Columbia Sportswear 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

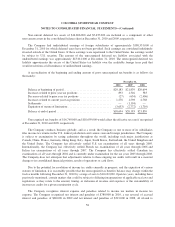

December 31, 2010 and 2009, inventory purchase obligations were $323,327,000 and $258,069,000,

respectively. To support certain inventory purchase obligations, the Company maintains unsecured and

uncommitted lines of credit available for issuing import letters of credit. At December 31, 2010 and 2009, the

Company had letters of credit of $439,000 and $7,771,000, respectively, outstanding for inventory purchase

obligations.

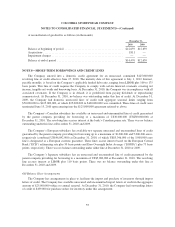

Litigation

The Company is a party to various legal claims, actions and complaints from time to time. Although the

ultimate resolution of legal proceedings cannot be predicted with certainty, management believes that disposition

of these matters will not have a material adverse effect on the Company’s consolidated financial statements.

Indemnities and Guarantees

During its normal course of business, the Company has made certain indemnities, commitments and

guarantees under which it may be required to make payments in relation to certain transactions. These include

(i) intellectual property indemnities to the Company’s customers and licensees in connection with the use, sale

and/or license of Company products, (ii) indemnities to various lessors in connection with facility leases for

certain claims arising from such facility or lease, (iii) indemnities to customers, vendors and service providers

pertaining to claims based on the negligence or willful misconduct of the Company, (iv) executive severance

arrangements and (v) indemnities involving the accuracy of representations and warranties in certain contracts.

The duration of these indemnities, commitments and guarantees varies, and in certain cases, may be indefinite.

The majority of these indemnities, commitments and guarantees do not provide for any limitation of the

maximum potential for future payments the Company could be obligated to make. The Company has not

recorded any liability for these indemnities, commitments and guarantees in the accompanying Consolidated

Balance Sheets.

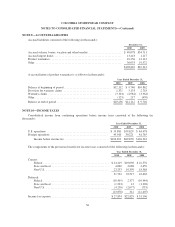

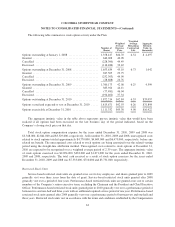

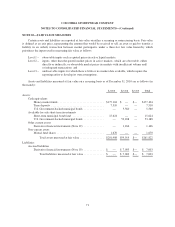

NOTE 14—SHAREHOLDERS’ EQUITY

Since the inception of the Company’s stock repurchase plan in 2004 through December 31, 2010, the

Company’s Board of Directors has authorized the repurchase of $500,000,000 of the Company’s common stock.

As of December 31, 2010, the Company had repurchased 9,190,890 shares under this program at an aggregate

purchase price of approximately $421,237,000. During the year ended December 31, 2010, the Company

repurchased an aggregate of $13,838,000 of common stock under the stock repurchase plan, of which $4,339,000

was recorded as a reduction to retained earnings; otherwise, the aggregate purchase price would have resulted in

a negative common stock carrying amount. Shares of the Company’s common stock may be purchased in the

open market or through privately negotiated transactions, subject to market conditions. The repurchase program

does not obligate the Company to acquire any specific number of shares or to acquire shares over any specified

period of time.

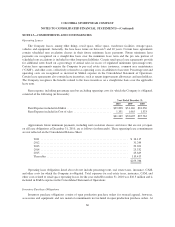

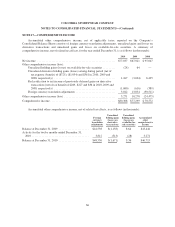

NOTE 15—STOCK-BASED COMPENSATION

1997 Stock Incentive Plan

The Company’s 1997 Stock Incentive Plan (the “Plan”) provides for issuance of up to 8,900,000 shares of

the Company’s Common Stock, of which 1,711,768 shares were available for future grants under the Plan at

December 31, 2010. The Plan allows for grants of incentive stock options, non-statutory stock options, restricted

stock awards, restricted stock units and other stock-based awards. The Company uses original issuance shares to

satisfy share-based payments.

61