Cincinnati Bell 2005 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2005 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

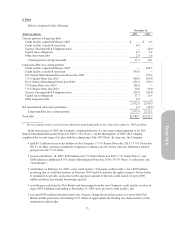

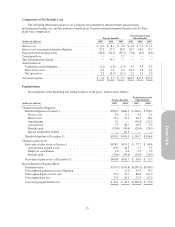

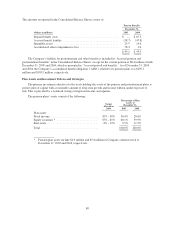

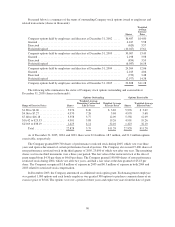

The postretirement and other plans’ assets consist of the following:

Health Care Group Life Insurance

Target

Allocation

2006

Percentage of Plan

Assets at

December 31, Target

Allocation 2006

Percentage of Plan

Assets at

December 31,

2005 2004 2005 2004

Plan assets:

Fixed income ....................... 35%-45% 40.9% 42.8% 35% - 45% 42.3% 20.3%

Equity securities ..................... 55%-65% 59.1% 57.2% 55% - 65% 57.7% 32.0%

Cash* ............................. — — — — — 47.7%

Total .............................. 100.0% 100.0% 100.0% 100.0%

* The plan assets included $13.2 million in cash to be used for group health benefits under postretirement plans at

December 31, 2004.

The Company expects to make cash payments related to its pension plans and postretirement health plans in

2006 of $2.4 million and $10.2 million, respectively.

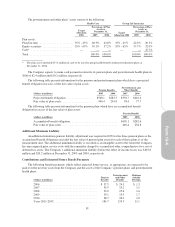

The following table presents information for the pension and postretirement plans which have a projected

benefit obligation in excess of the fair value of plan assets:

Pension Benefits

Postretirement and

Other Benefits

(dollars in millions) 2005 2004 2005 2004

Projected benefit obligation .................. $500.1 $283.5 $356.7 $416.4

Fair value of plan assets ..................... 440.4 234.8 58.4 77.7

The following table presents information for the pension plans which have an accumulated benefit

obligation in excess of the fair value of plan assets:

Pension Benefits

(dollars in millions) 2005 2004

Accumulated benefit obligation ................................ $499.1 $282.6

Fair value of plan assets ...................................... 440.4 234.8

Additional Minimum Liability

An additional minimum pension liability adjustment was required in 2005 for the three pension plans as the

accumulated benefit obligation exceeded the fair value of pension plan assets for each of those plans as of the

measurement date. The additional minimum liability is recorded as an intangible asset to the extent the Company

has unrecognized prior service costs with the remainder charged to accumulated other comprehensive loss, net of

deferred tax assets. The Company’s additional minimum liability (before the effect of income taxes) was $103.8

million and $24.2 million at December 31, 2005 and 2004, respectively.

Contributions and Estimated Future Benefit Payments

The following benefit payments, which reflect expected future service, as appropriate, are expected to be

paid over the next ten years from the Company and the assets of the Company’s pension plans and postretirement

health plans:

(dollars in millions)

Pension

Benefits

Postretirement

and Other

Benefits

Medicare

Subsidy

Receipts

2006 ........................................ $ 57.5 $ 24.5 $ 1.3

2007 ........................................ 39.5 25.2 1.5

2008 ........................................ 39.0 25.6 1.6

2009 ........................................ 39.1 25.9 1.7

2010 ........................................ 38.7 26.2 1.8

Years 2011-2015 .............................. 184.7 124.3 11.1

81