Cincinnati Bell 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

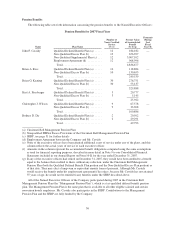

2007, the Company reversed a portion of previously recorded FAS 123(R) expense related to stock options previously granted to

Mr. Dir. For a discussion of valuation assumptions and methodology, see Note 14 to our Consolidated Financial Statements included in

our Annual Report on Form 10-K for the year ended December 31, 2007. The actual stock option grants are shown in the Grant of Plan-

Based Awards table on page 48.

(d) The amounts shown in this column in 2007 for each of the executives and in 2006 for Messrs. Cassidy, Ross, Dir and Wilson represent

the one-year increase in the value of their qualified defined benefit plan and nonqualified excess plan as of December 31, 2007 and

December 31, 2006, respectively, projected forward to age 65 for each executive with interest credited at the rate a terminated participant

would be given (3.5%) and then discounted back to December 31, 2007 and December 31, 2006, respectively, at the discount rate

(6.20% for 2007 and 5.75% for 2006) required under FAS 87. Mr. Cassidy’s total increase also includes an amount in 2007 of $722,311,

which represents the change from 2006 to 2007, and an amount in 2006 of $505,000, which represents the change from 2005 to 2006, in

the actuarial present value of the accumulated benefit under the SERP. Mr. Cassidy’s total increase from 2005 to 2006 also includes an

amount equal to $203,000 which represents the change in the actuarial present value of the accumulated benefit for a contractual

retirement benefit in his employment agreement. None of the executives receive any preferential treatment under the Company’s

retirement plans.

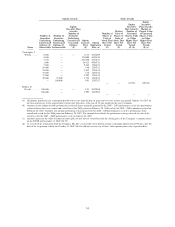

(e) The table below shows the components of the “All Other Compensation” column.

Name Year

401(k) Match

($)

Flexible Perquisite

Program Reimbursements

($) (1)

Total “All Other

Compensation”

($)

John F. Cassidy ....................... 2007 8,800 32,952 41,752

2006 8,400 29,059 37,459

Brian A. Ross ......................... 2007 8,800 22,825 31,625

2006 8,400 23,000 31,400

Brian G. Keating ...................... 2007 8,717 14,049 22,766

Kurt A. Freyberger ..................... 2007 6,355 5,444 11,799

Christopher J. Wilson ................... 2007 1,761 16,000 17,761

2006 7,233 12,915 20,148

Rodney D. Dir ........................ 2007 8,800 18,453 27,253

2006 8,400 16,989 25,389

(1) For more detail about the Company’s Flexible Perquisite Reimbursement Program, see the discussion in the Compensation

Disclosure and Analysis beginning on page 41. The following program benefits were utilized by the executives: Mr. Cassidy —

automobile allowance election, legal/financial planning fees and club dues; Mr. Ross — automobile allowance, club dues, life

insurance, monthly home security system and legal/financial planning fees; Mr. Keating — automobile allowance, life insurance

and legal/financial planning fees; Mr. Freyberger — automobile allowance and club dues; Mr. Wilson — automobile allowance,

club dues, life insurance premiums and legal/financial planning fees; and Mr. Dir — automobile allowance, club dues, life insurance

and legal/financial planning fees. None of the executives received in excess of $25,000 in either 2007 or 2006 for any individual

type of perquisite available under the Flexible Perquisite Reimbursement Program.

As described on page 51, each executive is provided an annual allowance to use in connection with participation in the Company’s

Flexible Perquisite Program. The amounts for Messrs. Keating and Wilson for 2007 in the table above are greater than their

respective annual allowances for 2007 because such amounts include the reimbursement in 2007 for expenses incurred in 2006 and

reimbursement related to physical examination. The Company applied the expenses incurred in 2006 but reimbursed in 2007 against

the 2006 annual allowances.

46