Cincinnati Bell 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

benefits, they may not continue to outsource their IT infrastructure to companies within the Company’s industry.

Additionally, outsourcing may be associated with larger companies than Cincinnati Bell, and the Company may

not be as successful as these larger companies. As a result of these risks, the Company’s business may suffer and

it could adversely affect its business strategy and objectives and its ability to generate revenues, profits and cash

flows.

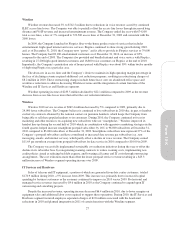

The long sales cycle for data center services may materially affect the data center business and results of its

operations.

A customer’s decision to lease cabinet space in one of the Company’s data centers and to purchase

additional services typically involves a significant commitment of resources, significant contract negotiations

regarding the service level commitments, and significant due diligence on the part of the customer regarding the

adequacy of the Company’s facilities, including the adequacy of carrier connections. As a result, the sale of data

center space has a long sales cycle. Furthermore, the Company may expend significant time and resources in

pursuing a particular sale or customer that may not result in revenue. Delays in the length of the data center sales

cycle may have a material adverse effect on the Data Center Colocation segment and results of its operations.

The Company’s failure to meet performance standards under its agreements could result in customers

terminating their relationships with the Company or customers being entitled to receive financial

compensation, which could lead to reduced revenues and/or increased costs.

The Company’s agreements with its customers contain various requirements regarding performance and

levels of service. If the Company fails to provide the levels of service or performance required by its agreements,

customers may be able to receive service credits for their accounts and other financial compensation, and also

may be able to terminate their relationship with the Company. In addition, any inability to meet service level

commitments or other performance standards could reduce the confidence of customers and could consequently

impair the Company’s ability to obtain and retain customers, which would adversely affect both the Company’s

ability to generate revenues and operating results.

Data center business could be harmed by prolonged electrical power outages or shortages, increased costs of

energy, or general lack of availability of electrical resources.

Data centers are susceptible to regional costs of power, planned or unplanned power outages and shortages,

and limitations on the availability of adequate power resources. The Company attempts to limit exposure to

system downtime by using backup generators and power supplies. As a result of these data center redundancies,

the Company’s data center customers incurred only minimal downtime during the aftermath of the Hurricane Ike

windstorm that caused severe disruption to power sources in the Cincinnati area for approximately two weeks in

September 2008. However, the Company may not be able to limit the exposure entirely in future occurrences

even with those protections in place. In addition, global fluctuations in the price of power can increase the cost of

energy, and although contractual price increase clauses may exist and, in some cases, the data center customer

pays directly for the cost of power, the Company may not be able to pass all of these increased costs on to

customers, or the increase in power costs may impact additional sales of data center space.

The Company’s failure to effectively integrate its recently completed acquisition of CyrusOne could result in

an inability to realize the anticipated benefits of the purchase and adversely affect the Company’s business

and operating results.

The Company’s recent acquisition of CyrusOne will involve the integration of two companies that had

previously operated independently, which is challenging and time-consuming. The process of integrating

CyrusOne, a previously privately held company, into the Company, a publicly traded company, could result in

the loss of key employees, the disruption of its ongoing businesses, or inconsistencies in the respective standards,

controls, procedures, and policies of the two companies, any of which could adversely affect the Company’s

ability to maintain relationships with customers, suppliers, and employees. In addition, the successful

combination of the companies will require the Company to dedicate significant management resources and to

potentially expend additional funds for additional staffing, resources and control procedures, all of which could

temporarily divert attention from the day-to-day business of the combined company. If the Company fails to

17

Form 10-K