Cincinnati Bell 2005 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2005 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

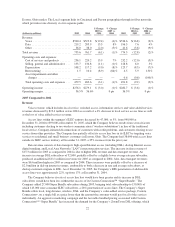

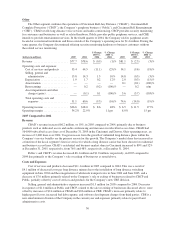

2005 Compared to 2004

Costs and Expenses

During 2005 and 2004, selling, general, and administrative expenses primarily consisted of the reversals of

certain operating tax reserves totaling $11.2 million and $3.5 million, respectively, primarily due to resolutions

of audits.

Adjustments to restructuring reserves in 2005 and 2004 resulted in income of $0.5 million and $1.8 million,

respectively, due to changes in estimates related to the termination of contractual obligations. The restructuring

credit in 2004 was offset by a corporate restructuring adjustment of $2.0 million. Refer to Note 3 to the

Consolidated Financial Statements.

Asset impairments and other charges (gains) in 2005 and 2004 were primarily due to proceeds received

from the sale of assets previously written off.

The gain on sale of $3.7 million recorded in 2004 was due to the expiration of certain indemnities to the

buyer. Refer to Note 16 to the Consolidated Financial Statements.

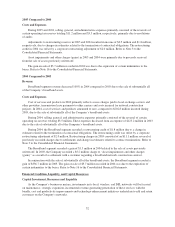

2004 Compared to 2003

Revenue

Broadband segment revenue decreased 100% in 2004 compared to 2003 due to the sale of substantially all

of the Company’s broadband assets.

Costs and Expenses

Cost of services and products in 2003 primarily reflects access charges paid to local exchange carriers and

other providers, transmission lease payments to other carriers and costs incurred for network construction

projects. In 2004, cost of services and products amounted to zero, compared to $202.8 million incurred during

2003, due to the sale of substantially all of the Company’s broadband assets.

During 2004, selling, general, and administrative expenses primarily consisted of the reversal of certain

operating tax reserves totaling $3.5 million. These expenses decreased from an expense of $125.2 million in 2003

due to the sale of substantially all of the Company’s broadband assets.

During 2004, the Broadband segment recorded a restructuring credit of $1.8 million due to a change in

estimate related to the termination of contractual obligations. The restructuring credit was offset by a corporate

restructuring adjustment of $2.0 million. Restructuring charges in 2003 consisted of an $11.1 million reversal of

previously recorded charges due to settlements and change in estimates related to contract terminations. Refer to

Note 3 to the Consolidated Financial Statements.

The Broadband segment recorded a gain of $1.5 million in 2004 related to the sale of assets previously

written off. In 2003, the Company recorded a $5.2 million charge to “Asset impairments and other charges

(gains)” as a result of a settlement with a customer regarding a broadband network construction contract.

In conjunction with the sale of substantially all of the broadband assets, the Broadband segment recorded a

gain of $336.7 million in 2003. The gain on sale of $3.7 million recorded in 2004 was due to the expiration of

certain indemnities to the buyer. Refer to Note 16 to the Consolidated Financial Statements.

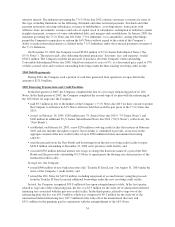

Financial Condition, Liquidity, and Capital Resources

Capital Investment, Resources and Liquidity

As the Company’s businesses mature, investments in its local, wireless, and DSL networks will be focused

on maintenance, strategic expansion, incremental revenue-generating penetration of these services with the

bundle, cost and productivity improvements and technology enhancement initiatives undertaken to add and retain

customers on the Company’s networks.

32