Columbia Sportswear 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Net cash used in investing activities was $91.2 million in 2010 compared to net cash used in investing

activities of $33.2 million in 2009. For the 2010 period, net cash used in investing activities primarily consisted

of $46.1 million for the net purchases of short-term investments, $28.8 million for capital expenditures and

$16.3 million for acquisitions. For the 2009 period, net cash used in investing activities primarily consisted of

capital expenditures of $33.1 million.

Net cash used in financing activities was $82.3 million in 2010 compared to $29.6 million in 2009. For the

2010 period, net cash used in financing activities primarily consisted of dividend payments of $75.4 million,

including a $50.5 million special dividend paid in December 2010, and the repurchase of common stock at an

aggregate price of $13.8 million, partially offset by proceeds from issuance of common stock of $6.5 million. For

the 2009 period, net cash used in financing activities included dividend payments of $22.3 million and the

repurchase of common stock at an aggregate price of $7.4 million.

To fund our domestic working capital requirements, we have an unsecured, committed $125.0 million

revolving line of credit available. We entered into this credit agreement effective June 15, 2010. At

December 31, 2010, no balance was outstanding under this line of credit and we were in compliance with all

associated covenants. Internationally, our subsidiaries have local currency operating lines of credit in place

guaranteed by the parent company with a combined limit of approximately $81.9 million at December 31, 2010,

of which $3.4 million is designated as a European customs guarantee. At December 31, 2010, no balance was

outstanding under these lines of credit.

We expect to fund our future capital expenditures with existing cash, operating cash flows and credit

facilities. If the need arises, we may need to seek additional funding. Our ability to obtain additional financing

will depend on many factors, including prevailing market conditions, our financial condition, and our ability to

negotiate favorable terms and conditions. Financing may not be available on terms that are acceptable or

favorable to us, if at all.

Our operations are affected by seasonal trends typical in the outdoor apparel industry, and have historically

resulted in higher sales and profits in the third and fourth calendar quarters. This pattern has resulted primarily

from the timing of shipments of fall season products to wholesale customers and proportionally higher sales from

our direct-to-consumer operations in the fourth quarter. We believe that our liquidity requirements for at least the

next 12 months will be adequately covered by existing cash, cash provided by operations and existing short-term

borrowing arrangements.

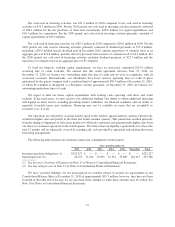

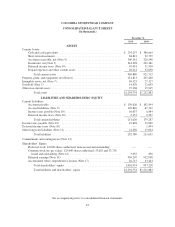

The following table presents our estimated contractual commitments (in thousands):

Year ended December 31,

2011 2012 2013 2014 2015 Thereafter Total

Inventory purchase obligations (1) ..... $323,327 $ — $ — $ — $ — $ — $323,327

Operating leases (2): ................ 34,115 31,244 29,031 25,332 23,649 110,415 253,786

(1) See Inventory Purchase Obligations in Note 13 of Notes to Consolidated Financial Statements.

(2) See Operating Leases in Note 13 of Notes to Consolidated Financial Statements.

We have recorded liabilities for net unrecognized tax benefits related to income tax uncertainties in our

Consolidated Balance Sheet at December 31, 2010 of approximately $19.7 million; however, they have not been

included in the table above because we are uncertain about whether or when these amounts may be settled. See

Note 10 of Notes to Consolidated Financial Statements.

37