Cincinnati Bell 2007 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2007 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Anthem Demutualization Claim

In November 2007, a class action complaint was filed against the Company and Wellpoint Inc., formerly

known as Anthem, Inc. The complaint alleges that the Company improperly received stock as a result of the

demutualization of Anthem and that a class of insured persons should have received the stock instead. In

February 2008, the Company filed a response in which it denied all liability and raised a number of defenses. The

Company believes that it has meritorious defenses and intends to vigorously defend this action. The Company

does not believe this claim will have a material effect on its financial condition.

Other

In September 2006, the SEC issued Staff Accounting Bulletin (“SAB”) No. 108, “Considering the Effects of

Prior Year Misstatements When Quantifying Misstatements in Current Year Financial Statements,” which

provides interpretive guidance on how registrants should quantify financial statement misstatements. Under SAB

No. 108, registrants are required to consider both a “rollover” method, which analyzes the impact of the

misstatement on the financial statements based on the amount of the error originating in the income statement

being analyzed, and the “iron curtain” method, which analyzes the impact of the misstatement on the financial

statements based on the cumulative effect of the error on the income statement being analyzed. The transition

provisions of SAB No. 108 permit a registrant to adjust retained earnings for the cumulative effect of immaterial

errors relating to prior years. The Company was required to adopt SAB No. 108 in 2006.

The Company recorded a net adjustment of $9.0 million to the 2006 opening accumulated deficit balance,

comprised of $14.2 million in regulatory tax liabilities, net of expected refunds, offset by the income tax effects

of $5.2 million. The Company has determined that its past filing positions should have resulted in an accrual of a

contingent liability in prior years. Historically, the Company has evaluated uncorrected differences utilizing the

rollover approach. The Company believes the impact of not recording the regulatory taxes was not material to

prior fiscal years under the rollover method. However, under SAB No. 108, the Company must assess materiality

using both the rollover method and the iron-curtain method, which resulted in the $9.0 million adjustment to the

2006 opening accumulated deficit balance.

At December 31, 2006, regulatory tax liabilities, net of expected refunds, related to the past filing positions

being questioned totaled $18.0 million. As a result of payments made in 2007, at December 31, 2007, the

Company’s liability has decreased to $2.5 million. The issues have not been resolved, and the Company believes

it has meritorious defenses related to the payment of these regulatory taxes and intends to defend its position in

order to limit the ultimate payment of the fees.

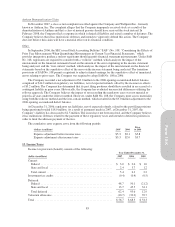

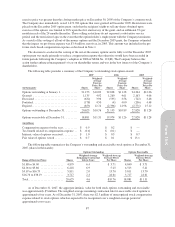

The cumulative error expense arose from the following periods:

(dollars in millions) 2005 2004

Prior

to 2004

Expense adjustment before income taxes ..................... $5.3 $3.1 $5.8

Expense adjustment after income taxes ...................... $3.3 $2.0 $3.7

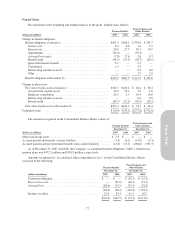

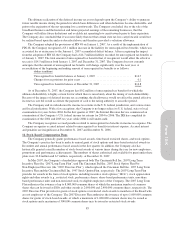

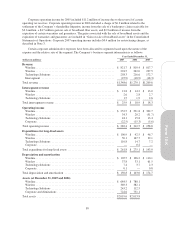

13. Income Taxes

Income tax provision (benefit) consists of the following:

Year Ended December 31,

(dollars in millions) 2007 2006 2005

Current:

Federal .................................................. $ 3.0 $ 2.6 $ 1.0

State and local ............................................ 2.4 3.7 1.2

Total current .............................................. 5.4 6.3 2.2

Investment tax credits ........................................ (0.4) (0.4) (0.5)

Deferred:

Federal .................................................. 48.7 50.1 (21.2)

State and local ............................................ 13.7 45.5 34.1

Total deferred ............................................. 62.4 95.6 12.9

Valuation allowance .......................................... (10.7) (33.2) 39.7

Total ...................................................... $56.7 $ 68.3 $ 54.3

83

Form 10-K