Columbia Sportswear 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

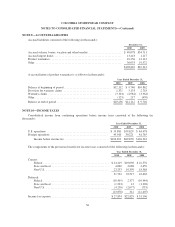

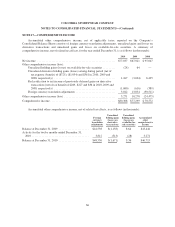

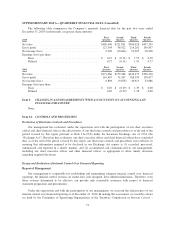

NOTE 17—COMPREHENSIVE INCOME

Accumulated other comprehensive income, net of applicable taxes, reported on the Company’s

Consolidated Balance Sheets consists of foreign currency translation adjustments, unrealized gains and losses on

derivative transactions and unrealized gains and losses on available-for-sale securities. A summary of

comprehensive income, net of related tax effects, for the year ended December 31, is as follows (in thousands):

2010 2009 2008

Net income ....................................................... $77,037 $67,021 $ 95,047

Other comprehensive income (loss):

Unrealized holding gains (losses) on available-for-sale securities ......... (28) 64 —

Unrealized derivative holding gains (losses) arising during period (net of

tax expense (benefit) of ($725), ($1,054) and $361 in 2010, 2009 and

2008, respectively) ........................................... 1,167 (3,024) 6,425

Reclassification to net income of previously deferred gains on derivative

transactions (net of tax benefit of $269, $227 and $36 in 2010, 2009 and

2008, respectively) ........................................... (1,680) (616) (389)

Foreign currency translation adjustments ............................ 3,812 13,854 (30,511)

Other comprehensive income (loss) .................................... 3,271 10,278 (24,475)

Comprehensive income .............................................. $80,308 $77,299 $ 70,572

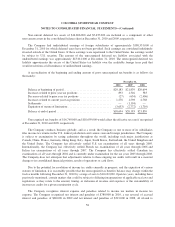

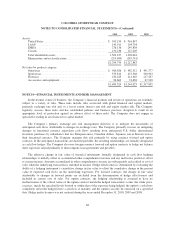

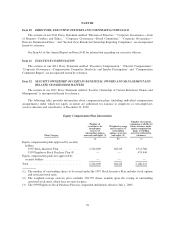

Accumulated other comprehensive income, net of related tax effects, is as follows (in thousands):

Foreign

currency

translation

adjustments

Unrealized

holding gains

(losses) on

derivative

transactions

Unrealized

holding gains

(losses) on

available-for-

sale securities

Accumulated

other

comprehensive

income

Balance at December 31, 2009 ..................... $44,538 $(1,158) $ 64 $43,444

Activity for the twelve months ended December 31,

2010 ........................................ 3,812 (513) (28) 3,271

Balance at December 31, 2010 ..................... $48,350 $(1,671) $ 36 $46,715

66