Columbia Sportswear 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

benefit to the LAAP net sales comparison. The net sales increase in the LAAP region by product category was

led by sportswear, followed by outerwear, footwear and accessories and equipment. The LAAP net sales increase

was primarily concentrated in the Columbia brand and was led by Korea, followed by Japan and our LAAP

distributor business. The increase in Korea net sales was primarily due to increased sales from existing stores, the

favorable effect of foreign currency exchange rates and a greater number of retail stores operating during 2010.

The increase in Japan net sales was primarily the result of the favorable effect of foreign currency exchange

rates, increased wholesale net sales to the sporting goods channel and continued growth in our

direct-to-consumer business. Net sales to our LAAP distributors increased due to improved macro-economic

conditions in certain distributor markets, increased advance orders for both the Spring and Fall seasons, as well

as a shift in the timing of shipments as a higher percentage of spring 2011 shipments occurred in the fourth

quarter of 2010, while a higher percentage of spring 2010 shipments occurred in the first quarter of 2010.

Net sales in the EMEA region increased $25.0 million, or 13%, to $222.4 million in 2010 from

$197.4 million in 2009. Changes in foreign currency exchange rates compared to 2009 negatively affected the net

sales comparison by four percentage points. The increase in net sales in the EMEA region by product category

was led by footwear, followed by sportswear, outerwear and accessories and equipment. The net sales increase

by channel was led by EMEA distributors, followed by our EMEA direct business. The increase in net sales to

EMEA distributors was partially the result of improved macro-economic conditions in Russia, coupled with a

shift in the timing of shipments as a higher percentage of spring 2011 shipments occurred in the fourth quarter of

2010, while a higher percentage of spring 2010 shipments occurred in the first quarter of 2010. The increase in

EMEA direct net sales was primarily the result of increased net sales of Sorel-branded footwear.

Net sales in Canada increased $10.2 million, or 10%, to $116.7 million in 2010 from $106.5 million in

2009. Changes in foreign currency exchange rates compared to 2009 contributed eight percentage points of

benefit to the Canada net sales comparison.

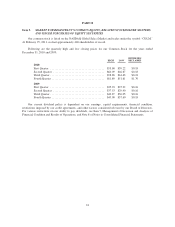

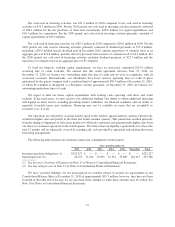

Sales by Product Category

Net sales by product category are summarized in the following table:

Year Ended December 31,

2010 2009 % Change

(In millions, except for percentage changes)

Outerwear ........................................... $ 560.8 $ 482.5 16%

Sportswear .......................................... 555.8 472.5 18%

Footwear ........................................... 270.2 214.6 26%

Accessories and Equipment ............................. 96.7 74.4 30%

$1,483.5 $1,244.0 19%

Net sales of outerwear increased $78.3 million, or 16%, to $560.8 million in 2010 from $482.5 million in

2009. The increase in outerwear net sales was primarily concentrated in the Columbia brand and was led by the

United States, followed by the LAAP region, Canada and the EMEA region. The net sales increase in outerwear

in the United States was led by our direct-to-consumer business, followed by our wholesale business. The

outerwear net sales increase in the LAAP region was led by Korea, followed by Japan and our LAAP distributor

business.

Net sales of sportswear increased $83.3 million, or 18%, to $555.8 million in 2010 from $472.5 million in

2009. The increase in sportswear net sales was primarily concentrated in the Columbia brand and was led by the

United States, followed by the LAAP region, EMEA region and Canada. The sportswear net sales increase in the

United States was led by our wholesale business, followed by our direct-to-consumer business. The sportswear

net sales increase in the LAAP region was led by Korea, followed by our LAAP distributor business and Japan.

31