Cincinnati Bell 2007 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2007 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

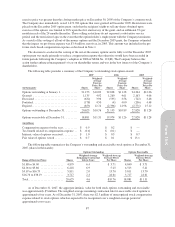

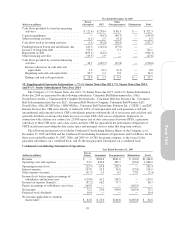

Corporate operating income for 2005 included $11.2 million of income due to the reversal of certain

operating tax reserves. Corporate operating income in 2006 included a charge of $6.3 million related to the

settlement of the Company’s shareholder litigation, income from the sale of a bankruptcy claim receivable for

$3.6 million, a $4.7 million gain on sale of broadband fiber assets, and $2.9 million of income from the

expiration of certain warranties and guarantees. The gains associated with the sale of broadband assets and the

expiration of warranties and guarantees are included in “Gain on sale of broadband assets” in the Consolidated

Statements of Operations. Corporate 2007 operating income includes $0.4 million for restructuring charges, as

described in Note 3.

Certain corporate administrative expenses have been allocated to segments based upon the nature of the

expense and the relative size of the segment. The Company’s business segment information is as follows:

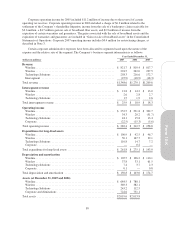

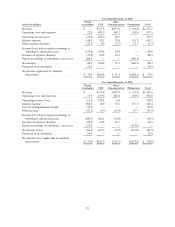

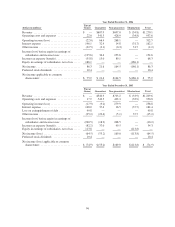

Year Ended December 31,

(dollars in millions) 2007 2006 2005

Revenue

Wireline ....................................................... $ 821.7 $ 810.4 $ 817.7

Wireless ....................................................... 294.5 262.0 237.5

Technology Solutions ............................................ 258.3 216.6 172.7

Intersegment ................................................... (25.9) (18.9) (18.3)

Total revenue ..................................................... $1,348.6 $1,270.1 $1,209.6

Intersegment revenue

Wireline ....................................................... $ 21.8 $ 14.2 $ 13.0

Wireless ....................................................... 2.6 2.8 2.7

Technology Solutions ............................................ 1.5 1.9 2.6

Total intersegment revenue .......................................... $ 25.9 $ 18.9 $ 18.3

Operating income

Wireline ....................................................... $ 252.5 $ 291.8 $ 302.7

Wireless ....................................................... 34.3 20.2 (51.7)

Technology Solutions ............................................ 18.1 15.8 13.4

Corporate ...................................................... (22.5) (15.3) (5.6)

Total operating income ............................................. $ 282.4 $ 312.5 $ 258.8

Expenditures for long-lived assets

Wireline ....................................................... $ 100.9 $ 92.5 $ 96.7

Wireless ....................................................... 50.1 167.7 39.1

Technology Solutions ............................................ 110.8 14.7 7.2

Corporate ...................................................... — 0.2 —

Total expenditure for long-lived assets ................................. $ 261.8 $ 275.1 $ 143.0

Depreciation and amortization

Wireline ....................................................... $ 105.5 $ 106.2 $ 110.1

Wireless ....................................................... 37.8 33.1 61.5

Technology Solutions ............................................ 7.4 3.7 2.3

Corporate ...................................................... 0.1 — 0.8

Total depreciation and amortization ................................... $ 150.8 $ 143.0 $ 174.7

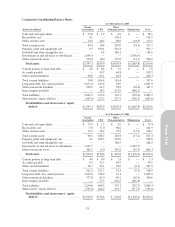

Assets (at December 31, 2007 and 2006)

Wireline ....................................................... $ 684.5 $ 788.1

Wireless ....................................................... 369.3 382.1

Technology Solutions ............................................ 243.2 112.5

Corporate and eliminations ........................................ 722.6 731.1

Total assets ...................................................... $2,019.6 $2,013.8

89

Form 10-K