Columbia Sportswear 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

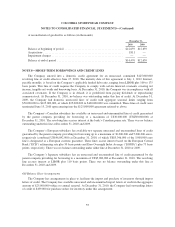

Recent Accounting Pronouncements:

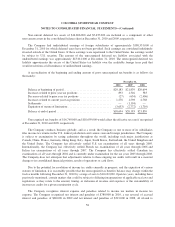

In January 2010, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

(“ASU”) 2010-06, Improving Disclosures about Fair Value Measurements. ASU 2010-06 requires additional

disclosures about fair value measurements including transfers in and out of Levels 1 and 2 and a higher level of

disaggregation for the different types of financial instruments. For the reconciliation of Level 3 fair value

measurements, information about purchases, sales, issuances and settlements are presented separately. This

standard is effective for interim and annual reporting periods beginning after December 15, 2009 with the

exception of revised Level 3 disclosure requirements, which are effective for interim and annual reporting

periods beginning after December 15, 2010. The adoption of this standard did not have a material effect on the

Company’s consolidated financial position, statement of operations or cash flows. See Note 20.

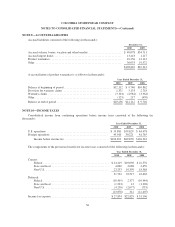

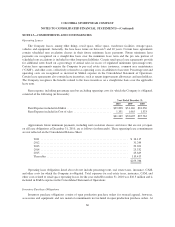

NOTE 3—CONCENTRATIONS

Cash and Cash Equivalents

At December 31, 2010, approximately 70% of the Company’s cash and cash equivalents were concentrated

in domestic and international money market mutual funds. All of the Company’s money market mutual funds

were assigned top-tier investment grade credit ratings.

Short-term Investments

At December 31, 2010, approximately 77% of the Company’s short-term investments were concentrated in

short-term municipal debt securities whose interest and principal payments were 100% collateralized in an

escrow account by U.S. Treasury Securities, U.S. Government Securities or U.S. Government Agency Securities,

and approximately 23% were invested in a short-term municipal bond fund.

Trade Receivables

At December 31, 2010 and 2009, the Company had one customer in its Canadian segment that accounted for

approximately 11.9% and 15.5% of consolidated accounts receivable, respectively. No single customer accounted

for 10% or more of consolidated revenues for any of the years ended December 31, 2010, 2009 or 2008.

Derivatives

The Company uses derivative instruments primarily to hedge the exchange rate risk of anticipated

transactions denominated in non-functional currencies that are designated and qualify as cash flow hedges. From

time to time, the Company also uses derivative instruments to economically hedge the exchange rate risk of

certain investment positions, to hedge balance sheet re-measurement risk and to hedge other anticipated

transactions that do not qualify as cash flow hedges. At December 31, 2010, the Company’s derivative contracts

had a remaining maturity of approximately two years or less. All the counterparties to these transactions had

investment grade short-term credit ratings. The maximum net exposure to any single counterparty, which is

generally limited to the aggregate unrealized gain of all contracts with that counterparty, was less than

$1,000,000 at December 31, 2010. The majority of the Company’s derivative counterparties have strong credit

ratings and as a result, the Company does not require collateral to facilitate transactions. See Note 19 for further

disclosures concerning derivatives.

52