Columbia Sportswear 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

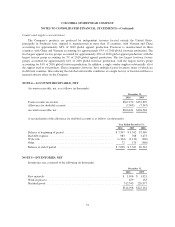

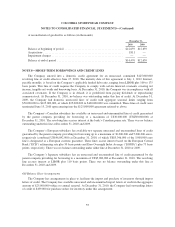

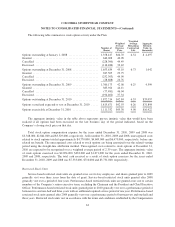

The following is a reconciliation of the statutory federal income tax rate to the effective rate reported in the

financial statements:

Year Ended

December 31,

2010 2009 2008

(percent of income)

Provision for federal income taxes at the statutory rate ....................... 35.0% 35.0% 35.0%

State and local income taxes, net of federal benefit .......................... 2.6 1.9 0.8

Non-U.S. income taxed at different rates .................................. (2.3) 0.4 (4.1)

Foreign tax credits ................................................... (3.5) (5.8) (3.2)

Reduction of accrued income taxes ...................................... (4.0) (4.1) (3.3)

Tax-exempt interest .................................................. (0.2) (0.5) (0.8)

Other .............................................................. (1.0) (1.5) 0.3

Actual provision for income taxes ....................................... 26.6% 25.4% 24.7%

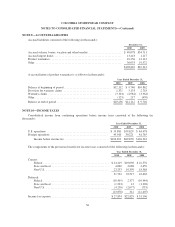

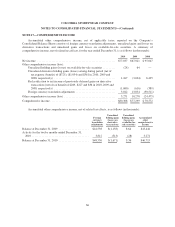

Significant components of the Company’s deferred taxes consisted of the following (in thousands):

December 31,

2010 2009

Deferred tax assets:

Non-deductible accruals and allowances ............................. $26,905 $18,979

Capitalized inventory costs ........................................ 21,065 15,326

Stock compensation .............................................. 6,157 5,399

Net operating loss carryforward .................................... 6,894 4,734

Depreciation and amortization ..................................... 1,722 582

Tax credits ..................................................... 11,187 —

Other ......................................................... 414 1,633

74,344 46,653

Valuation allowance ............................................. (7,261) (5,163)

Net deferred tax assets ............................................ 67,083 41,490

Deferred tax liabilities:

Deductible accruals and allowance .................................. (593) (1,129)

Depreciation and amortization ..................................... (7,182) (4,624)

Foreign currency loss ............................................ — (1,475)

Other ......................................................... (1,564) (1,368)

(9,339) (8,596)

Total ............................................................. $57,744 $32,894

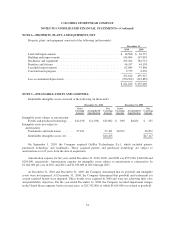

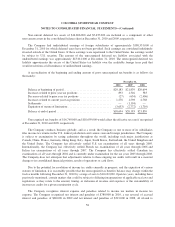

The Company had net operating loss carryforwards at December 31, 2010 and 2009 in certain international

tax jurisdictions of $67,800,000 and $50,338,000, respectively, which will begin to expire in 2014. The net

operating losses result in a deferred tax asset at December 31, 2010 of $6,894,000, which was subject to a

$6,894,000 valuation allowance, and a deferred tax asset at December 31, 2009 of $4,734,000, which was subject

to a $4,734,000 valuation allowance. To the extent that the Company reverses a portion of the valuation

allowance, the adjustment would be recorded as a reduction to income tax expense.

57