Cincinnati Bell 2005 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2005 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

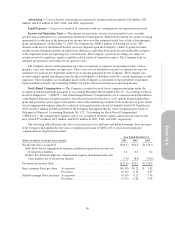

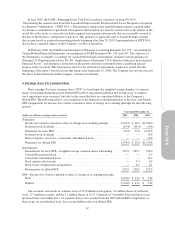

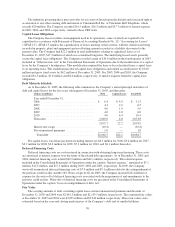

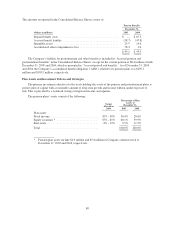

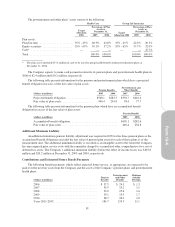

6. Debt

Debt is comprised of the following:

December 31,

(dollars in millions) 2005 2004

Current portion of long-term debt:

Credit facility, repaid in February 2005 ....................................... $ — $ 4.3

Credit facility, tranche B term loan ........................................... 4.0 —

Various Cincinnati Bell Telephone notes ...................................... — 20.0

Capital lease obligations ................................................... 4.9 4.2

Other short-term debt ..................................................... 2.4 1.6

Current portion of long-term debt .......................................... 11.3 30.1

Long-term debt, less current portion:

Credit facility, repaid in February 2005 ....................................... — 434.5

Credit facility, tranche B term loan ........................................... 395.0 —

16% Senior Subordinated Discount Notes due 2009 ............................. — 375.2

7

1

⁄

4

% Senior Notes due 2013 ............................................... 500.0 500.0

83/8% Senior Subordinated Notes due 2014* ................................... 633.4 543.9

7% Senior Notes due 2015* ................................................ 246.4 —

7

1

⁄

4

% Senior Notes due 2023 ............................................... 50.0 50.0

Various Cincinnati Bell Telephone notes ...................................... 230.0 230.0

Capital lease obligations ................................................... 17.3 11.4

Other long-term debt ...................................................... 0.3 —

2,072.4 2,145.0

Net unamortized (discounts) premiums ......................................... 1.0 (33.9)

Long-term debt, less current portion ........................................ 2,073.4 2,111.1

Total debt ................................................................. $2,084.7 $2,141.2

* The face amount of these notes has been adjusted to mark hedged debt to fair value at December 31, 2005 and 2004.

In the first quarter of 2005, the Company completed the first of a two stage refinancing plan of its 16%

Senior Subordinated Discount Notes due 2009 (“16% Notes”). In the third quarter of 2005, the Company

completed the second stage of its plan with the refinancing of the 16% Notes. In stage one, the Company:

•paid $9.7 million in fees to the holders of the Company’s 7

1

⁄

4

% Senior Notes due 2013 (“7

1

⁄

4

% Notes due

2013”) for their consent to permit the Company to refinance its 16% Notes with new debt that would be

pari passu to the 7

1

⁄

4

% Notes;

•issued, on February 16, 2005, $250 million new 7% Senior Notes due 2015 (“7% Senior Notes”) and

$100 million in additional 8

3

⁄

8

% Senior Subordinated Notes due 2014 (“8

3

⁄

8

% Notes”) (collectively, the

“New Bonds”);

•established, on February 16, 2005, a new credit facility (“Corporate credit facility”) for a $250 million

revolving line of credit that matures in February 2010 and also includes the right to request, but no lender

is committed to provide, an increase in the aggregate amount of the new credit facility of up to $500

million in future incremental borrowing capacity;

•used the proceeds from the New Bonds and borrowings from the new Corporate credit facility revolver to

repay $438.8 million outstanding at December 31, 2004 on its previous credit facility; and

•executed $350 million notional interest rate swaps to change the fixed rate nature of a part of the New

Bonds and the previously outstanding 8

3

⁄

8

% Notes to approximate the floating rate characteristics of the

terminated credit facility.

71