Columbia Sportswear 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

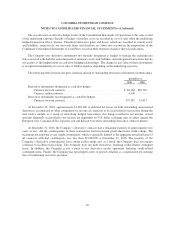

Committee of the Board of Directors, and are based on continued service and, in some instances, on individual

performance and/or Company performance. For the majority of restricted stock units granted, the number of shares

issued on the date the restricted stock units vest is net of the minimum statutory withholding requirements that the

Company pays in cash to the appropriate taxing authorities on behalf of its employees. For the years ended

December 31, 2010, 2009 and 2008, the Company withheld 18,721, 19,819 and 5,951 shares, respectively, to satisfy

$853,000, $624,000 and $243,000 of employees’ tax obligations, respectively.

The fair value of service-based and performance-based restricted stock units is discounted by the present

value of the estimated future stream of dividends over the vesting period using the Black-Scholes model. The

relevant inputs and assumptions used in the Black-Scholes model to compute the discount are the vesting period,

expected annual dividend yield and closing price of the Company’s common stock on the date of grant.

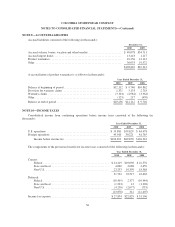

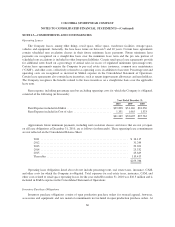

The following table presents the weighted average assumptions for the years ended December 31:

2010 2009 2008

Vesting period ....................................... 3.75 years 3.82 years 3.06 years

Expected dividend yield ............................... 1.56% 2.19% 1.56%

Estimated average fair value per restricted stock unit granted . . $ 43.95 $ 27.14 $ 39.27

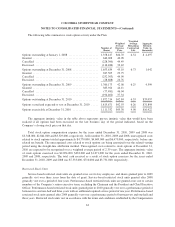

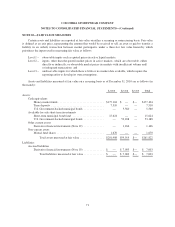

The following table summarizes the restricted stock unit activity under the Plan:

Number of

Shares

Weighted Average

Grant Date Fair Value

Per Share

Restricted stock units outstanding at January 1, 2008 ............. 159,870 $55.31

Granted ............................................. 168,347 39.27

Vested .............................................. (20,625) 51.85

Forfeited ............................................ (47,083) 49.25

Restricted stock units outstanding at December 31, 2008 .......... 260,509 46.32

Granted ............................................. 136,327 27.14

Vested .............................................. (65,935) 53.41

Forfeited ............................................ (44,381) 41.22

Restricted stock units outstanding at December 31, 2009 .......... 286,520 36.35

Granted ............................................. 128,525 43.95

Vested .............................................. (62,417) 42.95

Forfeited ............................................ (23,833) 42.44

Restricted stock units outstanding at December 31, 2010 .......... 328,795 $37.63

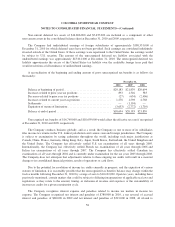

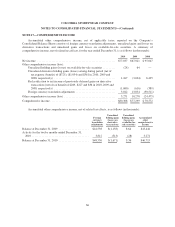

Restricted stock unit compensation expense for the years ended December 31, 2010, 2009 and 2008 was

$3,382,000, $3,492,000 and $2,973,000, respectively. At December 31, 2010, 2009 and 2008, unrecognized costs

related to restricted stock units totaled approximately $5,540,000, $4,216,000 and $5,499,000, respectively,

before any related tax benefit. The unrecognized costs related to restricted stock units are being amortized over

the related vesting period using the straight-line attribution method. These unrecognized costs at December 31,

2010 are expected to be recognized over a weighted average period of 1.82 years. The total grant date fair value

of restricted stock units vested during the year ended December 31, 2010, 2009 and 2008 was $2,681,000,

$3,522,000 and $1,069,000, respectively.

64