Cincinnati Bell 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

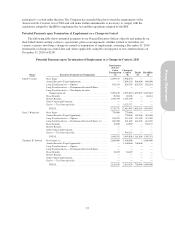

Company terminates Mr. Torbeck he would be owed: in Calendar year 2011 a payment equal to four times

of his base salary, in Calendar year 2012 a payment equal to three times his base salary, in Calendar year

2013 a payment equal to two times his base salary, and in 2014 and beyond a payment equal to his

accrued salary and annual incentive award.

•For Mr. Cassidy only, a payment equal to five times his base salary plus the product obtained by

multiplying the fair market value of the Company’s common share on the date of termination times

526,549;

•A payment equal to the present value of an additional one year (two years for Mr. Cassidy) of

participation in the Company’s Management Pension Plan and SERP, if applicable, as though the

executive had remained employed at the same base rate of pay and target bonus;

•Continued medical, dental, vision and life insurance benefits during the one-year period (or two-year

period for Mr. Cassidy) following the executive’s termination of employment on the same basis as any

active salaried employee provided any required monthly contributions are made;

•Except for Mr. Cassidy, continued treatment as an active employee during the one-year period following

termination with respect to any outstanding long-term incentive cycles the executive may be participating

in and any unvested stock options will continue to vest under the normal vesting schedule as though the

executive was still an active employee; and

•The ability to exercise any vested options for an additional 90 days after the end of the one-year period,

or, in the case of Mr. Cassidy, the ability to exercise any vested options (which are all fully vested upon

his termination of employment) during the two-year period following his termination.

If an executive is terminated within the one-year period (or a two-year period for Mr. Cassidy) following a

change-in-control, the executive will be entitled to the following:

•A payment equal to two times the sum of their base salary plus target bonus (2.99 times for Mr. Cassidy);

•If eligible to participate in the Management Pension Plan, a payment equal to the present value of an

additional one year (two years for Mr. Cassidy) of participation in the Plan as though the executive had

remained employed at the same base rate of pay and target bonus;

•Continued medical, dental, vision and life insurance coverage during the one-year period (or two-year

period for Mr. Cassidy) following the executive’s termination of employment on the same basis as other

active employees provided any required monthly contributions are made;

•Full vesting of any options, restricted shares and/or other equity awards and the ability to exercise such

options for the one-year period (or two-year period for Mr. Cassidy) following termination;

•Full vesting and payout at target amounts of any awards granted under long-term incentive plans; and

•To the extent that any of the executives are deemed to have received an excess parachute payment, an

additional payment sufficient to pay any taxes imposed under section 4999 of the Internal Revenue Code

plus any federal, state and local taxes applicable to any taxes imposed under section 4999 of the Internal

Revenue Code.

In addition, Mr. Cassidy’s SERP benefit would be fully vested and he would receive a lump sum payment

without adjustment for age and service.

If an executive is “terminated” because of his or her death, the executive’s beneficiary will be entitled to the

following:

•A payment equal to the bonus accrued and payable to the deceased executive for the current year;

•Full vesting of all options held by the deceased executive and the ability to exercise such options for the

one-year period following the date of the executive’s death; and

•Full vesting and payout at target amounts of any awards granted to the deceased executive under long-

term incentive plans.

59

Proxy Statement