Cincinnati Bell 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Vote Required

Adoption of the proposed amendments to the Company’s Amended Articles of Incorporation and Amended

Regulations requires both (i) the affirmative vote of the holders of two-thirds of the issued and outstanding

common shares and 6

3

⁄

4

% Cumulative Convertible Preferred Shares, voting as one class and (ii) the affirmative

vote of the holders of a majority of disinterested shares voted on the proposal. Accordingly, in determining the

vote of the issued and outstanding common shares and 6

3

⁄

4

% Cumulative Convertible Preferred Shares, voting as

one class (subclause (i) above), abstentions from voting and broker non-votes will have the effect of a vote

against the proposed amendment and, in determining the vote of disinterested shares voted (subclause (ii) above),

abstentions from voting and broker non-votes will have no effect on the vote.

If approved, this amendment will become effective upon the filing of a Certificate of Amendment to the

Company’s Amended Articles of Incorporation with the Secretary of State of Ohio. The Company would make

such filing promptly after approval of the proposal at the annual meeting. The directors elected at the 2009

annual meeting of shareholders would then be elected to serve one-year terms.

For purposes of the above vote, “disinterested” shares means voting shares beneficially owned by any

person not an interested shareholder or an affiliate or associate of an interested shareholder. An interested

shareholder, with respect to the Company, means a person, other than the Company, a subsidiary of the

Company, any employee stock ownership or benefit plan of the Company or a subsidiary of the Company, or any

trustee or fiduciary with respect to any such plan acting in such capacity, who is the beneficial owner of a

sufficient number of shares of the Company that, when added to all other shares of the Company in respect of

which that person may exercise or direct the exercise of voting power, would entitle that person, directly or

indirectly, alone or with others, including affiliates and associates of that person, to exercise or direct the exercise

of ten percent (10%) of the voting power of the Company in the election of directors after taking into account all

of that person’s beneficially owned shares that are not currently outstanding.

The Board recommends a vote FOR the proposed amendments.

Effect of Management Vote on Proposal

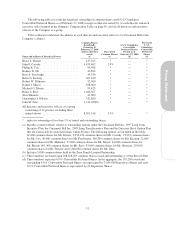

Since the directors and officers of the Company own beneficially 8,091,316 voting securities or 3.3 percent

of the outstanding voting securities, their votes are not likely to have a material impact on whether the proposal is

adopted.

22