Cincinnati Bell 2005 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2005 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Indemnifications Related to the Sale of Broadband Assets

The Company has indemnified the buyer of the broadband assets against certain potential claims, including

environmental, tax, title and authorization. The title and authorization indemnification was capped at 100% of the

purchase price of the broadband assets, which initially was $91.5 million, subject to reductions under the terms of

the purchase agreement. The environmental and general indemnities were capped at 50% of the purchase price of

the broadband assets.

In order to determine the fair value of the indemnity obligations and warranties provided to the buyer of the

broadband assets, the Company performed a probability-weighted discounted cash flow analysis, utilizing the

minimum and maximum potential claims and several scenarios within the range of possibilities. For 2003, the

analysis originally resulted in a $7.8 million estimated fair value of the indemnity obligations, which was

included in other liabilities and was reflected as a reduction of the 2003 gain on sale of broadband assets in the

Consolidated Statement of Operations. In 2004, the Company decreased the liability related to the indemnity

obligations to $4.1 million due to the expiration of the general representations and warranties and no broker

warranties, and recorded $3.7 million as a gain on sale of broadband assets in the Consolidated Statement of

Operations. In 2005, no additional representations or warranties expired. Based on the updated probability-

weighted discounted analysis, the estimated fair value of the indemnity obligations remained unchanged at $4.1

million at December 31, 2005.

In order to determine the fair value of the indemnity obligations and warranties provided under the legal

settlement agreements, the Company utilized a best estimates approach when possible and for certain

transactions performed a probability-weighted discounted cash flow analysis, utilizing the minimum and

maximum potential claims and certain scenarios within the range of possibilities. The Company also provided an

indemnity with respect to a legal settlement associated to a broadband construction dispute. For the year ended

December 31, 2003, the analysis resulted in a $3.2 million estimated fair value of the indemnity obligations,

which was included in other liabilities and was reflected as other operating expense in the Consolidated

Statement of Operations. In 2005 and 2004, the Company paid approximately $0.2 million and $2.7 million,

respectively, related to these indemnity obligations. At December 31, 2005 and 2004, $0.3 million and $0.5

million, respectively, remained in other liabilities related to the indemnity for certain representations and

warranties provided under the terms of the legal settlement agreement.

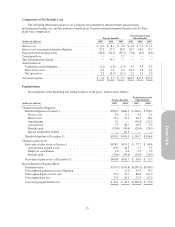

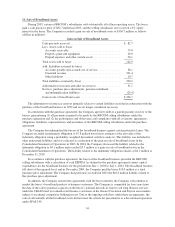

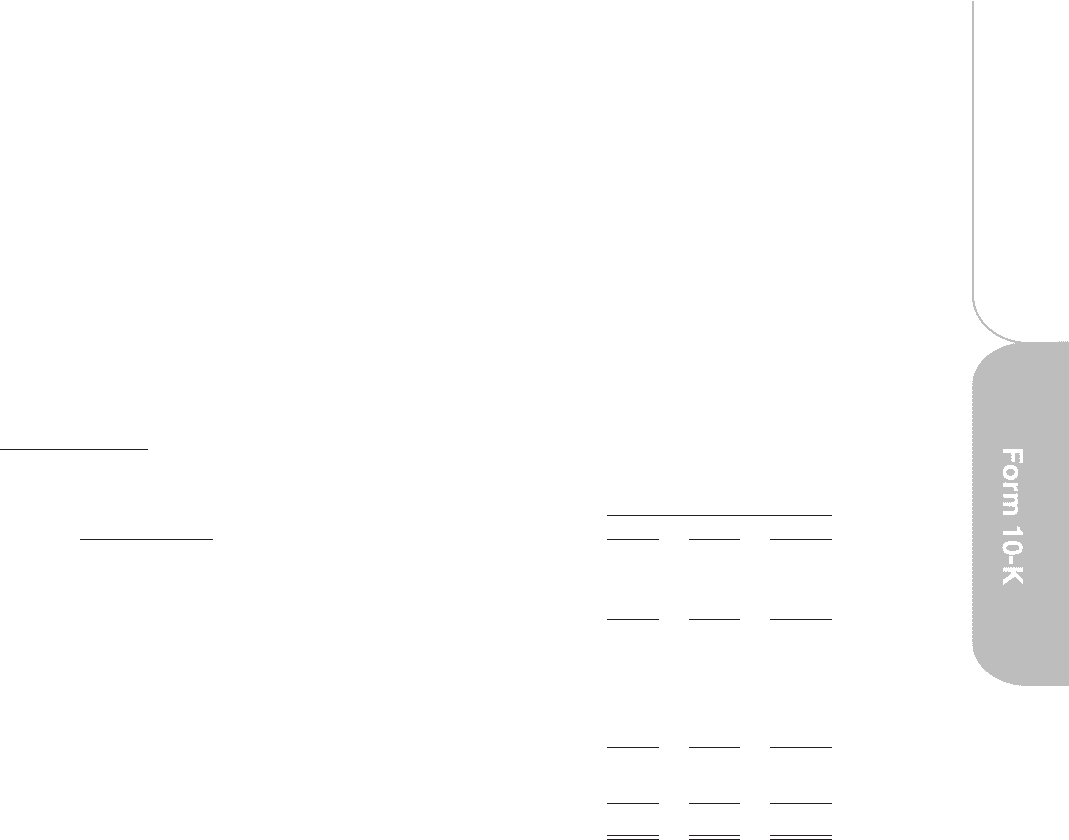

12. Income Taxes

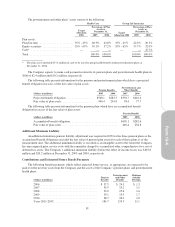

Income tax provision (benefit) consists of the following:

Year Ended December 31,

(dollars in millions) 2005 2004 2003

Current:

Federal ....................................... $ 1.0 $ (0.5) $ —

State and local ................................. 1.2 1.5 1.0

Total current ................................... 2.2 1.0 1.0

Investment tax credits ............................... (0.5) (0.3) (0.6)

Deferred:

Federal ....................................... (21.2) 52.8 194.3

State and local ................................. 34.1 10.4 (76.6)

Total deferred .................................. 12.9 63.2 117.7

Valuation allowance ................................. 39.7 (27.8) (946.9)

Total ..................................... $54.3 $ 36.1 $(828.8)

87