68 $39.22 $0.18

Second Quarter .................................... $60.09 $46.67 $0.18

Third Quarter ...................................... $58.86 $44.43 $0.18

Fourth Quarter ..................................... $61.89 $51.61 $1.70

2009

First Quarter ...................................... $35.93 $25.22 $0.16

Second Quarter .................................... $37.53 $29.90 $0.16

Third Quarter ...................................... $42.87 $30.05 $0.16

Fourth Quarter ..................................... $45.00 $37.60 $0.18

Our current dividend policy is dependent on our earnings, capital requirements, financial condition,

restrictions imposed by our credit agreements, and other factors considered relevant by our Board of Directors.

For various restrictions on our ability to pay dividends, see Item 7, Management’s Discussion and Analysis of

Financial Condition and Results of Operations, and Note 8 of Notes to Consolidated Financial Statements.

24