Cincinnati Bell 2007 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2007 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cash Flow

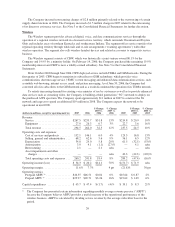

2007 Compared to 2006

For the twelve months ended December 31, 2007, cash provided by operating activities totaled $308.8

million, a decrease of $25.9 million compared to the $334.7 million provided by operating activities during the

same period in 2006. The decrease was due to payments of $56.0 million for operating taxes and early pension

contributions partially offset by a customer prepayment of $21.5 million for data center services and increased

operating cash generated by the Wireless segment due to service revenue growth.

Cash flow utilized for investing activities increased $3.5 million to $263.5 million during 2007 as compared

to $260.0 million for 2006. Capital expenditures were $233.8 million, an increase of $82.5 million compared to

2006, which resulted mostly from data center expansion. In addition to the increase in capital expenditures for

data centers, the Company purchased a data center business in South Bend, Indiana in December 2007 for a

purchase price of $20.3 million (including $0.6 million of accrued transaction costs), of which $19.0 million was

paid in cash in 2007. In the first quarter of 2007, the Company purchased a local telecommunication business and

paid $4.6 million. Also, in late 2007 the Company deposited $4.4 million with the FCC for the opportunity to

participate in the auction for the purchase of additional wireless spectrum. Cash flows from investing activities

for 2006 includes payments of $86.7 million for the acquisitions of ATI and the 19.9% minority interest in CBW,

as well as $37.1 million for the purchase of wireless licenses in an FCC auction. Proceeds were received in 2006

for $4.7 million on sale of broadband fiber assets and for $5.7 million on the sale of an investment.

Cash flow used in financing activities was $98.6 million in 2007 compared to $21.0 million during 2006.

The increased use of cash flow for financing activities primarily relates to increased repayments of debt, net of

debt issuances, as discussed above.

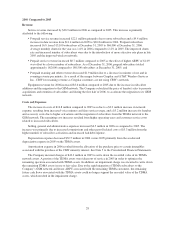

2006 Compared to 2005

In 2006, cash provided by operating activities totaled $334.7 million, an increase of $12.4 million compared

to the $322.3 million provided by operating activities during 2005. The increase was generated by working

capital improvements, partially offset by lower operating cash due to access line losses and shareholder claim

payments of $6.3 million.

Cash utilized in investing activities in 2006 was $260.0 million, an increase of $117.3 million compared to

the $142.7 million utilized in 2005. The increase predominately relates to the acquisitions of ATI and the 19.9%

minority interest in CBW for $86.7 million, and the purchase of wireless licenses in the FCC auction for $37.1

million. Capital expenditures increased slightly in 2006 compared to last year. Proceeds were received in 2006

for $4.7 million on the sale of broadband fiber assets and for $5.7 million on the sale of an investment.

Cash flows used in financing activities decreased $157.8 million to a net outflow of $21.0 million in 2006

from an outflow of $178.8 million during 2005. During 2006, the Company funded the acquisitions of the

remaining 19.9% membership interest in CBW and ATI and the purchase of the wireless licenses, which

decreased the Company’s repayment of debt as compared to 2005. The Company repaid $13.3 million in debt in

2006. During 2005, the Company received $752.1 million of cash proceeds from the issuance of the 7% Notes,

additional 8

3

⁄

8

% Notes and new bank term notes. In addition, during 2005, the Company repaid $903.3 million in

borrowings, substantially all of which was the prepayment of borrowings under its term and revolving credit

facilities and its 16% Notes, using the net cash proceeds discussed above. In conjunction with the debt issuance

and repayments in 2005, the Company incurred debt issuance costs and consent fees of $21.9 million.

36