Cincinnati Bell 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

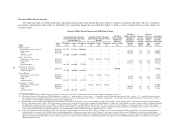

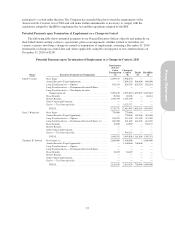

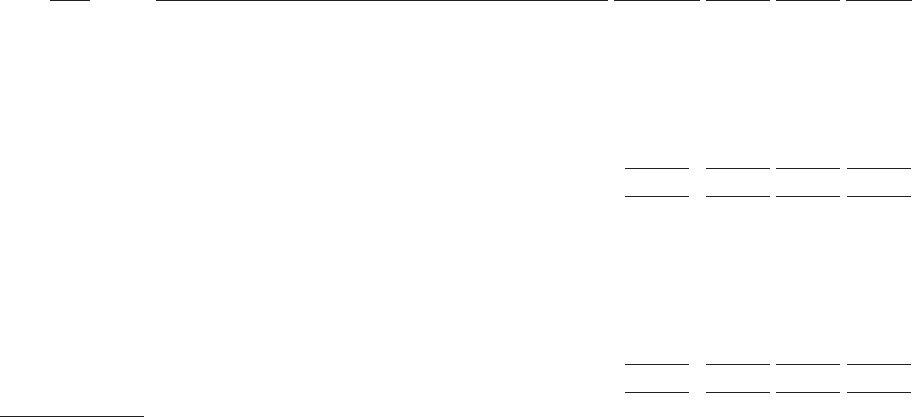

Name Executive Payment on Termination

Involuntary

Not for

Cause

Termination

($)

Change

in

Control

($)

Death

($)

Disability

($)

Tara L. Khoury Base Salary ............................................... 514,080 642,600 — —

Annual Incentive Target Opportunity .......................... — 385,560 192,780 192,780

Long Term Incentives — Options ............................. 53,332 70,995 70,995 70,995

Long Term Incentives — Performance Restricted Shares (e) ........ 274,164 446,219 446,219 446,219

Basic Benefits ............................................ 10,660 10,660 — —

Retiree Benefits ........................................... — — — —

Other Contractual Payments ................................. — — — —

Excise — Tax Gross-up (a)(b) ................................ — — — —

TOTAL ............................................... 852,236 1,556,034 709,994 709,994

Christopher J. Wilson Base Salary ............................................... 520,080 630,400 — —

Annual Incentive Target Opportunity .......................... — 409,760 204,880 204,880

Long Term Incentives — Options ............................. 205,595 241,866 241,866 241,866

Long Term Incentives — Performance Restricted Shares (e) ........ 353,718 565,631 565,821 565,631

Basic Benefits ............................................ 10,753 10,753 — 165,811

Retiree Benefits ........................................... — — — —

Other Contractual Payments ................................. — — — —

Excise — Tax Gross-up (a)(b) ................................ — 621,376 — —

TOTAL ............................................... 1,090,146 2,479,786 1,012,567 1,178,188

(a) These amounts are meant to defray related tax liabilities related to a change in control. The discount rate used for retiree benefit

parachute values was 4.90%, consistent with the rate determined for the Company’s financial statements under Accounting Standards

Codification Topic 960. On April 27, 2010, the Compensation Committee adopted a policy that the Company would no longer enter into

new or materially alter employment agreements with named executive officers providing for excise tax gross-ups upon a change of

control. As a result, the employment agreements of Mr. Torbeck and Ms. Khoury do not contain any excise tax gross-up provisions, and

Mr. Wojtaszek will not have an excise tax gross-up provision beginning in 2011.

(b) The executives are subject to restrictive covenants post-termination that were, in part, consideration for compensation of benefits. The

value of these restrictive covenants would be favorable and were not considered for this calculation.

(c) If Mr. Torbeck’s employment is terminated due to disability or an involuntary not for cause termination, then he is entitled to a lump sum

cash payment equal to four times his salary. The payment decreases to three times his salary in calendar year 2012, two times his salary

in calendar year 2013, and equal to his accrued salary and accrued incentive award in calendar year 2014 and beyond.

(d) Non-equity incentive compensation payment is contingent on the Company’s attainment of target performance metrics for the 2011 and

2012 performance years and is indexed to the Company’s stock price at the end of each performance year. The table includes the target

payout, but the actual payout based on performance metric attainment and the Company’s stock price could range from zero to $5

million.

(e) Performance restricted shares include shares that are based on the attainment of target performance metrics in the 2011 performance year.

These awards have been included in the table at target; however, the actual payouts based on attainment of the metrics could range from

zero to 200% of the target amount.

If any of the executives elects to voluntarily terminate employment with the Company, or if they are

terminated by the Company for cause, they are entitled to no payments from the Company other than those

benefits which they have a non-forfeitable vested right to receive, which include any shares of stock they own

outright, vested options which may be exercisable for a period of 90 days following termination, deferred

compensation amounts and vested amounts under the Company’s pension and savings plans. Mr. Cassidy is

entitled to receive payment of the nonqualified retirement benefit of $968,996 provided for in his employment

agreement in which he is already vested. Payment of such accrued, vested and non-forfeitable amounts is also

applicable to each of the other four termination scenarios detailed in the above table and discussed below, and

each executive is still bound by the non-disclosure, non-compete and non-solicitation provisions of their

agreements.

If an executive is terminated by the Company without cause (an involuntary not for cause termination), the

executive will be entitled to the following:

•A payment equal to two times of his base salary in the case of Mr. Wojtaszek, 1.65 times of his base

salary in the case of Mr. Wilson, and 1.60 times her base salary in the case of Ms. Khoury. If the

58