Cincinnati Bell 2010 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2010 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

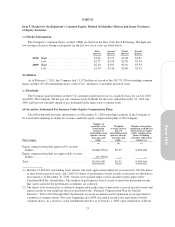

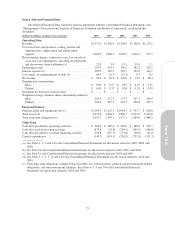

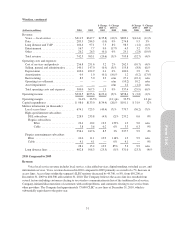

Wireline

Wireline revenue decreased 3% to $742.5 million due to reductions in voice revenue caused by continued

ILEC access line losses. The Company was able to partially offset the access line losses through increased long

distance and VoIP revenue and increased entertainment revenue. The Company ended the year with 674,100

total access lines, a loss of 7% compared to 723,500 access lines at December 31, 2009 and consistent with the

2009 losses.

In 2009, the Company launched its Fioptics fiber-to-the-home product suite of services that includes

entertainment, high-speed internet and voice services. Fioptics continued to show strong growth during 2010,

and, as of December 31, 2010, the Company now “passes” and is able to provide its Fioptics services to 79,000

homes. The Company had 28,100 entertainment customers as of December 31, 2010, an increase of 85%

compared to the end of 2009. The Company also provided and bundled internet and voice service with Fioptics,

resulting in 27,200 high-speed internet customers and 16,800 voice customers on Fioptics at the end of 2010.

Importantly, the Company’s penetration rate of homes passed with Fioptics was about 30% within twelve months

of deploying Fioptics in a particular area.

The decreases in access lines and the Company’s desire to maintain its high operating margin percentage in

the face of declining revenue required additional cost reduction programs, resulting in restructuring charges of

$8.2 million in 2010. These restructuring charges include future lease costs on abandoned office space and

workforce reductions to address decreasing Wireline revenue and the integration of certain functions of the

Wireline and IT Services and Hardware segments.

Wireline operating income of $233.5 million declined by $22.1 million compared to 2009 as the revenue

decrease from access line losses more than offset the cost reduction initiatives.

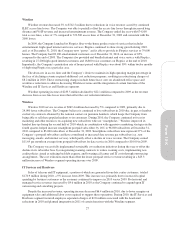

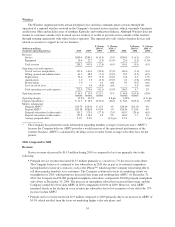

Wireless

Wireless 2010 service revenue of $269.4 million decreased by 5% compared to 2009, primarily due to

24,000 fewer subscribers. The Company believes it continued to lose subscribers in 2010 due, in part, to handset

exclusivity contracts obtained by the national carriers on premium handsets, which keeps the Company from

being able to sell these popular handsets to its customers. During 2010, the Company continued to focus its

marketing and other resources on acquiring new subscribers who use “smartphones.” Wireless improved its

handset line-up during the second half of 2010 which, in combination with aggressive marketing strategies in the

fourth quarter, helped increase smartphone postpaid subscribers by 16% to 96,000 subscribers at December 31,

2010 compared to 83,000 subscribers at December 31, 2009. Smartphone subscribers now represent 27% of the

Company’s postpaid subscribers and have contributed to increased data revenue per subscriber (e.g., text

messaging, emails, and internet service), which partly offset a decline in voice revenue. The Company earned

$11.69 per month on average from postpaid subscribers for data service in 2010 compared to $10.00 in 2009.

The Company successfully implemented sustainable cost reduction initiatives during the year to offset the

decline in its subscriber base by renegotiating roaming contracts to reduce roaming costs, implementing new

credit policies aimed at reducing bad debt expense, and lowering call center and IT costs through outsourcing

arrangements. The cost reductions more than offset the lower postpaid service revenue resulting in a $23.3

million increase of Wireless segment operating income over 2009.

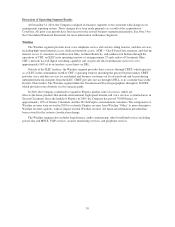

IT Services and Hardware

Sales of telecom and IT equipment, a portion of which are generated from data center customers, totaled

$174.9 million during 2010, a 9% increase from 2009. This increase was primarily due to increased capital

spending by business customers as the economy continued to improve in 2010 versus 2009. Professional and

managed service revenues increased by $9.6 million in 2010 as the Company continued to expand upon IT

outsourcing and consulting projects.

Despite the increased revenue, operating income decreased $6.4 million in 2010, due to lower margins on

equipment sales and additional labor costs required to support these operations. During 2010, the IT Services and

Hardware segment incurred employee separation charges of $2.8 million associated with the headcount

reductions in 2010 and planned integration in 2011 of certain functions with the Wireline segment.

27

Form 10-K