Cincinnati Bell 2005 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2005 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

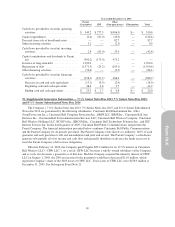

17. Senior Executive Bonuses and Termination Benefits

During 2003, the Company recorded a charge of $11.2 million related to four senior executives for certain

success-based incentives and termination benefits in accordance with their employment contracts, including all of

the benefits related to its former Chief Executive Officer who resigned effective July 31, 2003. Substantially all

of these benefits were paid upon termination. The charge was required as the success plan, as defined in the

senior executive employment agreements, was completed upon the first stage closing of the sale of substantially

all of the broadband assets on June 13, 2003. Three of the senior executives, excluding the former Chief

Executive Officer, were required to remain with the Company for 180 days following the completion of the

success plan. The charge included $0.8 million of non-cash expenses related to the accelerated vesting of stock

options.

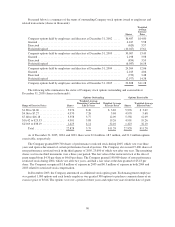

18. Supplemental Guarantor Information — Cincinnati Bell Telephone Notes

CBT, a wholly-owned subsidiary of Cincinnati Bell Inc. (the “Parent Company”), has $230.0 million in

notes outstanding that are guaranteed by the Parent Company and no other subsidiaries of the Parent Company.

In the fourth quarter of 2005, Cincinnati Bell Public Communications merged into the Parent Company. The

financial information presented below combines Cincinnati Bell Public Communications and the Parent

Company for all periods presented. The guarantee is full and unconditional. The Parent Company’s subsidiaries

generate substantially all of its income and cash flow and generally distribute or advance the funds necessary to

meet the Parent Company’s debt service obligations.

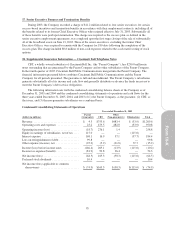

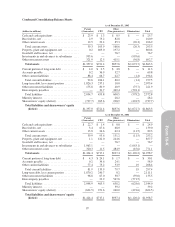

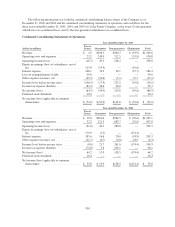

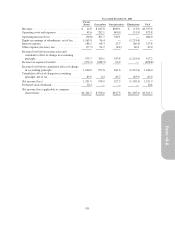

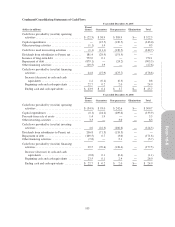

The following information sets forth the condensed consolidating balance sheets of the Company as of

December 31, 2005 and 2004 and the condensed consolidating statements of operations and cash flows for the

three years ended December 31, 2005, 2004, and 2003 of (1) the Parent Company, as the guarantor, (2) CBT, as

the issuer, and (3) the non-guarantor subsidiaries on a combined basis:

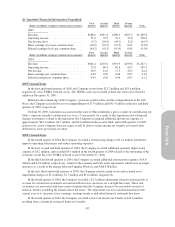

Condensed Consolidating Statements of Operations

Year ended December 31, 2005

(dollars in millions)

Parent

(Guarantor) CBT

Other

(Non-guarantors) Eliminations Total

Revenue ................................ $ 4.5 $755.6 $483.4 $ (33.9) $1,209.6

Operating costs and expenses ............... 23.2 479.5 482.0 (33.9) 950.8

Operating income (loss) .................... (18.7) 276.1 1.4 — 258.8

Equity in earnings of subsidiaries, net of tax .... 115.0 — — (115.0) —

Interest expense .......................... 168.1 16.9 37.1 (37.7) 184.4

Loss on extinguishment of debt .............. 99.8 — — — 99.8

Other expense (income), net ................ (25.2) (5.9) (21.8) 37.7 (15.2)

Income (loss) before income taxes ........... (146.4) 265.1 (13.9) (115.0) (10.2)

Income tax expense (benefit) ................ (81.9) 99.8 36.4 — 54.3

Net income (loss) ......................... (64.5) 165.3 (50.3) (115.0) (64.5)

Preferred stock dividends ................... 10.4 — — — 10.4

Net income (loss) applicable to common

shareowners ........................... $ (74.9) $165.3 $ (50.3) $(115.0) $ (74.9)

95