Cincinnati Bell 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

a $3.6 million charge in the first quarter of 2006 related to new Kentucky state tax regulations issued in February

2006, which limited the Company’s ability to use its state net operating loss carryforwards against future state

taxable income, and higher pretax income. These increases were partially offset by an income tax charge of $47.5

million in 2005 resulting from the state of Ohio instituting a gross receipts tax and phasing out Ohio’s corporate

franchise and income tax which caused certain deferred tax assets to become unrealizable. The Company used

federal and state net operating loss carryforwards to substantially defray payment of federal and state tax

liabilities and as a result, had cash income tax payments of $6.6 million during the year.

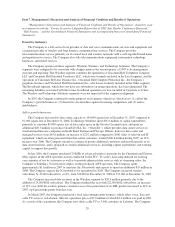

Discussion of Operating Segment Results

Wireline

The Wireline segment primarily provides local voice telephone service, including enhanced custom calling

features, and data services, which include DSL, dial-up Internet access, dedicated network access, Gigabit

Ethernet and Asynchronous Transfer Mode based data transport, to customers in southwestern Ohio, northern

Kentucky, and southeastern Indiana. CBT, which operates as the Incumbent Local Exchange Carrier (“ILEC”) in

its operating territory of an approximate 25-mile radius of Cincinnati, Ohio, is the primary provider of these

services. CBT’s network has full digital switching capability and can provide data transmission services to over

90% of its in-territory access lines via DSL.

Outside of its ILEC territory, the Wireline segment provides these services through CBET, which operates

as a competitive local exchange carrier (“CLEC”) both in the communities north of CBT’s operating territory and

in the greater Dayton market. CBET provides voice and data services for residential and business customers on

its own network and by purchasing unbundled network elements from the ILEC. CBET provides service through

UNE-L to its customer base in the Dayton, Ohio market. The Wireline segment links its Cincinnati and Dayton

geographies through its SONET, which provides route diversity via two separate paths.

In March 2007, CBET purchased a local telecommunication business, which offers voice, data and cable

services, in Lebanon, Ohio.

The Wireline segment also includes the operations of CBAD, CBCP, the Company’s payphone business and

CBE. CBAD provides long distance, audio conferencing and VoIP services and CBCP provides security

monitoring for consumers and businesses as well as related hardware. CBE had no activity in 2007.

In late 2007, CBAD committed to the acquisition of eGIX, a CLEC provider of voice and long distance

services to business customers in Indiana. Revenues for eGIX were approximately $15 million in 2007. The

Company completed this acquisition in February 2008.

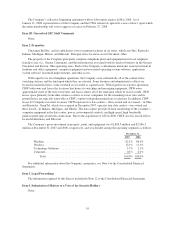

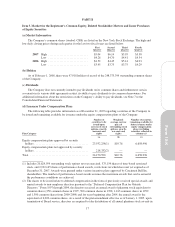

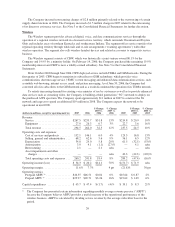

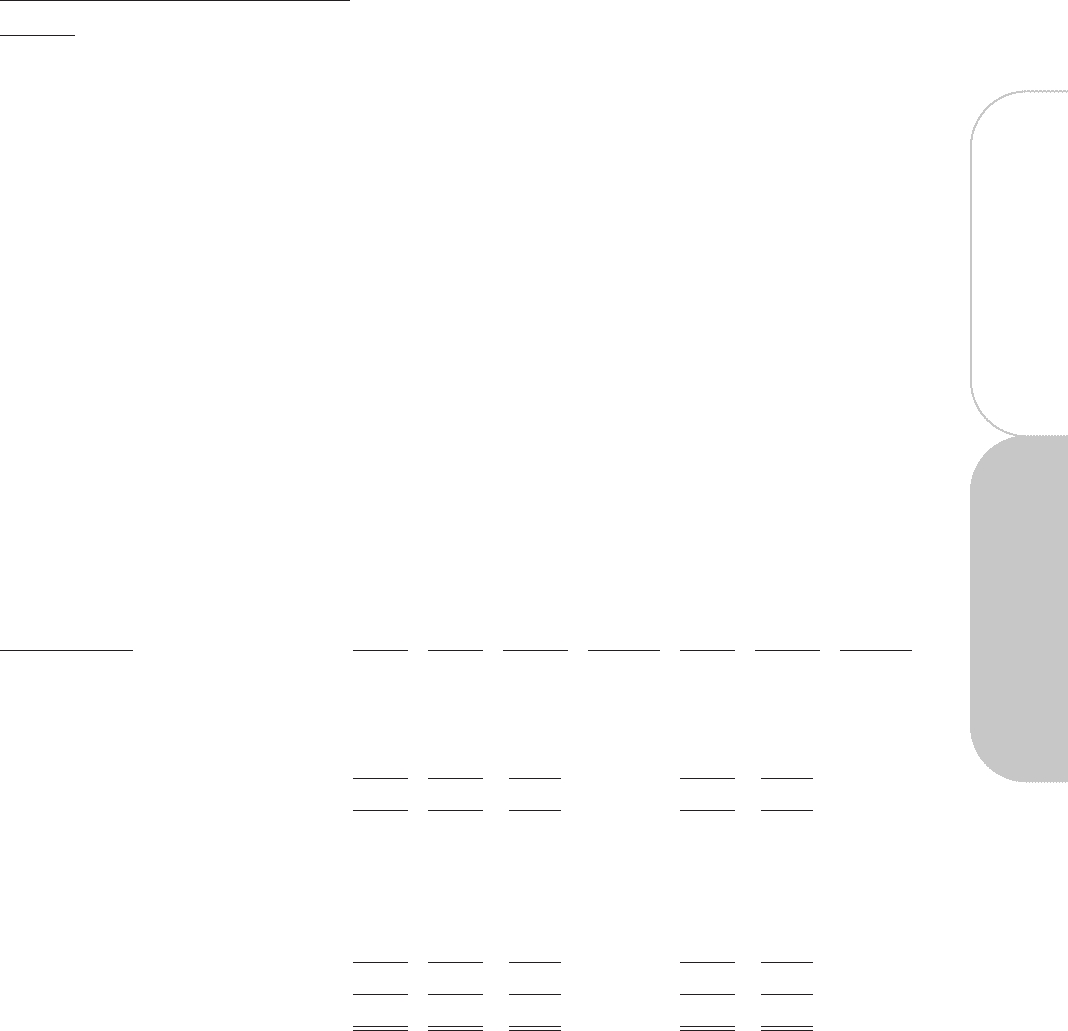

(dollars in millions) 2007 2006

$ Change

2007 vs.

2006

% Change

2007 vs.

2006 2005

$ Change

2006 vs.

2005

% Change

2006 vs.

2005

Revenue:

Voice — local service ............. $432.4 $463.9 $(31.5) (7)% $491.9 $(28.0) (6)%

Data ........................... 258.6 238.2 20.4 9% 219.2 19.0 9%

Long distance .................... 79.3 71.8 7.5 10% 69.5 2.3 3%

Other .......................... 51.4 36.5 14.9 41% 37.1 (0.6) (2)%

Total revenue .................... 821.7 810.4 11.3 1% 817.7 (7.3) (1)%

Operating costs and expenses:

Cost of services and products ....... 276.6 264.1 12.5 5% 260.1 4.0 2%

Selling, general and administrative . . . 151.0 145.5 5.5 4% 143.3 2.2 2%

Depreciation .................... 105.2 106.2 (1.0) (1)% 110.1 (3.9) (4)%

Amortization .................... 0.3 — 0.3 n/m — — n/m

Restructuring .................... 36.1 2.8 33.3 n/m 1.5 1.3 87%

Total operating costs and expenses . . . 569.2 518.6 50.6 10% 515.0 3.6 1%

Operating income .................. $252.5 $291.8 $(39.3) (13)% $302.7 $(10.9) (4)%

Operating margin ................... 30.7% 36.0% (5) pts 37.0% (1) pts

Capital expenditures ................ $ 96.3 $ 92.5 $ 3.8 4% $ 96.7 $ (4.2) (4)%

23

Form 10-K