Cincinnati Bell 2005 Annual Report Download - page 114

Download and view the complete annual report

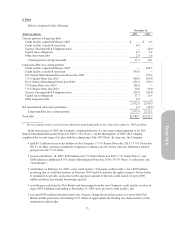

Please find page 114 of the 2005 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company estimates fair value using external information and discounted cash flow analyses. In 2003, the

Company received $3.8 million from the sale of an investment. During 2004, the Company received a return on

capital on an investment and recorded $3.2 million in the Consolidated Statements of Operations under the

heading “Other income, net.”

Revenue Recognition — The Company recognizes revenue as services are provided. Local and special

access fees, which are billed monthly, and prepaid wireless receipts are collected in advance, but the revenue is

not recognized until the service is provided. Postpaid wireless, long distance, switched access, data center

management services, reciprocal compensation, and data and Internet product services are billed monthly in

arrears. The Company bills service revenue in regular monthly cycles, which are dispersed throughout the days

of the month. As the day of each billing cycle rarely coincides with the end of the Company’s reporting period

for usage-based services such as postpaid wireless, long distance, and switched access, the Company must

estimate service revenues earned but not yet billed. The Company bases its estimates upon historical usage and

adjusts these estimates during the period in which the Company can determine actual usage, typically in the

following reporting period.

Cincinnati Bell Telephone Company LLC (“CBT”) advanced billings for customer connection and

activation are deferred and amortized into revenue on a straight-line basis over the average customer life. The

associated connection and activation costs, to the extent of the upfront fees, are also deferred and amortized on a

straight-line basis over the average customer life. Subsequent to July 1, 2003 and in accordance with the

Emerging Issues Task Force Issue 00-21, “Accounting for Revenue Arrangements with Multiple Deliverables”

(“EITF 00-21”), Cincinnati Bell Wireless LLC (“CBW”) ceased deferral of revenue and cost related to customer

connections and activations. As CBW’s activation costs exceed activation revenues, both the activation revenue

and associated costs are recorded upon the sale of the wireless handset. This change did not have a material

impact on the Company’s financial position, results of operations, or cash flows.

With respect to arrangements with multiple deliverables, the Company follows the guidance in EITF 00-21

to determine whether more than one unit of accounting exists in an arrangement. To the extent that the

deliverables are separable into multiple units of accounting, total consideration is allocated to the individual units

of accounting based on their relative fair value, determined by the price of each deliverable when it is regularly

sold on a stand-alone basis. Revenue is recognized for each unit of accounting as delivered or as service is

performed depending on the nature of the deliverable comprising the unit of accounting.

The Company recognizes equipment revenue generally upon the performance of contractual obligations,

such as shipment, delivery, installation or customer acceptance. The Company is a reseller of IT and telephony

equipment and considers the criteria of EITF 99-19, “Reporting Revenue Gross as a Principal versus Net as an

Agent,” when recording revenue, such as title transfer, risk of product loss, and collection risk. Based on this

guidance, these equipment revenues and associated costs have generally been recorded on a gross basis, rather

than recording the revenues net of the associated costs.

Prior to the sale of the broadband assets in 2003, broadband transport services were billed monthly, in

advance, while revenue was recognized as the services were provided. In addition, the Company had entered into

indefeasible right-of-use (“IRU”) agreements, which represent the lease of network capacity or dark fiber,

recording unearned revenue at the earlier of the acceptance of the applicable portion of the network by the

customer or the receipt of cash. The buyer of IRU services typically paid cash or other consideration upon

execution of the contract, and the associated IRU revenue was recognized over the life of the agreement as

services were provided, beginning on the date of customer acceptance. In the event the buyer of an IRU

terminated a contract prior to the contract expiration and released the Company from the obligation to provide

future services, the remaining unamortized unearned revenue was recognized in the period in which the contract

was terminated. The Company generated $59.4 million in non-cash IRU revenue in 2003. Concurrent with the

broadband asset sale in 2003, substantially all of the remaining IRU obligations were assumed by the buyer of the

broadband assets.

Pricing of local services is generally subject to oversight by both state and federal regulatory commissions.

Such regulation also covers services, competition and other public policy issues. Various regulatory rulings and

interpretations could result in adjustments to revenue in future periods. The Company monitors these proceedings

closely and adjusts revenue accordingly.

64