Cincinnati Bell 2010 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2010 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

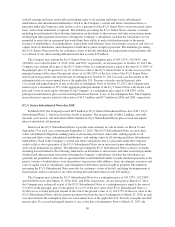

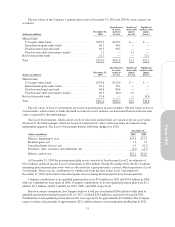

The amounts recognized in the Consolidated Balance Sheets consist of:

Pension Benefits

Postretirement and

Other Benefits

December 31, December 31,

(dollars in millions) 2010 2009 2010 2009

Accrued payroll and benefits (current liability) ..................... $ (1.9) $ (1.9) $ (22.1) $ (13.0)

Pension and postretirement benefit obligations (noncurrent liability) . . . (200.2) (179.0) (129.1) (132.2)

As of December 31, 2010 and 2009, the Company’s accumulated benefit obligation related to its pension

plans was $526.1 million and $506.3 million, respectively.

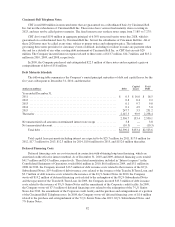

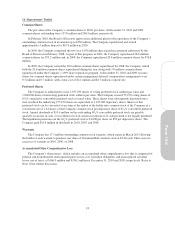

Amounts recognized in “Accumulated other comprehensive loss” in the Consolidated Balance Sheets

consisted of the following:

Pension Benefits

Postretirement and

Other Benefits

December 31, December 31,

(dollars in millions) 2010 2009 2010 2009

Prior service benefit (cost) .......................... $ (5.2) $ (5.7) $ 98.2 $111.3

Actuarial loss ..................................... (248.4) (230.6) (96.3) (89.6)

(253.6) (236.3) 1.9 21.7

Income tax effect .................................. 92.4 86.4 (0.7) (7.9)

$(161.2) $(149.9) $ 1.2 $ 13.8

Amounts recognized in “Accumulated other comprehensive loss” on the Consolidated Statements of

Shareowners’ Deficit and Comprehensive Income for the year ended December 31, 2010, are shown below:

(dollars in millions)

Pension

Benefits

Postretirement

and Other

Benefits

Prior service cost recognized:

Reclassification adjustments ...................................... $ 0.5 $(13.1)

Actuarial loss recognized:

Reclassification adjustments ...................................... 9.3 5.2

Actuarial loss arising during the period .............................. (27.1) (11.9)

The following amounts currently included in “Accumulated other comprehensive loss” are expected to be

recognized in 2011 as a component of net periodic pension and postretirement cost:

(dollars in millions)

Pension

Benefits

Postretirement

and Other

Benefits

Prior service cost (benefit) ........................................ $ 0.5 $(13.1)

Actuarial loss .................................................. 13.3 5.9

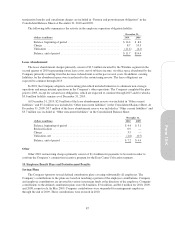

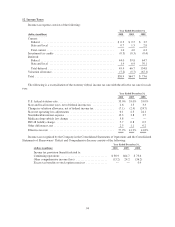

Plan Assets, Investment Policies and Strategies

The primary investment objective for the trusts holding the assets of the pension and postretirement plans is

preservation of capital with a reasonable amount of long-term growth and income without undue exposure to

risk. This is provided by a balanced strategy using fixed income and equity securities. The target allocations for

the pension plan assets are 61% equity securities, 31% investment grade fixed income securities and 8% in

pooled real estate funds. Equity securities are primarily held in the form of passively managed funds that seek to

track the performance of a benchmark index. Equity securities include investments in growth and value common

stocks of companies located in the United States, which represents approximately 80% of the equity securities

held by the pension plans at December 31, 2010, as well as stock of international companies located in both

developed and emerging markets around the world. Fixed income securities primarily include holdings of funds

which generally invest in a variety of intermediate and long-term investment grade corporate bonds from

diversified industries. The postretirement plan assets are currently invested in various short-term liquid funds.

90