Columbia Sportswear 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

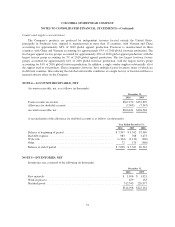

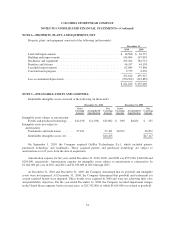

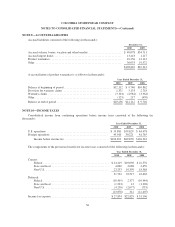

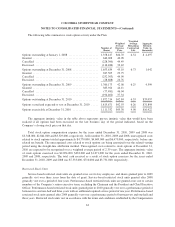

NOTE 6—PROPERTY, PLANT, AND EQUIPMENT, NET

Property, plant, and equipment consisted of the following (in thousands):

December 31,

2010 2009

Land and improvements ........................................... $ 16,898 $ 16,557

Building and improvements ........................................ 144,004 147,093

Machinery and equipment ......................................... 193,104 184,721

Furniture and fixtures ............................................. 46,147 44,158

Leasehold improvements .......................................... 62,884 57,866

Construction in progress ........................................... 9,775 8,932

472,812 459,327

Less accumulated depreciation ...................................... (250,999) (223,887)

$ 221,813 $ 235,440

NOTE 7—INTANGIBLE ASSETS AND GOODWILL

Identifiable intangible assets consisted of the following (in thousands):

December 31, 2010 December 31, 2009

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Intangible assets subject to amortization:

Patents and purchased technology . . . $14,198 $(1,196) $13,002 $ 898 $(643) $ 255

Intangible assets not subject to

amortization:

Trademarks and trade names ....... 27,421 27,421 26,872 26,872

Identifiable intangible assets, net .... $40,423 $27,127

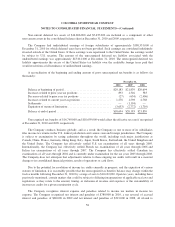

On September 1, 2010, the Company acquired OutDry Technologies S.r.l., which included patents,

purchased technology and trademarks. These acquired patents and purchased technology are subject to

amortization over 10 years from the date of acquisition.

Amortization expense for the years ended December 31, 2010, 2009, and 2008 was $553,000, $109,000 and

$205,000, respectively. Amortization expense for intangible assets subject to amortization is estimated to be

$1,402,000 per year in 2011 and 2012 and $1,330,000 in 2013 through 2015.

At December 31, 2010 and December 31, 2009, the Company determined that its goodwill and intangible

assets were not impaired. At December 31, 2008, the Company determined that goodwill and trademarks for

certain acquired brands were impaired. These brands were acquired in 2006 and were not achieving their sales

and profitability objectives. For the year ended December 31, 2008, the Company recorded impairment charges

in the United States segment, before income taxes, of $24,742,000, of which $4,614,000 was related to goodwill.

54