Cincinnati Bell 2007 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2007 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5. Acquisitions of Businesses and Wireless Licenses

GramTel USA, Inc.

On December 31, 2007, the Company purchased GramTel USA, Inc. (“GramTel”), a data center business in

South Bend, Indiana, for a purchase price of $20.3 million (including $0.6 million of accrued transaction costs),

of which $19.0 million was paid in cash in 2007. The Company funded the purchase with its Corporate credit

facility. The purchase price was primarily allocated to property, plant and equipment for $4.3 million, customer

relationship intangible assets for $9.0 million, and goodwill for $7.0 million. The preliminary purchase price

allocation for this transaction may be adjusted upon completion of the Company’s valuation of the assets and

liabilities of the business. The Company anticipates both the goodwill and intangible assets to be fully deductible

for tax purposes. The financial results will be included in the Technology Solutions segment.

Local Telecommunication Business

In March 2007, the Company purchased a local telecommunication business (“Lebanon”), which offers

voice, data and cable TV services, in Lebanon, Ohio for a purchase price of $7.0 million, of which $4.6 million

was paid in March 2007. The Company funded the purchase with its available cash. The purchase price was

primarily allocated to property, plant and equipment for $4.4 million, customer relationship intangible assets for

$1.5 million and goodwill for $2.1 million. The financial results have been included in the Wireline segment and

were immaterial to the Company’s financial statements for the year ended December 31, 2007.

Acquisition of Remaining Interest in Cincinnati Bell Wireless LLC

In February 2006, the Company purchased the remaining 19.9% membership interest in Cincinnati Bell

Wireless LLC (“CBW”). As a result, the Company paid purchase consideration of $83.0 million in cash and

incurred transaction expenses of $0.2 million. CBW is now a wholly-owned subsidiary of the Company. The

Company funded the purchase with its Corporate credit facility and available cash.

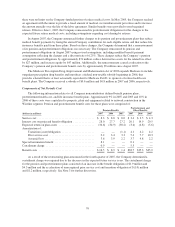

The transaction was accounted for as a step acquisition using the purchase method of accounting in

accordance with SFAS No. 141, “Business Combinations.” The Company applied the purchase price against the

minority interest and then allocated the remainder to identifiable tangible and intangible assets and liabilities

acquired as follows:

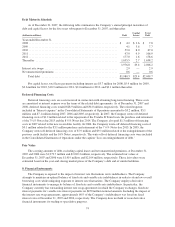

(dollars in millions)

Minority interest .................... $27.8

Intangible assets .................... 42.1

Goodwill .......................... 10.2

Other ............................. 3.1

Total purchase price ................. $83.2

The purchase price allocation was based upon the estimated fair values as of February 2006 of the tangible

and intangible assets and liabilities. Estimated fair value was compared to the book value already recorded, and

19.9% of the excess of estimated fair value over book value was allocated to the respective tangible and

intangible assets and liabilities. The excess purchase price over the minority interest and fair value ascribed to the

tangible and intangible assets and liabilities was recorded as goodwill. The Company anticipates both the

goodwill and intangible assets to be fully deductible for tax purposes.

66