Columbia Sportswear 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.General and administrative expenses increased $31.3 million, or 10%, to 27.4% of net sales in 2009 from

23.4% of net sales for the comparable period in 2008. The increase in general and administrative expenses as a

percentage of net sales was primarily due to incremental operating costs in support our direct-to-consumer

initiatives and the expansion of our in-house sales organization, partially offset by lower bad debt expense.

Depreciation and amortization included in SG&A expense totaled $35.5 million for 2009, compared to

$30.1 million for the same period in 2008.

Impairment of Acquired Intangible Assets: We did not incur any impairment of acquired intangible

assets in 2009. During the fourth quarter of 2008, we incurred a $24.7 million non-cash pre-tax charge, or

approximately $0.46 per diluted share after tax, for the write-down of acquired intangible assets related to our

acquisitions of the Pacific Trail and Montrail brands in 2006. The impairment charge related primarily to

goodwill and trademarks and resulted from our annual evaluation of intangible asset values. These brands had not

achieved our sales and profitability objectives and the deterioration in the macro-economic environment and

resulting effect on consumer demand have decreased the probability of realizing these objectives in the near

future. We remain committed to marketing and distributing Montrail-branded footwear through the outdoor

specialty, running specialty and sporting goods channels. Beginning in 2009, Pacific Trail products are sold

primarily through licensing arrangements.

Net Licensing Income: Net licensing income increased $2.4 million, or 40%, to $8.4 million in 2009 from

$6.0 million in 2008. The increase in net licensing income was primarily due to increased apparel and footwear

licensing in the LAAP region. Products distributed by our licensees in 2009 included apparel, footwear, leather

accessories, eyewear, socks, insulated products including soft-sided coolers, camping gear, bicycles, home

products, luggage, watches and other accessories.

Interest Income, Net: Interest income was $2.1 million in 2009 compared to $7.6 million in 2008. The

decrease in interest income was almost entirely due to significantly lower interest rates in 2009 compared to

2008. Interest expense was nominal in 2009 and 2008.

Income Tax Expense: Our provision for income taxes decreased to $22.8 million in 2009 from

$31.2 million in 2008. This decrease resulted from lower income before tax, partially offset by an increase in our

effective income tax rate to 25.4% in 2009 compared to 24.7% in 2008. Our 2009 effective tax rate varied from

the U.S. statutory rate due to foreign tax credits and the favorable settlement of uncertain tax positions.

Liquidity and Capital Resources

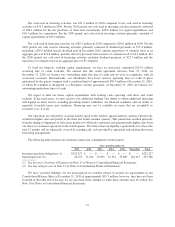

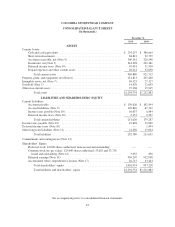

Our primary ongoing funding requirements are for working capital, investing activities associated with the

expansion of our global operations and general corporate needs. At December 31, 2010, we had total cash and

cash equivalents of $234.3 million compared to $386.7 million at December 31, 2009. In addition, we had short-

term investments of $68.8 million at December 31, 2010 compared to $22.8 million at December 31, 2009.

Net cash provided by operating activities was $23.5 million in 2010 compared to $214.4 million in 2009.

The decrease in cash provided by operating activities was primarily the result of increases in inventory and

accounts receivable in 2010 compared to decreases in accounts receivable and inventory in 2009, partially offset

by increases in accounts payable and accrued liabilities in 2010 compared to a net decrease in accounts payable

and accrued liabilities in 2009. The increase in inventory was due to a larger volume of excess fall 2010

inventory designated for sale primarily through our own outlet retail stores compared to fall 2009 inventory,

earlier receipt of spring 2011 inventory compared to spring 2010 inventory, increased 2010 replenishment

inventory compared to 2009 and incremental inventory to support increased direct-to-consumer sales. The

increase in accounts receivable was in line with the 19% increase in net sales and was also due to an increase in

close-out product sales and shipment of spring 2011 advance orders close to the end of the 2010 period.

36