Cincinnati Bell 2010 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2010 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The increase in the Data Center Colocation segment resulted from the CyrusOne acquisition in June 2010.

See Note 2 for further discussion.

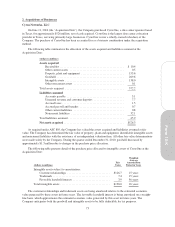

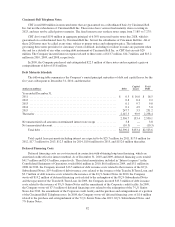

Amortization expense for intangible assets subject to amortization was $11.6 million in 2010, $4.1 million

in 2009, and $4.9 million in 2008. The following table presents estimated amortization expense for 2011 through

2015:

(dollars in millions)

2011 ............................................... $17.5

2012 ............................................... 18.4

2013 ............................................... 18.6

2014 ............................................... 18.4

2015 ............................................... 15.7

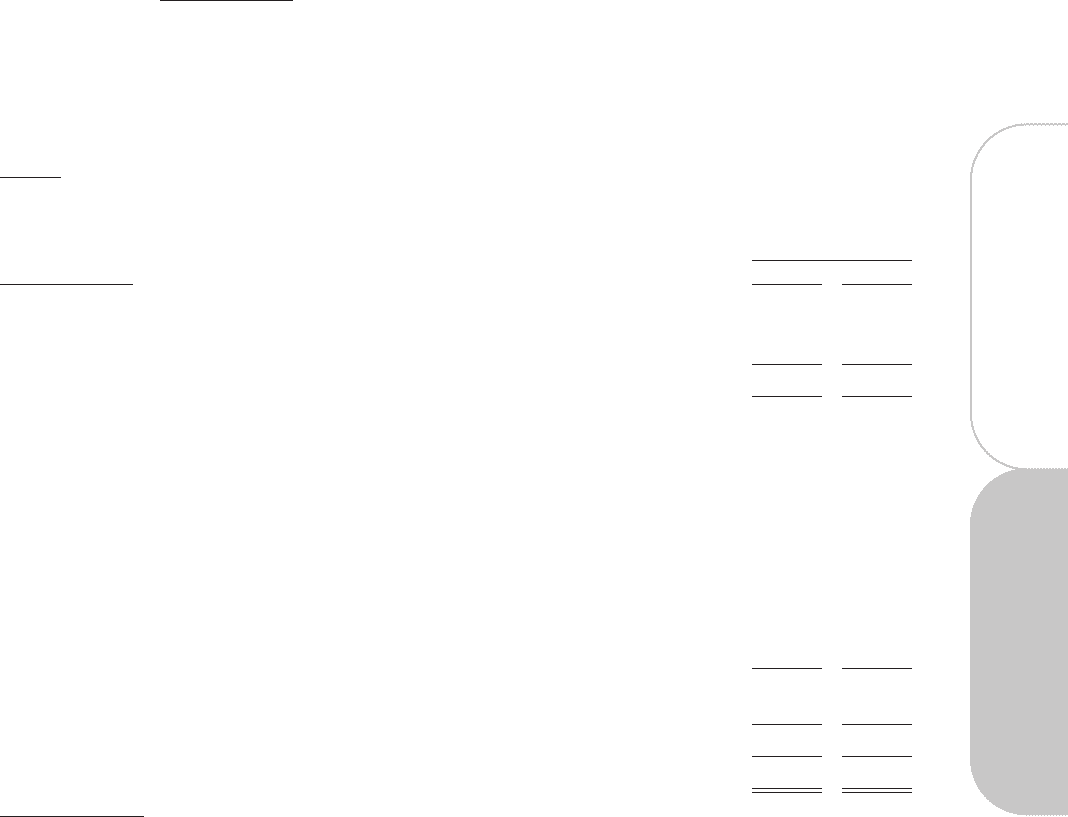

6. Debt

Debt is comprised of the following:

December 31,

(dollars in millions) 2010 2009

Current portion of long-term debt:

Credit facility, Tranche B Term Loan ......................................... $ — $ 2.1

Capital lease obligations and other debt ....................................... 16.5 13.7

Current portion of long-term debt .......................................... 16.5 15.8

Long-term debt, less current portion: ...........................................

Credit facility, Tranche B Term Loan ......................................... — 202.8

83/8% Senior Subordinated Notes due 2014* ................................... — 569.8

7% Senior Notes due 2015* ................................................ 251.4 252.3

81/4% Senior Notes due 2017 ............................................... 500.0 500.0

83/4% Senior Subordinated Notes due 2018 .................................... 625.0 —

83/8% Senior Notes due 2020 ............................................... 775.0 —

71/4% Senior Notes due 2023 ............................................... 40.0 40.0

Receivables Facility ...................................................... — 85.9

Various Cincinnati Bell Telephone notes ...................................... 207.5 207.5

Capital lease obligations and other debt ....................................... 118.5 111.8

2,517.4 1,970.1

Net unamortized discount .................................................... (10.3) (6.8)

Long-term debt, less current portion ........................................ 2,507.1 1,963.3

Total debt ................................................................. $2,523.6 $1,979.1

* The face amount of these notes has been adjusted for the unamortized called amounts received on

terminated interest rate swaps.

Capital lease obligations are addressed in Note 7.

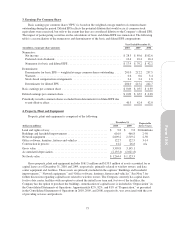

Corporate Credit Facilities

On June 11, 2010, the Company entered into a new Corporate credit facility agreement, which included a

new revolving credit facility, replacing the existing revolving credit facility that would have expired in August

2012, and a $760 million secured term loan credit facility (“Tranche B Term Loan”). The new Corporate

revolving credit facility provides a $210 million revolving line of credit and terminates in June 2014. The net

proceeds of $737 million from the Tranche B Term Loan were used to fund the acquisition of CyrusOne, to repay

the Company’s previous term loan facility totaling $204.3 million, and to pay related fees and expenses. The

77

Form 10-K