Cincinnati Bell 2010 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2010 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Pension Plans

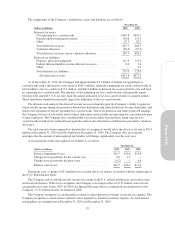

The Company sponsors three noncontributory defined benefit pension plans: one for eligible management

employees, one for non-management employees, and one supplemental, nonqualified, unfunded plan for certain

senior executives. The management pension plan is a cash balance plan in which the pension benefit is

determined by a combination of compensation-based credits and annual guaranteed interest credits. The

non-management pension plan is also a cash balance plan in which the combination of service and

job-classification-based credits and annual interest credits determine the pension benefit. Benefits for the

supplemental plan are based on eligible pay, adjusted for age and service upon retirement. The Company funds

both the management and non-management plans in an irrevocable trust through contributions, which are

determined using the traditional unit credit cost method. The Company also uses the traditional unit credit cost

method for determining pension cost for financial reporting purposes.

Postretirement Health and Life Insurance Plans

The Company also provides health care and group life insurance benefits for eligible retirees. The Company

funds health care benefits and other group life insurance benefits using Voluntary Employee Benefit Association

(“VEBA”) trusts. It is the Company’s practice to fund amounts as deemed appropriate from time to time.

Contributions are subject to IRS limitations developed using the traditional unit credit cost method. The actuarial

expense calculation for the Company’s postretirement health plan is based on numerous assumptions, estimates,

and judgments including health care cost trend rates and cost sharing with retirees.

Significant Events

In 2009, the Company announced significant changes to its management pension plan and its postretirement

plans. The Company announced that it had frozen pension benefits for certain management employees below 50

years of age and had provided a 10-year transition period for those employees over the age of 50 after which the

pension benefits will be frozen. Additionally, the Company announced it will phase out the retiree healthcare

plans for all management employees and certain retirees from the bargained plan in 10 years.

The significant changes in 2009 caused a 90% decrease in the expected future service years for active

participants in the management pension plan, which triggered a plan curtailment. The curtailment gain of $7.6

million consisted of the acceleration of unrecognized prior service benefits. The Company also determined that

the significant changes to the postretirement plan benefits required a remeasurement of these plans. The

Company remeasured its management pension plan and its postretirement plans, using revised assumptions,

including modified retiree benefit payment assumptions, revised discount rates and updated plan asset

information. Additionally, the Company determined that these benefit changes result in substantially all of the

remaining participants in the management postretirement plan to be either fully eligible for benefits or retired. As

such, the unrecognized prior service gain and unrecognized actuarial gains are amortized over the average life

expectancy of the participants rather than the shorter service periods previously used. As a result of the

remeasurement, the Company’s pension and postretirement obligations were reduced by approximately $124

million, deferred tax assets were reduced for the related tax effect by $45 million, and equity was increased by

$79 million.

In the first quarter of 2008, the Company incurred a $22.1 million special termination benefit charge related

to 284 union employees accepting early retirement special termination benefits. The Company also recorded $2.1

million and $4.9 million of expense during 2009 and 2008, respectively, related to remaining special termination

benefits being amortized over the future service period for both the management and union employees. As a

result of the early retirement special termination benefits, which decreased the expected future service years of

the plan participants, the Company determined curtailment charges were required. The 2008 curtailment charge

for the union pension plan and union postretirement plan consisted of an increase in the benefit obligation of $2.2

million and $12.5 million, and the acceleration of unrecognized prior service cost of $0.9 million and a benefit of

$0.1 million, respectively. In the first quarter of 2008, as a result of the early retirement special termination

benefits, the Company remeasured its non-management pension and postretirement obligations using revised

assumptions, including modified retiree benefit payment assumptions and a revised discount rate. As a result of

the remeasurement, the Company’s pension and postretirement obligations were reduced by approximately $17

million, deferred tax assets were reduced for the related tax effect by $6 million, and equity was increased by $11

million.

88