Cincinnati Bell 2005 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2005 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

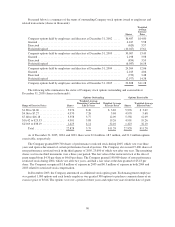

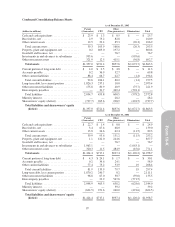

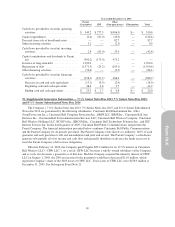

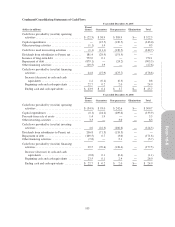

The following information sets forth the condensed consolidating balance sheets of the Company as of

December 31, 2005 and 2004 and the condensed consolidating statements of operations and cash flows for the

three years ended December 31, 2005, 2004, and 2003 of (1) the Parent Company, as the issuer (2) the guarantor

subsidiaries on a combined basis, and (3) the non-guarantor subsidiaries on a combined basis:

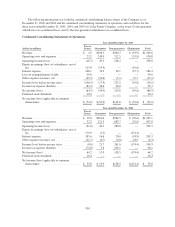

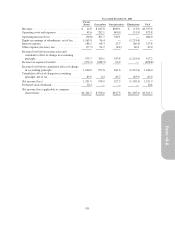

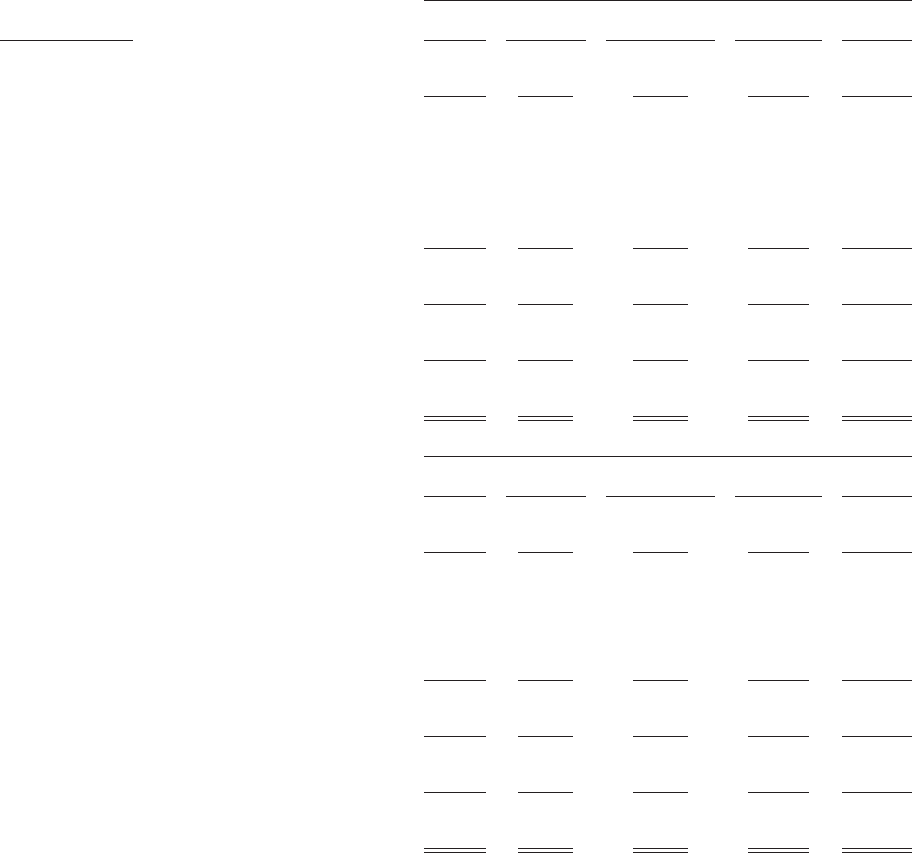

Condensed Consolidating Statements of Operations

Year ended December 31, 2005

(dollars in millions)

Parent

(Issuer) Guarantors Non-guarantors Eliminations Total

Revenue ................................. $ 4.5 $298.3 $940.7 $ (33.9) $1,209.6

Operating costs and expenses ................ 23.2 249.0 712.5 (33.9) 950.8

Operating income (loss) ..................... (18.7) 49.3 228.2 — 258.8

Equity in earnings (loss) of subsidiaries, net of

tax ................................... 115.0 (55.4) — (59.6) —

Interest expense ........................... 168.1 33.9 20.1 (37.7) 184.4

Loss on extinguishment of debt ............... 99.8 — — — 99.8

Other expense (income), net ................. (25.2) (22.6) (5.1) 37.7 (15.2)

Income (loss) before income taxes ............ (146.4) (17.4) 213.2 (59.6) (10.2)

Income tax expense (benefit) ................. (81.9) 36.6 99.6 — 54.3

Net income (loss) .......................... (64.5) (54.0) 113.6 (59.6) (64.5)

Preferred stock dividends ................... 10.4 — — — 10.4

Net income (loss) applicable to common

shareowners ............................ $ (74.9) $ (54.0) $113.6 $ (59.6) $ (74.9)

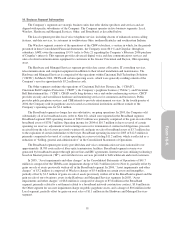

Year ended December 31, 2004

Parent

(Issuer) Guarantors Non-guarantors Eliminations Total

Revenue ................................. $ 10.6 $261.6 $964.5 $ (29.6) $1,207.1

Operating costs and expenses ................ 32.2 221.5 683.7 (29.6) 907.8

Operating income (loss) ..................... (21.6) 40.1 280.8 — 299.3

Equity in earnings (loss) of subsidiaries, net of

tax ................................... 176.9 (2.5) — (174.4) —

Interest expense ........................... 185.6 16.6 20.0 (18.9) 203.3

Other expense (income), net ................. (21.7) (0.7) (0.8) 18.9 (4.3)

Income (loss) before income taxes ............ (8.6) 21.7 261.6 (174.4) 100.3

Income tax expense (benefit) ................. (72.8) 5.8 103.1 — 36.1

Net income (loss) .......................... 64.2 15.9 158.5 (174.4) 64.2

Preferred stock dividends ................... 10.4 — — — 10.4

Net income (loss) applicable to common

shareowners ............................ $ 53.8 $ 15.9 $158.5 $(174.4) $ 53.8

100