Cincinnati Bell 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

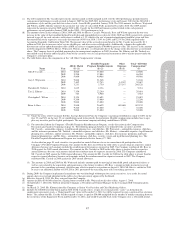

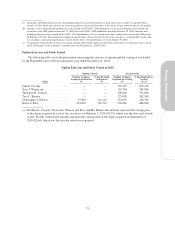

(a) All options and SARs granted are for a maximum period of ten years from the date of grant and vest over a three year period. These

awards vest 28% on the first anniversary of the original date of grant and, thereafter, at the rate of 3% per month for the next 24 months.

(b) Amounts in the column include performance units granted for the 2008 – 2010 performance cycle less performance units earned and

vested for (i) the 2008 period on February 27, 2009 and (ii) the 2008 – 2009 cumulative period on February 28, 2010. Amounts also

include performance units granted for the 2009 – 2011 performance cycle less performance units earned and vested for the 2009 period

on February 28, 2010. The amount also includes the performance unit grant made to each of the executives, except for Mr. Cassidy who

was awarded a cash payment performance award, for the 2010 – 2012 performance cycle on January 29, 2010.

(c) Assuming the target number of shares are earned, amounts represent the equity incentive plan awards not yet vested. The value is based

on the closing price of the Company’s common shares on December 31, 2010 ($2.80).

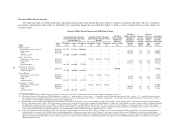

Option Exercises and Stock Vested

The following table sets forth information concerning the exercise of options and the vesting of stock held

by the Named Executive Officers during the year ended December 31, 2010:

Option Exercises and Stock Vested in 2010

Option Awards Stock Awards

Name

Number of Shares

Acquired on Exercise

(#)

Value Realized

on Exercise

($)

Number of Shares

Acquired on Vesting

(#)

Value Realized on

Vesting

($) (a)

John F. Cassidy ................... — — 303,139 879,103

Gary J. Wojtaszek ................. — — 132,364 383,856

Theodore H. Torbeck .............. — — 300,000 792,000

Tara L. Khoury ................... — — 125,000 362,500

Christopher J. Wilson .............. 37,867 112,425 154,053 446,754

Brian A. Ross .................... 243,825 754,912 236,860 686,894

(a) For Messrs. Cassidy, Wojtaszek, Wilson, and Ross and Ms. Khoury the amounts represent the closing price

of the shares acquired by each of the executives on February 1, 2010 ($2.90), which was the date such awards

vested. For Mr. Torbeck the amounts represent the closing price of the shares acquired on September 27,

2010 ($2.64), which was the date his awards were granted.

53

Proxy Statement