Cincinnati Bell 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

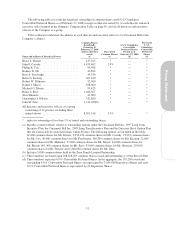

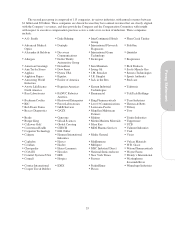

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of common shares as of December 31, 2007 by each

beneficial owner of more than five percent (5%) of the common shares outstanding known by the Company. No

beneficial owner owns more than five percent (5%) of the 6

3

⁄

4

% Cumulative Convertible Preferred Shares.

Name and Address of Beneficial Owner

Common Shares

Beneficially

Owned

Percent Of

Common Shares

Barclays Global Investors, N.A. ....................

45 Fremont Street

San Francisco, CA 94105

18,132,723 (a) 7.3% (a)

FMRLLC......................................

82 Devonshire Street

Boston, MA 02109

17,763,736 (b) 7.2% (b)

GAMCO Investors, Inc. and affiliates ................

One Corporate Center

Rye, NY 10580

12,704,969 (c) 5.1% (c)

Wells Fargo & Company ..........................

420 Montgomery Street

San Francisco, CA 94163

13,894,061 (d) 5.6% (d)

(a) As reported on Schedule 13G filed on February 5, 2008 by Barclays Global Investors, N.A., as of

December 31, 2007, Barclays Global Investors, N.A. had sole voting power for 8,705,490 common shares

and sole dispositive power for 9,894,390 common shares and Barclays Global Fund Advisors had sole voting

and dispositive power for 8,238,333 common shares.

(b) As reported on Schedule 13G filed on February 14, 2008 by FMR LLC, as of December 31, 2007, FMR LLC

had sole voting power for 592,760 common shares and sole dispositive power for 17,763,736 common

shares.

(c) As reported on Schedule 13D filed on January 9, 2008 by GAMCO Investors, Inc., Gabelli Funds, LLC has

sole voting and dispositive power for 4,787,363 common shares, GAMCO Asset Management Inc. has sole

voting power for 7,521,606 common shares and sole dispositive power for 7,824,606 common shares, MJG

Associates, Inc. has sole voting and dispositive power for 55,000 common shares, Gabelli Securities, Inc. has

sole voting and dispositive power for 33,000 common shares and Mario J. Gabelli has sole voting and

dispositive power for 5,000 common shares. The amounts found in the Schedule 13D include a number of

shares with respect to which certain of the reporting persons (Gabelli Funds, LLC and GAMCO Asset

Management, Inc.) have the right to beneficial ownership upon the conversion of the Company’s 6

3

⁄

4

%

Cumulative Convertible Preferred Shares.

(d) As reported on Schedule 13G filed on February 1, 2008 by Wells Fargo & Company, as of December 31,

2007, Wells Fargo & Company had sole voting power for 13,414,706 common shares and sole dispositive

power for 13,707,539 common shares.

30