Cincinnati Bell 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.complete an effective integration of CyrusOne into the Company, anticipated growth in revenue, profitability,

and cash flow resulting from the purchase of CyrusOne could be adversely affected.

The Company’s future cash flows could be adversely affected if it is unable to realize fully its deferred tax

assets.

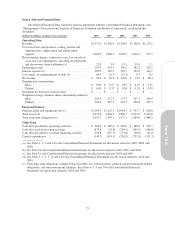

As of December 31, 2010, the Company had net deferred income taxes of $451.8 million, which are

primarily composed of deferred tax assets associated with U.S. federal net operating loss carryforwards of $385.3

million and state and local net operating loss carryforwards of $60.5 million. The Company has recorded

valuation allowances against deferred tax assets related to certain state and local net operating losses and other

deferred tax assets due to the uncertainty of the Company’s ability to utilize the assets within the statutory

expiration period. For more information concerning the Company’s net operating loss carryforwards, deferred

tax assets, and valuation allowance, see Note 12 to the Consolidated Financial Statements. The use of the

Company’s deferred tax assets enables it to satisfy current and future tax liabilities without the use of the

Company’s cash resources. If the Company is unable for any reason to generate sufficient taxable income to fully

realize its deferred tax assets, or if the use of its net operating loss carryforwards is limited by Internal Revenue

Code Section 382 or similar state statute, the Company’s net income, shareowners’ equity, and future cash flows

could be adversely affected.

A few large customers account for a significant portion of the Company’s revenues and accounts receivable.

The loss or significant reduction in business from one or more of these large customers could cause operating

revenues to decline significantly and have a materially adverse long-term impact on the Company’s business.

The Company has receivables with one large customer that exceeds 10% of the Company’s outstanding

accounts receivable balance. Contracts with customers may not sufficiently reduce the inherent risk that

customers may terminate or fail to renew their relationships with the Company. As a result of customer

concentration, the Company’s results of operations and financial condition could be materially affected if the

Company lost one or more large customers or if services purchased were significantly reduced. If one or more of

the Company’s larger customers were to default on its accounts receivable obligations the Company could be

exposed to potentially significant losses in excess of the provisions established. This could also negatively impact

the available capacity under the accounts receivable facility.

The Company depends on a number of third-party providers, and the loss of, or problems with, one or more of

these providers may impede our growth or cause us to lose customers.

The Company depends on third-party providers to supply products and services. For example, many of the

Company’s information technology functions and call center functions are performed by third-party providers,

network equipment is purchased from and maintained by vendors, and data center space is leased from landlords.

In addition, with the recent sale of the Company-owned wireless towers, almost half of the towers are managed

by a single independent service provider. Any failure on the part of suppliers to provide the contracted services,

additional required services, additional products, or additional leased space could impede the growth of the

Company’s business and cause financial results to suffer.

A failure of back-office information technology systems could adversely affect the Company’s results of

operations and financial condition.

The efficient operation of the Company’s business depends on back-office information technology systems.

The Company relies on back-office information technology systems to effectively manage customer billing,

business data, communications, supply chain, order entry and fulfillment and other business processes. A failure

of the Company’s information technology systems to perform as anticipated could disrupt the Company’s

business and result in a failure to collect accounts receivable, transaction errors, processing inefficiencies, and the

loss of sales and customers, causing the Company’s reputation and results of operations to suffer. In addition,

information technology systems may be vulnerable to damage or interruption from circumstances beyond the

Company’s control, including fire, natural disasters, systems failures, security breaches and viruses. Any such

damage or interruption could have a material adverse effect on the Company’s business.

18