Cincinnati Bell 2010 Annual Report Download - page 110

Download and view the complete annual report

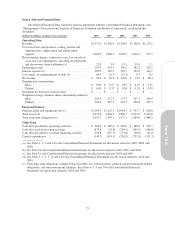

Please find page 110 of the 2010 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the next several years under generally accepted accounting principles. Additionally, the Company’s

postretirement costs are adversely affected by increases in medical and prescription drug costs. If the Company

incurs future investment losses or future investment gains that are less than expected, or if medical and

prescription drug costs increase significantly, the Company would expect to face even higher annual net pension

and postretirement costs. Refer to Note 10 to the Consolidated Financial Statements for further information.

Adverse changes in the value of assets or obligations associated with the Company’s employee benefit plans

could negatively impact shareowners’ deficit and liquidity.

The Company sponsors three noncontributory defined benefit pension plans: one for eligible management

employees, one for non-management employees, and one supplemental, nonqualified, unfunded plan for certain

senior executives. The Company’s consolidated balance sheets indirectly reflect the value of all plan assets and

benefit obligations under these plans. The accounting for employee benefit plans is complex, as is the process of

calculating the benefit obligations under the plans. Further adverse changes in interest rates or market conditions,

among other assumptions and factors, could cause a significant increase in the Company’s benefit obligations or

a significant decrease of the asset values, without necessarily impacting the Company’s net income. In addition,

the Company’s benefit obligations could increase significantly if it needs to unfavorably revise the assumptions

used to calculate the obligations. These adverse changes could have a further significant negative impact on the

Company’s shareowners’ deficit. In addition, with respect to the Company’s pension plans, the Company expects

to make approximately $246 million of estimated cash contributions to fully fund its qualified pension plans for

the years 2011 to 2017, of which $23.4 million is currently expected to be paid in 2011. Further, adverse changes

to plan assets could require the Company to contribute additional material amounts of cash to the plan or could

accelerate the timing of required payments.

Third parties may claim that the Company is infringing upon their intellectual property, and the Company

could suffer significant litigation or licensing expenses or be prevented from selling products.

Although the Company does not believe that any of its products or services infringe upon the valid

intellectual property rights of third parties, the Company may be unaware of intellectual property rights of others

that may cover some of its technology, products, or services. Any litigation growing out of third-party patents or

other intellectual property claims could be costly and time-consuming and could divert the Company’s

management and key personnel from its business operations. The complexity of the technology involved and the

uncertainty of intellectual property litigation increase these risks. Resolution of claims of intellectual property

infringement might also require the Company to enter into costly license agreements. Likewise, the Company

may not be able to obtain license agreements on acceptable terms. The Company also may be subject to

significant damages or injunctions against development and sale of certain of its products. Further, the Company

often relies on licenses of third-party intellectual property for its businesses. The Company cannot ensure these

licenses will be available in the future on favorable terms or at all.

Third parties may infringe upon the Company’s intellectual property, and the Company may expend

significant resources enforcing its rights or suffer competitive injury.

The Company’s success depends in significant part on the competitive advantage it gains from its

proprietary technology and other valuable intellectual property assets. The Company relies on a combination of

patents, copyrights, trademarks and trade secrets protections, confidentiality provisions, and licensing

arrangements to establish and protect its intellectual property rights. If the Company fails to successfully enforce

its intellectual property rights, its competitive position could suffer, which could harm its operating results.

The Company may also be required to spend significant resources to monitor and police its intellectual

property rights. The Company may not be able to detect third-party infringements and its competitive position

may be harmed before the Company does so. In addition, competitors may design around the Company’s

technology or develop competing technologies. Furthermore, some intellectual property rights are licensed to

other companies, allowing them to compete with the Company using that intellectual property.

20