Cincinnati Bell 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192

|

|

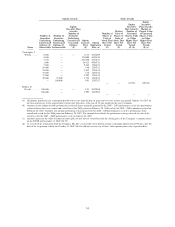

be awarded units equal to 100% of their target unit grant. If the Company’s cumulative three-year free cash flow is 110% or more of the cumulative three-year goal, each of the executives will be

awarded units equal to 150% of the original target unit grant. The fair market value of one unit is equivalent to one share of common stock and, as required under the Cincinnati Bell Inc. 1997 Long

Term Incentive Plan, is determined by averaging the low and high traded price of the Company’s stock on the NYSE on the date of grant. The average of the high and low price of the Company’s

common shares on the NYSE on January 26, 2007 was $4.73.

(c) The material terms of the options granted are: grant type — non-incentive; exercise price — fair market value on grant date; vesting — 28% on the first anniversary of the original grant date and

thereafter at the rate of 3% per month for the next 24 months; term of grant — 10 years; termination — except in the case of death, disability or retirement, any unvested options will be cancelled 90

days following termination of employment.

(d) For the amounts related to option awards, the amounts set forth in this column represent the amount that will be expensed by the Company over the three-year vesting period. The grant date fair

value was determined using the Black-Scholes option-pricing model. For the amounts related to stock awards, the amounts set forth in this column represent the expense the Company may record

over the next three years assuming the maximum number of shares are earned and the executive remains with the Company through the applicable vesting dates. The grant date fair value was $4.73

as determined on the date of grant, January 26, 2007. For further discussion of assumptions and valuation, refer to Note 14 to our Consolidated Financial Statements included in our Annual Report

on Form 10-K for the year ended December 31, 2007.

49

Proxy Statement