Columbia Sportswear 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

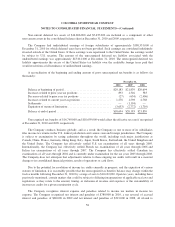

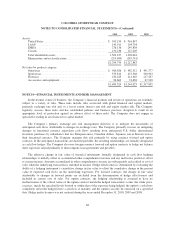

NOTE 18—SEGMENT INFORMATION

The Company operates in four geographic segments: (1) United States, (2) Latin America and Asia Pacific

(“LAAP”), (3) Europe, Middle East and Africa (“EMEA”), and (4) Canada, which are reflective of the

Company’s internal organization, management, and oversight structure. Each geographic segment operates

predominantly in one industry: the design, development, marketing and distribution of active outdoor apparel,

including outerwear, sportswear, footwear and accessories and equipment.

The geographic distribution of the Company’s net sales, income before income taxes, interest income

(expense), income tax (expense) benefit, and depreciation and amortization expense are summarized in the

following tables (in thousands) for the years ended December 31, 2010, 2009 and 2008 and for identifiable assets

at December 31, 2010 and 2009. Inter-geographic net sales, which are recorded at a negotiated mark-up and

eliminated in consolidation, are not material.

2010 2009 2008

Net sales to unrelated entities:

United States ........................................... $ 880,990 $ 736,942 $ 727,706

LAAP ................................................ 263,429 203,230 198,236

EMEA ................................................ 222,451 197,357 267,152

Canada ................................................ 116,654 106,494 124,741

$1,483,524 $1,244,023 $1,317,835

Income before income taxes:

United States ........................................... $ 53,752 $ 49,660 $ 38,674

LAAP ................................................ 35,635 27,138 32,857

EMEA ................................................ 5,817 1,410 26,167

Canada ................................................ 8,123 9,554 21,008

Interest ................................................ 1,564 2,088 7,537

$ 104,891 $ 89,850 $ 126,243

Interest income (expense), net:

United States ........................................... $ 4,664 $ 4,561 $ 5,804

LAAP ................................................ 500 561 1,023

EMEA ................................................ (717) (910) 45

Canada ................................................ (2,883) (2,124) 665

$ 1,564 $ 2,088 $ 7,537

Income tax (expense) benefit:

United States ........................................... $ (9,938) $ (13,710) $ (13,363)

LAAP ................................................ (9,325) (6,745) (8,312)

EMEA ................................................ (7,668) (2,744) (2,692)

Canada ................................................ (923) 370 (6,829)

$ (27,854) $ (22,829) $ (31,196)

Depreciation and amortization expense:

United States ........................................... $ 28,634 $ 26,850 $ 21,866

LAAP ................................................ 2,557 2,120 1,865

EMEA ................................................ 6,410 6,642 6,978

Canada ................................................ 829 641 449

$ 38,430 $ 36,253 $ 31,158

67