Cincinnati Bell 2010 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2010 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

termination benefits and curtailment charges are included in “Pension and postretirement obligations” in the

Consolidated Balance Sheets at December 31, 2010 and 2009.

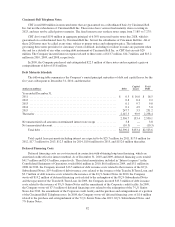

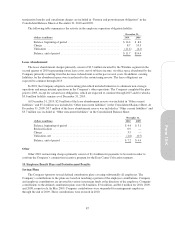

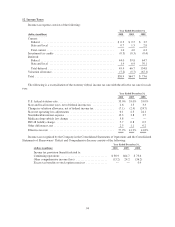

The following table summarizes the activity in the employee separation obligation liability:

December 31,

(dollars in millions) 2010 2009

Balance, beginning of period .................................... $14.4 $ 8.0

Charge ..................................................... 8.7 10.5

Utilization .................................................. (11.4) (4.1)

Balance, end of period ......................................... $11.7 $14.4

Lease Abandonment

The lease abandonment charges primarily consist of $3.3 million incurred by the Wireline segment in the

second quarter of 2010 representing future lease costs, net of sublease income, on office space abandoned by the

Company primarily resulting from the decrease in headcount over the past several years. In addition, existing

liabilities for the abandoned space were transferred to the restructuring reserve. The lease obligations are

expected to continue through 2015.

In 2001, the Company adopted a restructuring plan which included initiatives to eliminate non-strategic

operations and merge internet operations in the Company’s other operations. The Company completed the plan

prior to 2003, except for certain lease obligations, which are expected to continue through 2015 and for which a

$3.6 million liability remains as of December 31, 2010.

At December 31, 2010, $2.0 million of the lease abandonment reserve was included in “Other current

liabilities” and $5.2 million was included in “Other noncurrent liabilities” in the Consolidated Balance Sheet. At

December 31, 2009, $0.7 million of the lease abandonment reserve was included in “Other current liabilities” and

$3.7 million was included in “Other noncurrent liabilities” in the Consolidated Balance Sheet.

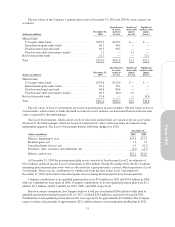

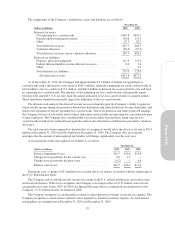

December 31,

(dollars in millions) 2010 2009

Balance, beginning of period ..................................... $4.4 $5.1

Reclassification ................................................ 0.9 —

Charge ....................................................... 3.5 —

Utilization, net ................................................ (1.6) (0.7)

Balance, end of period .......................................... $7.2 $4.4

Other

Other 2010 restructuring charges primarily consist of $1.4 million for payments to be made in order to

conform the Company’s commission incentive program for the Data Center Colocation segment.

10. Employee Benefit Plans and Postretirement Benefits

Savings Plans

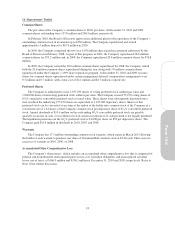

The Company sponsors several defined contribution plans covering substantially all employees. The

Company’s contributions to the plans are based on matching a portion of the employee contributions. Company

and employee contributions are invested in various investment funds at the direction of the employee. Company

contributions to the defined contribution plans were $4.8 million, $3.6 million, and $6.0 million for 2010, 2009,

and 2008, respectively. In May 2009, Company contributions were suspended for management employees

through the end of 2009. These contributions were restored in 2010.

87

Form 10-K