Cincinnati Bell 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$32.0 million decline resulting from the exchange of the 12

1

⁄

2

% Junior Exchangeable Preferred Stock of

BRCOM (the “12

1

⁄

2

% Preferreds”) for common stock of the Company in September 2003 and a decline in the

net income of CBW.

Interest expense of $203.3 million in 2004 decreased $14.5 million compared to 2003. This was primarily

the result of an $8.4 million reduction in amortization of note issuance costs related to the prepayment of the

Company’s credit facilities in 2003, and $6.1 million of lower interest expense primarily due to the net of

approximately $531.0 million reduced average debt outstanding offset partially by the issuance of the

$500.0 million 7

1

⁄

4

% Notes in July 2003 and the issuance of the 16% Notes.

The Company recorded a loss on extinguishment of debt of $17.6 million in 2003. The loss is comprised of

$17.4 million from retirement of the remaining $46 million of BRCOM 9% notes and related accrued interest of

$1.6 million in exchange for approximately 11.1 million shares of common stock of the Company, which had a

fair value of $65.0 million at the exchange date. Additionally, the Company wrote off $16.4 million of deferred

financing costs related to the prepayment and amendments of the Company’s credit facilities. These losses were

offset by a non-cash gain of $16.2 million from the Company purchasing all of its outstanding Convertible

Subordinated Notes due 2009, which bore interest at a rate of 9%, at a discounted price equal to 97% of their

accreted value.

The Company had income tax expense of $36.1 million in 2004 compared to a benefit of $828.8 million in

2003. The increase in expense is primarily the result of the fourth quarter 2003 reversal of the Company’s

deferred income tax valuation allowance as a result of the substantial resolution of uncertainties related to

BRCOM’s liquidity. The effective income tax rate in 2004 is 36%, which differs from the federal statutory rate

primarily due to the effects of certain non-deductible interest expense amounts, benefits from the reduction of

certain state deferred tax valuation allowances and recurring state income tax expenses. The Company used

$25.2 million of federal and state operating loss tax carryforwards in 2004 to defray payment of the majority of

its federal and state tax liabilities. The Company paid $2.3 million in federal and state tax liabilities during 2004.

Effective January 1, 2003, the Company recorded a benefit of $85.9 million as a cumulative effect of a

change in accounting principle, net of taxes, related to the adoption of SFAS 143. The benefit principally related

to the estimated telephone plant removal costs previously included in accumulated depreciation, which were

reversed. Refer to Note 1 to the Consolidated Financial Statements for a detailed discussion of the adoption of

SFAS 143.

Discussion of Operating Segment Results

The Company realigned its business segments in 2004. CBTS, a data equipment and managed services

subsidiary, was previously reported in the Broadband segment and is now reported in the Hardware and Managed

Services segment. Additionally, the sale of telephony equipment of CBT and its associated installation and

maintenance business, previously reported in the Local segment, is now included in the HMS segment.

Accordingly, the historical results of operations of the Local, HMS, and Broadband segments have been recast to

reflect the current segment reporting.

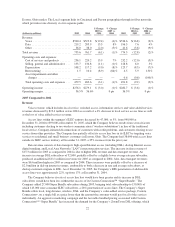

Local

The Local segment provides local voice telephone service, including enhanced custom calling features, and

data services, which include dedicated network access, Gigabit Ethernet and Asynchronous Transfer Mode based

data transport, and DSL and dial-up Internet access, to customers in southwestern Ohio, northern Kentucky, and

southeastern Indiana. These services are provided primarily by CBT, which operates as the Incumbent Local

Exchange Carrier (“ILEC”) in its operating territory of an approximate 25-mile radius of Cincinnati, Ohio.

CBT’s network has full digital switching capability and can provide data transmission services to approximately

90% of its addressable access lines via DSL.

Outside of its ILEC territory, the Local segment provides these services through Cincinnati Bell Extended

Territories LLC (“CBET”), which operates as a competitive local exchange carrier (“CLEC”) both in the

communities north of CBT’s operating territory and in the greater Dayton market. CBET provides voice services

for residential as well as voice and data services for business customers on its own network and by purchasing

UNE-L’s or UNE-platform from the ILEC. CBET provides service through UNE-L to its customer base in the

21