Cincinnati Bell 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

also began partnering in 2007 with DirecTV©to offer satellite programming to Cincinnati Bell customers at

discounted prices. The Company receives a commission for each subscriber, but is not involved in the delivery of

the satellite television service. At December 31, 2007, the Company had 15,000 customers that were subscribers

to DirecTV©. The Lebanon acquisition and DirecTV©offer mark the Company’s first foray into the

entertainment business.

The Company also signed a definitive agreement to purchase eGIX for approximately $18.0 million and

contingent consideration up to $5.2 million. eGIX is located in Carmel, Indiana and provides advanced data and

voice services to businesses throughout the Midwest. In February 2008, the Company completed this acquisition.

Defend the core franchise against increasing competition

In its traditional operating area, the Company defended its core franchise through bundling, adding 11,000

net subscribers to its Custom ConnectionsSM “Super Bundle” which offers local, long distance, wireless, internet

access, and the Company’s value-added service package, Custom Connections®, at a price lower than the amount

the customer would pay for the services individually. The Company finished the year with approximately

180,000 in-territory Super Bundle subscribers, 7% more than at the end of 2006. Total access lines declined by

6% versus 2006, in line with Company expectations given wireless substitution and other competitive factors.

The Company believes that its Super Bundle customers are less likely to disconnect existing services and change

services to a competitor.

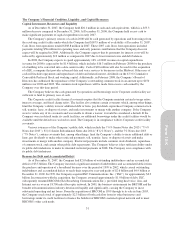

Reduce indebtedness

The Company’s total indebtedness was $2,009.7 million at December 31, 2007 compared to $2,073.2

million at December 31, 2006. In 2007, the Company repaid $184.0 million of the Tranche B Term Loan using

proceeds of $75.0 million from borrowings under the accounts receivables securitization facility (“receivables

facility”) and the remainder from available cash. The Company expects interest savings to be approximately

1% per annum on the $75.0 million borrowed under the receivables facility as compared to interest that would

have been incurred under the Tranche B Term Loan. The Company also purchased and retired $26.4 million of

the 7

1

⁄

4

% Senior Notes due 2013 and $5.0 million of 8

3

⁄

8

% Senior Subordinated Notes due 2014. The Company

had borrowings of $55.0 million on its Corporate credit facility at December 31, 2007 to fund short-term working

capital needs.

Results of Operations

Consolidated Overview

The financial results for 2007, 2006, and 2005 referred to in this discussion should be read in conjunction

with the Consolidated Statements of Operations and Note 15 to the Consolidated Financial Statements.

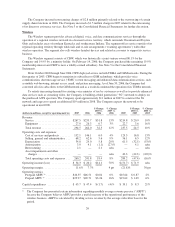

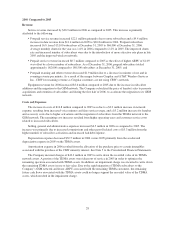

2007 Compared to 2006

Consolidated revenue totaled $1,348.6 million in 2007, an increase of $78.5 million, compared to $1,270.1

million in 2006. The increase was primarily due to the following:

•$41.7 million higher revenues in the Technology Solutions segment primarily due to increased data center

and managed services revenue and telecom and IT equipment revenue; and

•$32.5 million higher revenues in the Wireless segment primarily due to increased postpaid service revenue

from additional subscribers.

Operating income for 2007 was $282.4 million, a decrease of $30.1 million compared to 2006. The decrease

was primarily due to the following:

•$39.3 million decrease in Wireline segment operating income primarily due to 2007 restructuring costs;

•$14.1 million increase in Wireless segment operating income due to higher postpaid revenue partially

offset by higher network costs, selling, general and administrative expenses and depreciation; and

21

Form 10-K