Cincinnati Bell 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Generally, no one factor is given more weight than another, nor does the Company use a formulaic approach in

setting executive pay. Additionally, the Company does not look at total compensation of the peer group. Instead,

the various factors are considered as a whole in determining executive pay adjustments.

For all executive officers other than himself, the Chief Executive Officer recommends base salaries, which

the Compensation Committee takes into consideration when making its determinations.

Similarly, the Company’s Chairman of the Board solicits input from each of the other directors regarding

the Chief Executive Officer’s performance during the year. In executive session, the Chairman of the Board

provides the Compensation Committee with a summary of the input received for further discussion. The

Compensation Committee’s independent consultant reviews the annual executive compensation study for the

Chief Executive Officer’s position. Based on these factors, the Compensation Committee determines the

adjustments in the Chief Executive Officer’s base salary to recommend for approval by the full Board.

Annual Incentive

Payments under the Company’s annual incentive plan are tied to:

•the Company’s level of achievement of (a) earnings before interest, taxes, depreciation and amortization

(“EBITDA”) and (b) revenues, and

•the executive’s individual performance.

The Company has selected the EBITDA and revenue measures because it believes that investors use them to

evaluate the financial performance of the Company and because they also indicate the level of success of the

Company’s strategy to sustain operating cash flows and profitability to drive transformative growth through its

data center strategy to become a premier data center colocation provider to the Fortune 1000 companies.

EBITDA is a common measure of profitability employed in the telecommunications and other capital-intensive

industries. The Compensation Committee and the Board review and approve the calculations of EBITDA and

revenues. In conjunction with such review, they may adjust the calculated result or goal amount to reflect a

change in business direction, reallocation of Company resources or an unanticipated event.

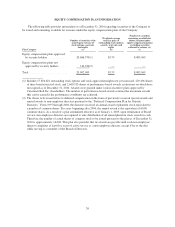

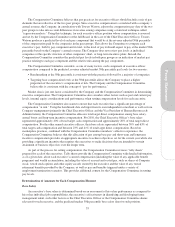

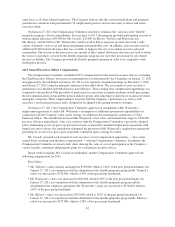

For 2010, the Compensation Committee generally allocated the annual incentive targets as follows:

•60% for attainment of the EBITDA goal

•20% for attainment of the revenue goal

•20% for individual performance

The EBITDA and revenue goals are assessed independently of each other and are scaled above and below

their respective targets in the manner set out below.

Percentage of

Criterion Achieved

EBITDA Goal Revenue Goal

Percentage of

Target Incentive

Goal

Percentage of

Total Annual

Incentive

Paid

Percentage of

Target Incentive

Goal

Percentage of

Total Annual

Incentive

Paid

Below 95% ................................ 0% 0% 0% 0%

95% ...................................... 50% 30% 50% 10%

100% ..................................... 100% 60% 100% 20%

105% ..................................... 150% 90% 150% 30%

120% or greater ............................. 200% 120% 200% 40%

As shown in the chart above, if a minimum percentage of the target goal for a criterion is not obtained, no

portion of the executive’s annual incentive for that criterion is paid; if the minimum percentage is reached, 50%

of the target incentive is paid; if the target goal is obtained, 100% of the target incentive is paid; and, if 120% or

more of the target goal is obtained, 200% of the target incentive for that criterion is paid. For example, if 95% of

the EBITDA target was reached, an executive would be paid 50% of the annual incentive target for the EBITDA

goal or 30% (50% x 60%) of the executive’s total annual incentive target. Linear interpolation is used to

determine payouts at achievement levels not set forth in the table.

36