Cincinnati Bell 2007 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2007 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

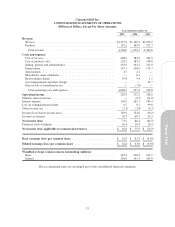

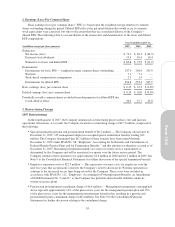

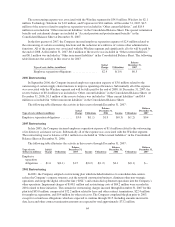

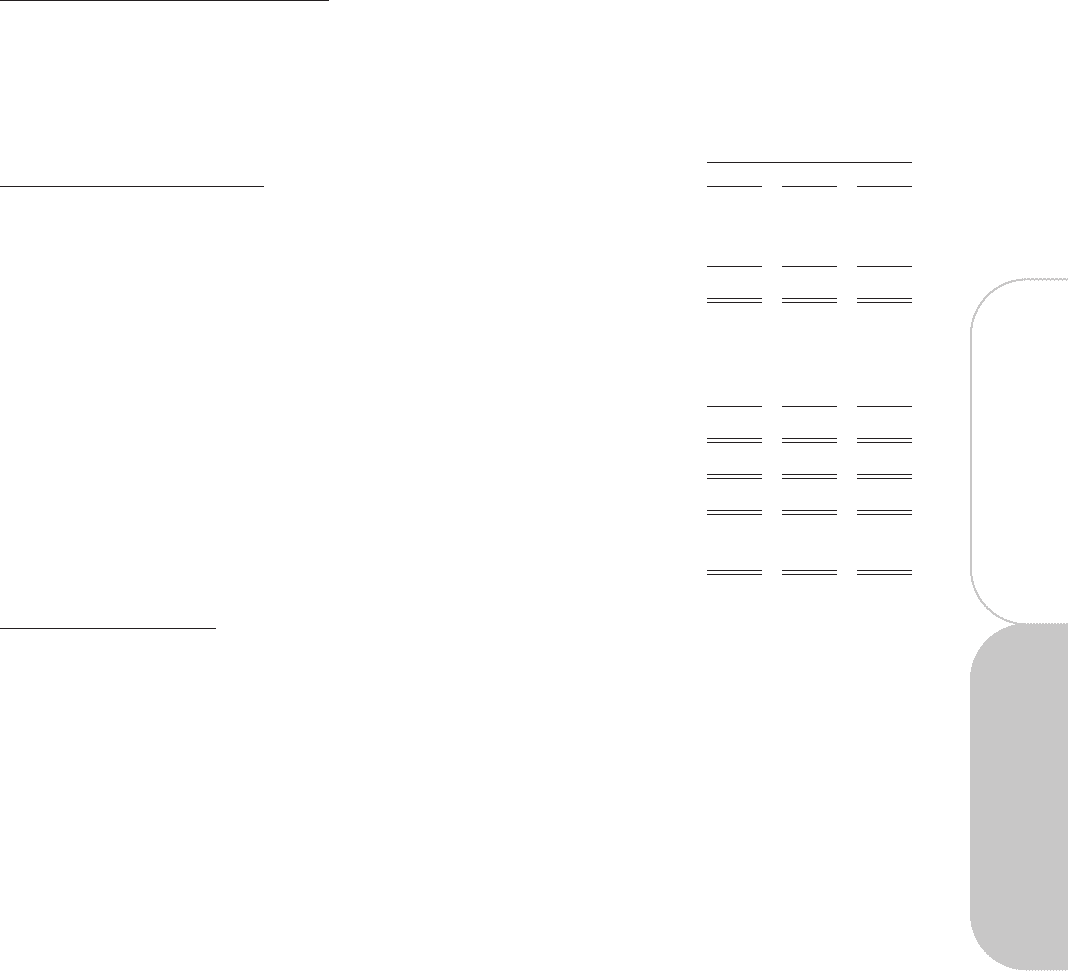

2. Earnings (Loss) Per Common Share

Basic earnings (loss) per common share (“EPS”) is based upon the weighted average number of common

shares outstanding during the period. Diluted EPS reflects the potential dilution that would occur if common

stock equivalents were exercised, but only to the extent that they are considered dilutive to the Company’s

diluted EPS. The following table is a reconciliation of the numerators and denominators of the basic and diluted

EPS computations:

Year Ended December 31,

(in millions, except per share amounts) 2007 2006 2005

Numerator:

Net income (loss) .................................................... $ 73.2 $ 86.3 $ (64.5)

Preferred stock dividends .............................................. 10.4 10.4 10.4

Numerator for basic and diluted EPS ..................................... $ 62.8 $ 75.9 $ (74.9)

Denominator:

Denominator for basic EPS — weighted average common shares outstanding .... 247.4 246.8 245.9

Warrants ........................................................... 7.1 5.1 —

Stock-based compensation arrangements ................................. 2.3 1.4 —

Denominator for diluted EPS ........................................... 256.8 253.3 245.9

Basic earnings (loss) per common share .................................... $ 0.25 $ 0.31 $ (0.30)

Diluted earnings (loss) per common share ................................... $ 0.24 $ 0.30 $ (0.30)

Potentially issuable common shares excluded from denominator for diluted EPS due

to anti-dilutive effect ................................................. 36.5 37.7 45.0

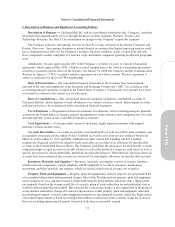

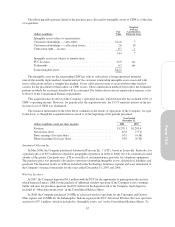

3. Restructuring Charges

2007 Restructurings

In the fourth quarter of 2007, the Company announced a restructuring plan to reduce costs and increase

operational efficiencies. As a result, the Company incurred a restructuring charge of $37.5 million, composed of

the following:

•Special termination pension and postretirement benefit of $8.2 million — The Company offered and, by

December 31, 2007, 105 management employees accepted special termination benefits totaling $12

million. The Company determined that $8.2 million of these benefits have been earned through

December 31, 2007 under SFAS No. 88, “Employers’ Accounting for Settlements and Curtailments of

Defined Benefit Pension Plans and for Termination Benefits,” and this amount was therefore accrued as of

December 31, 2007. Remaining termination benefits are subject to future service requirements as

determined by the Company and will be amortized to expense over the future service period. The

Company estimates these amounts to be approximately $2.6 million in 2008 and $1.2 million in 2009. See

Note 9 to the Consolidated Financial Statements for further discussion of the special termination benefits.

•Employee separation costs of $22.9 million — This represents severance costs for employees over the

next five years that are primarily related to the Company’s need to downsize its Wireline operations to

conform to the decreased access lines being served by the Company. These costs were recorded in

accordance with SFAS No. 112, “Employers’ Accounting for Postemployment Benefits, an Amendment

of FASB Statements No. 5 and 43,” as the Company has probable and estimable liabilities under its

written severance plans.

•Pension and postretirement curtailment charge of $6.4 million — Management terminations contemplated

above represent approximately 10% of the plan service years for the management pension plan and 15%

of the plan service years for the management postretirement benefits plan, resulting in a pension and

postretirement plans curtailment charge of $6.4 million. See Note 9 to the Consolidated Financial

Statements for further discussion relating to the curtailment charge.

63

Form 10-K