Cincinnati Bell 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

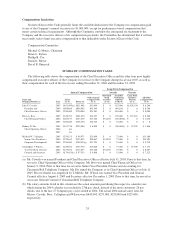

(c) The amounts listed in this column represent the amounts reimbursed during the course of 2005 to each named

executive officer under the Company’s flexible perquisite program, which, rather than fixing set amounts for

specific purposes, provides each executive with an annual allowance and a variety of categories for which

reimbursement may be made. Reimbursable categories include monthly automotive allowance, tax planning

and preparation, financial planning, estate planning, legal counseling, life insurance premiums on the life of

the executive, the cost of software in connection with the aforementioned items, fees in connection with the

adoption of a child, supplemental disability/long-term care insurance, social club dues and home security

systems.

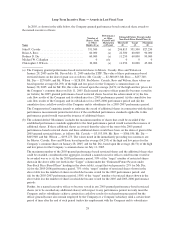

(d) The amounts in this column reflect the value of time-based restricted shares granted on February 5, 2004 to

Messrs. Ross, Callaghan and Wilson under the Cincinnati Bell Inc. 1997 Long Term Incentive Plan (the

“LTIP”). These values are based upon the average ($5.425) of the high and low prices of the Company’s

common shares on February 5, 2004. The restrictions on these time-based restricted shares lapsed on

February 5, 2006.

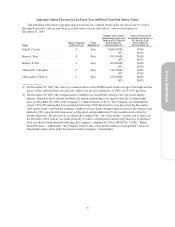

The Company also granted performance-based restricted shares in 2005 under the LTIP. For more

information about the performance-based restricted shares granted in 2005, see the table on page 28 and the

notes that immediately follow.

As of December 31, 2005, the number and value of time-based and performance-based restricted shares held

in the aggregate by the named executive officers was as follows: Mr. Cassidy — 551,500 restricted shares

($1,935,765); Mr. Ross — 70,000 restricted shares ($245,700); Mr. Dir — 60,000 restricted shares

($210,600); Mr. Callaghan — 10,000 restricted shares ($35,100); and Mr. Wilson — 40,000 restricted shares

($140,400). These values are based upon the closing price of $3.51 for the Company’s common shares on the

last trading day of 2005. As described in the table and accompanying notes on page 28, a portion of these

restricted shares will not vest (and are subject to forfeiture) if the Company does not meet certain free cash

flow performance criteria in the future; on the other hand, additional shares may be awarded under certain

circumstances described in the table. If the Company pays a dividend, dividends will be paid on the restricted

shares.

(e) The amounts listed in this column reflect the value of those performance-based restricted shares granted in

2005 under the LTIP (information as to which is contained in the table on page 28 and the notes that

immediately follow) with respect to which the named executive officers became vested on February 28, 2006

by reason of certain free cash flow performance results of the Company and its subsidiaries for 2005 (the first

performance period applicable to such restricted shares). The number of performance-based restricted shares

that vested for each named executive officer was as follows: Mr. Cassidy — 255,896 shares; Mr. Ross —

27,840 shares; Mr. Dir — 13,920 shares; and Mr. Wilson — 13,920 shares. These values are based upon the

average ($4.135) of the high and low prices of the Company’s common shares on February 28, 2006.

(f) All amounts in this column represent Company matching contributions to the Retirement Savings Plan and/or

to the Executive Deferred Compensation Plan.

(g) The 2005 salary amount reported above for Mr. Cassidy in this item includes $6,095 attributable to the

exercise of Convergys Corporation stock options that the Company is required to report as wages.

(h) Mr. Ross received two grants of stock options during 2004. The first grant of options was for 300,000 shares

on January 29, 2004, in connection with Mr. Ross’ appointment as Chief Financial Officer. The second grant

of options was for 150,000 shares on December 3, 2004, in connection with the Company’s award of long-

term incentives under the LTIP.

(i) Mr. Dir received a stock option grant of 200,000 shares upon his commencement of employment on July 11,

2005, and an additional stock option grant of 100,000 shares at the December meeting of the Compensation

Committee as part of the Company’s annual consideration of stock option grants under the LTIP.

(j) Mr. Callaghan’s bonus amount consisted of an annual bonus in the amount of $119,306 and a “success

bonus” in the amount of $181,250, which was paid in connection with the sale by the Company of the

broadband business of BCSI Inc. (f/k/a Broadwing Communications Services Inc.).

(k) Mr. Wilson’s base salary for 2003 reflected a blend of his starting annual salary rate of $140,000 and,

following his appointment as Vice President and General Counsel, an ending annual salary rate of $225,000.

25