Cincinnati Bell 2005 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2005 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Depreciation expense of $58.3 million increased $20.0 million in 2004 compared to 2003. The increase was

a result of $20.6 million in additional depreciation related to the change in estimated economic useful life of the

TDMA network to December 31, 2006.

Amortization expense of $9.1 million increased $8.6 million in 2004 compared to 2003. The increase was a

result of $7.4 million in accelerated amortization related to the shortened, estimated economic useful lives of

certain AWE roaming and trade name agreements, as a result of the merger between Cingular Wireless and

AWE, consummated on October 26, 2004.

Asset impairment charges of $5.9 million in 2004 were comprised of $3.5 million recorded to write-down

certain TDMA assets, which CBW removed from service, and a $2.4 million asset impairment charge related to

certain intangible assets.

Hardware and Managed Services

The Hardware and Managed Services segment provides data center collocation, IT consulting services,

telecommunications and computer equipment as well as related installation and maintenance. The Hardware and

Managed Services is comprised of the operations within CBTS. In March 2004, CBTS sold certain operating

assets, which were generally residing outside of the Company’s operating area, for approximately $3.2 million in

cash. During the second quarter of 2004, CBTS paid $1.3 million to the buyer of the assets in working capital

adjustments related to the sale.

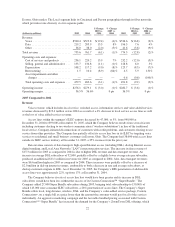

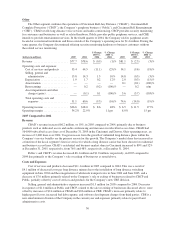

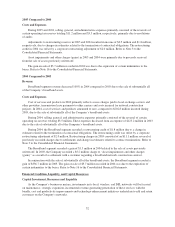

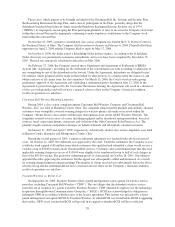

(dollars in millions) 2005 2004

$ Change

2005 vs.

2004

% Change

2005 vs.

2004 2003

$ Change

2004 vs.

2003

% Change

2004 vs.

2003

Revenue:

Hardware ....................... $106.6 $ 74.0 $32.6 44% $ 89.6 $(15.6) (17)%

Managed services ................ 66.1 60.7 5.4 9% 73.2 (12.5) (17)%

Total revenue .................... 172.7 134.7 38.0 28% 162.8 (28.1) (17)%

Operating costs and expenses:

Cost of services and products ....... 139.5 104.7 34.8 33% 121.4 (16.7) (14)%

Selling, general and administrative . . . 17.4 16.7 0.7 4% 24.3 (7.6) (31)%

Depreciation .................... 2.3 1.1 1.2 109% 0.7 0.4 57%

Restructuring .................... 0.1 0.6 (0.5) (83)% — 0.6 n/m

Asset impairments and other charges

(gains) ....................... — (1.1) 1.1 (100)% (1.1) — —

Total operating costs and expenses . . . 159.3 122.0 37.3 31% 145.3 (23.3) (16)%

Operating income .................. $ 13.4 $ 12.7 $ 0.7 6% $ 17.5 $ (4.8) (27)%

Operating margin ................... 7.8% 9.4% (2) pts 10.7% (1) pt

2005 Compared to 2004

Revenue

Hardware revenue is generated by the reselling of major manufacturers’ IT, data and telephony equipment.

Managed services revenue consists of the sale of outsourced technology resources, leveraging assets within the

Company, including but not limited to data center assets, and revenue of technical services and maintenance

directly related to the sale of IT, data and telephony equipment. The CBTS business model links the capability to

sell a wide range of equipment from various manufacturers along with the Company’s technical and

infrastructure capability to offer complete technology solutions for the small, medium, and large business

customer.

In March 2004, CBTS sold certain out-of-territory operations, which negatively impacted 2005 hardware

revenue by $20.7 million. This decrease was more than offset by increased hardware sales from core CBTS

operations. This increase in core CBTS hardware sales was due to a $49.1 million increase in IT and computer-

related hardware revenue, resulting primarily from increased hardware revenue from data center customers.

CBTS expanded its data center business with the purchase of its Mason, Ohio data center in late 2004 and the

28