Cincinnati Bell 2005 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2005 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Although the Company determined that the Local segment has no legal obligation to remove assets, the

Company had historically included in the Company group depreciation rates estimated net removal cost

associated with these outside plant assets in which estimated cost of removal exceeds gross salvage. These costs

had been reflected in the calculation of depreciation expense, which results in greater periodic depreciation

expense and the recognition in accumulated depreciation of future removal costs for existing assets. When the

assets were actually retired and removal costs were expended, the net removal costs were recorded as a reduction

to accumulated depreciation. In connection with the adoption of this standard, the Company removed existing

accrued net costs of removal in excess of the related estimated salvage from its accumulated depreciation of

those accounts. The adjustment was reflected as a non-recurring increase to net income as a cumulative effect of

a change in accounting principle as of January 1, 2003 of $86.3 million, net of tax. The Wireless segment

recorded $0.4 million in expense, resulting in a net cumulative change in accounting principle of $85.9 million,

net of tax. Additionally, the Company recorded an initial liability for removal costs at fair value of approximately

$2.6 million and an asset of approximately $2.3 million in 2003 related to the Wireless and Other segments.

During the fourth quarter of 2003, the Wireless segment recorded an additional retirement obligation of $1.9

million due to a change in estimate.

Goodwill and Indefinite-Lived Intangible Assets — Goodwill represents the excess of the purchase price

consideration over the fair value of assets acquired recorded in connection with purchase business combinations.

Indefinite-lived intangible assets consist of Federal Communications Commission (“FCC”) licenses for spectrum

of the Wireless segment. The Company may renew the wireless licenses in a routine manner every ten years for a

nominal fee, provided the Company continues to meet the service and geographic coverage provisions required

by the FCC.

Pursuant to Statement of Financial Accounting Standards No. 142, “Goodwill and Other Intangible Assets”

(“SFAS 142”), goodwill and intangible assets not subject to amortization are tested for impairment annually, or

when events or changes in circumstances indicate that the asset might be impaired. The impairment test for

goodwill involves comparing the estimated fair value of the reporting unit based on discounted future cash flows

to the unit’s carrying value. The impairment test for indefinite-lived intangibles consists of comparing the

estimated fair value of the intangible asset based on external valuation information to its carrying value. For each

intangible tested, the carrying values were lower than the estimated fair values, and no impairment charges were

recorded in 2005, 2004, and 2003.

Impairment of Long-Lived Assets, Other than Goodwill and Indefinite-Lived Intangibles — The

Company reviews the carrying value of long-lived assets, other than goodwill and indefinite-lived assets

discussed above, when events or changes in circumstances indicate that the carrying amount of the assets may

not be recoverable. In assessing impairments, the Company follows the provisions of Statement of Financial

Accounting Standards No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets”

(“SFAS 144”). An impairment loss is recognized when the estimated future undiscounted cash flows expected to

result from the use of an asset (or group of assets) and its eventual disposition are less than the carrying amount.

An impairment loss is measured as the amount by which the asset’s carrying value exceeds its fair value.

The Company retired certain Time Division Multiple Access (“TDMA”) network assets resulting in a

charge of $23.7 million in the first quarter of 2005. Remaining TDMA assets were determined to be impaired in

the fourth quarter in 2005, resulting in a charge of $18.6 million. These charges were included in “Asset

impairments and other charges” in the Consolidated Statements of Operations (refer to Note 14 for details of

“Asset impairments and other charges”). The Company calculated the fair value of the assets based on the

appraised amount at which the assets could be sold in a current transaction between willing parties (refer to Note

4). The Company recorded a $3.6 million asset impairment in 2003 to write-down the value of its public

payphone assets to fair value. The Company calculated the fair value of the assets utilizing a discounted cash

flow analysis based on the best estimate of projected cash flows from the underlying assets.

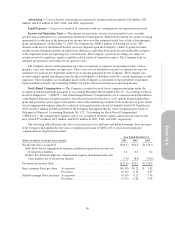

Investments — The Company has certain investments that do not have readily determinable fair market

values. These investments are recorded at cost as the Company owns less than 20% and cannot exercise

significant influence over the investee operations. The carrying value of these investments was approximately

$4.6 million and $3.4 million as of December 31, 2005 and 2004, respectively. Investments are reviewed

annually for impairment. If the carrying value of the investment exceeds its estimated fair value and the decline

in value is determined to be other-than-temporary, an impairment loss is recognized for the difference. The

63