Cincinnati Bell 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

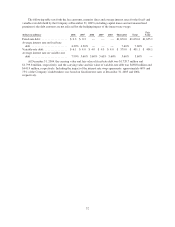

In addition to the federal tax net operating loss carryforwards, the Company has state and local net operating

loss carryforwards with a deferred tax asset value of $205.6 million and deferred tax temporary differences and

other tax attributes of $47.2 million. A valuation allowance of $183.9 million is provided at December 31, 2005

against certain state and local net operating losses and other deferred tax assets due to the uncertainty of the

Company’s ability to utilize the assets within the statutory expiration period.

The Company determines its effective tax rate by dividing its income tax expense by its income before taxes

as reported in its Consolidated Statement of Operations. For reporting periods prior to the end of the Company’s

fiscal year, the Company records income tax expense based upon an estimated annual effective tax rate. This rate

is computed using the statutory tax rate and an estimate of annual net income adjusted for an estimate of

non-deductible expenses.

The Company’s effective tax rate in 2005 was adversely affected by the $47.5 million income tax expense

associated with the change in Ohio tax law noted above, as well as by the non-deductible interest expense related

to securities originally issued to acquire its broadband business (the “Broadband Securities”) or securities which

the Company has subsequently issued to refinance the Broadband Securities. As a result of these items, the

Company recorded income tax expense of $54.3 million even though it had a loss before income taxes of $10.2

million.

Refer to Note 12 to the Consolidated Financial Statements for further information regarding the Company’s

income taxes.

Operating taxes

The Company incurs certain operating taxes that are reported as expenses in operating income, such as

property, sales, use, and gross receipts taxes. These taxes are not included in income tax expense because the

amounts to be paid are not dependent on the level of income generated by the Company. The Company also

records expense against operating income for the establishment of liabilities related to certain operating tax audit

exposures. These liabilities are established based on the Company’s assessment of the probability of payment.

Upon resolution of audit, any remaining liability not paid is released and increases operating income. The

Company recognized $14.4 million of income in 2005 upon resolution of certain operating tax audits, net of new

liabilities established, of which $11.2 million was associated with the Broadband segment. Refer to Note 14 to

the Consolidated Financial Statements. Additionally, the Company recognized $4.4 million and $0.2 million of

income in 2004 and 2003, respectively, upon resolution of operating tax audits, net of new liabilities established.

Accounting for Pension and Postretirement Expenses — The Company sponsors three noncontributory

defined benefit pension plans: one for eligible management employees, one for non-management employees and

one supplemental, nonqualified, unfunded plan for certain senior executives. The Company also provides health

care and group life insurance benefits for eligible retirees. The key assumptions used to account for the plans are

disclosed in Note 8 to the Consolidated Financial Statements. The actuarial assumptions attempt to anticipate

future events and are used in calculating the expenses and liabilities related to these plans. The most significant

of these numerous assumptions, which are reviewed annually, include the discount rate, expected long-term rate

of return on plan assets and health care cost trend rates.

Discount rate

A discount rate is selected annually to measure the present value of the benefit obligations. In determining

the selection of a discount rate, the Company estimates the timing and amounts of expected future benefit

payments and applies a yield curve developed to reflect yields available on high-quality bonds. Based on the

analysis, the discount rate was set at 5.50% for all of the plans as of December 31, 2005. At December 31, 2004,

the discount rates were set at 5.50% and 5.75% for the pension plans and postretirement plans, respectively.

Expected rate of return

The expected long-term rate of return on plan assets, developed using the building block approach, is based

on the following: the participant’s benefit horizons; the mix of investments held directly by the plans, which is

generally 60% equities and 40% bonds; and, the current view of expected future returns, which is influenced by

historical averages. The required use of an expected versus actual long-term rate of return on plan assets may

45