Cincinnati Bell 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

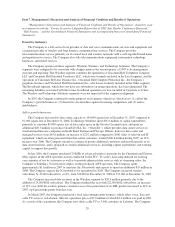

Wireless competes against national, well-funded wireless service providers in the Cincinnati and Dayton,

Ohio metropolitan market areas, including AT&T, Sprint Nextel, T-Mobile, Verizon and Leap. In addition, Time

Warner Cable entered into a joint venture with Sprint Nextel. This joint venture purchased spectrum licenses in

2006 during the AWS spectrum auction conducted by the FCC and in 2007 began to offer wireless services. The

Company anticipates that continued competition could compress its margins for wireless products and services as

carriers continue to offer more minutes for equivalent or lower service fees while CBW cannot offer more

minutes without incremental capital expenditures and operating costs. CBW’s ability to compete will depend, in

part, on its ability to anticipate and respond to various competitive factors affecting the telecommunications

industry.

Furthermore, there has been a trend in the wireless communications industry towards consolidation through

joint ventures, reorganizations, and acquisitions. The Company expects this consolidation trend to lead to larger

competitors with greater resources and more service offerings than CBW. In addition, wireless subscribers are

permitted to retain their wireless phone numbers when changing to another wireless carrier within the same

geographic area. The Company generally does not enter into long-term contracts with its wireless subscribers,

and therefore, this portability could have a significant adverse affect on the Company. The Company also

believes that these wireless competitors and in particular, companies that offer unlimited wireless service plans

for a flat monthly fee, are a cause of CBT’s access line loss.

Technology Solutions competes against numerous other information technology consulting, web-hosting,

data center and computer system integration companies, many of which are larger, national in scope, and better

financed. This market is rapidly evolving, highly competitive and likely to be characterized by over-capacity and

industry consolidation. Other competitors may consolidate with one another or acquire software application

vendors or technology providers, enabling them to more effectively compete with Technology Solutions. The

Company believes that many of the participants in this market must grow rapidly and achieve a significant

presence to compete effectively. This consolidation could affect prices and other competitive factors in ways that

could impede Technology Solutions’ ability to compete successfully in the market.

The effect of the foregoing competition on any of the Company’s segments could have a material adverse

impact on its businesses, financial condition, results of operations, and cash flows. This could result in increased

reliance on borrowed funds and could impact the Company’s ability to maintain its wireline and wireless

networks.

Maintaining the Company’s networks requires significant capital expenditures and its inability or failure to

maintain its networks would have a material impact on its market share and ability to generate revenue.

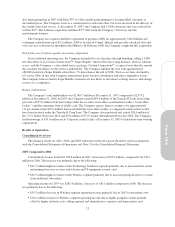

During the year ended December 31, 2007, capital expenditures totaled $233.8 million, which included

$97.4 million of capital expenditures related to data center construction and building its 3G wireless network.

The Company expects to spend approximately 16% of 2008 revenue on capital expenditures, which includes

approximately $19 million to finish building its 3G wireless network. The Company also purchased 10MHz of

spectrum in the Indianapolis area in 2006. The Company is considering its options with respect to the

Indianapolis spectrum, which include expansion of its wireless operations into this area, which would require

significant capital expenditures, or lease of the spectrum to another wireless provider.

The Company currently operates nine data centers, including those acquired through the purchase of GramTel

in December 2007, and any further data center expansion will involve significant capital expenditures for data

center construction. In order to provide guaranteed levels of service to our data center customers, the network

infrastructure must be protected against damage from human error, natural disasters, unexpected equipment failure,

power loss or telecommunications failures, terrorism, sabotage, or other intentional acts of vandalism. The

Company’s disaster recovery plan may not address all of the problems that may be encountered in the event of a

disaster or other unanticipated problem, which may result in disruption of service to data center customers.

The Company may also incur significant additional capital expenditures as a result of unanticipated

developments, regulatory changes, and other events that impact the business. If the Company is unable or fails to

adequately maintain or expand its networks to meet customer needs, there could be a material adverse impact on

the Company’s market share and its ability to generate revenue.

11

Form 10-K