Cincinnati Bell 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 Annual Report

Letters to

Shareholders

Notice of

2006 Annual Meeting

and Proxy Statement

Report on

Form 10-K

Table of contents

-

Page 1

2005 Annual Report Letters to Shareholders Notice of 2006 Annual Meeting Report on and Proxy Statement Form 10-K -

Page 2

Contents Letters to Shareholders From the Chairman From the Chief Executive Officer From the Chief Financial Officer Financial Highlights Board of Directors and Company Officers Notice of Annual Meeting of Shareholders Proxy Statement Report on Form 10-K -

Page 3

...help of our loyal customer base, Cincinnati Bell successfully met the challenge of increasing local competition while continuing to strengthen our financial condition. I invite you to see what Jack Cassidy, president and chief executive officer, and Brian Ross, chief financial officer, have to share... -

Page 4

... solutions Cincinnati Bell is the only provider that can seamlessly bundle together local, long distance, wireless and DSL services in one bundle, on one billing statement, and under one brand name. By the end of 2005, more than 150,000 customers subscribed to our Custom Connections® super bundle... -

Page 5

...August 2005. We changed the rules of wireless phone service by offering our subscribers unlimited calling to approximately 2 million Cincinnati Bell wireless and wireline phone numbers. This innovative approach combined with our superior network quality provides unmatchable local value and helped re... -

Page 6

... our shareholders. In addition to pursuing growth in established product areas like DSL and Wireless, we continued to invest in our managed services business by opening data centers. We now operate three fully leased centers from which we also deliver value-added managed services, equipment sales... -

Page 7

...C Driven by increased data services and computer hardware sales, revenue in 2005 represented a gain of 3 percent after adjusting for revenue associated with assets sold in 2004 and the impact of reduced wireless roaming revenue due to the 2004 merger of AT&T Wireless and Cingular. For the year, we... -

Page 8

..., DSL and data center businesses. Looking forward, I believe the future of Cincinnati Bell is bright and I am excited to be a part of it. 3 4 Brian A. Ross Chief Financial Officer Use of Non-GAAP Financial Measures The report contains information about Net Debt, Net income excluding special items... -

Page 9

... and launch new products and services. More information on potential risks and uncertainties is available in recent filings with the Securities and Exchange Commission, including Cincinnati Bell's Form 10-K report, Form 10-Q reports and Forms 8-K. The forward-looking statements included in this... -

Page 10

... (1) Audit & Finance (2) Compensation (3) Executive (4) Governance & Nominating * Committee Chair Company Officers John F. Cassidy President and Chief Executive Officer Brian A. Ross Chief Financial Officer Rodney D. Dir Chief Operating Officer Michael W. Callaghan Senior Vice President, Corporate... -

Page 11

... 2006 Annual Meeting of Shareholders of Cincinnati Bell Inc. (the "Company") will be held on Friday, April 28, 2006, at 11:00 a.m., Eastern Daylight Savings Time, at the METS Center, 3861 Olympic Boulevard, Erlanger, Kentucky 41018, for the following purposes: 1. To elect three Class I directors to... -

Page 12

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 13

... Savings Time, at the METS Center, 3861 Olympic Boulevard, Erlanger, Kentucky 41018. The combined Notice of Annual Meeting of Shareholders, Proxy Statement and the accompanying proxy card or voting instruction card, the Company's Annual Report on Form 10-K for the year ended December 31, 2005... -

Page 14

... shares held directly in your name as the shareholder of record, including common shares purchased through the Cincinnati Bell Employee Stock Purchase Plan, Cincinnati Bell Retirement Savings Plan, or Cincinnati Bell Inc. Savings and Security Plan and credited to your account under any of such plans... -

Page 15

... Bell has enclosed a proxy card for your use in voting by proxy. Beneficial Owner If your shares are held in a stock brokerage account or by another nominee, you are considered the beneficial owner of shares held in street name, and your broker or nominee is considered to be the shareholder... -

Page 16

... Trust Company ("Fidelity"), follow the instructions below. Q: If I own shares through a Cincinnati Bell or Convergys Corporation employee or director plan managed by Fidelity, how will my shares be voted? A: If you are a participant in the Cincinnati Bell Inc. Executive Deferred Compensation Plan... -

Page 17

... Investor Services, LLC, Cincinnati Bell's transfer agent and registrar, will tabulate the votes and act as the inspector of election. Q: Is my vote confidential? A: Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects... -

Page 18

... common shares of the Company: Barclays Global Investors, N.A. and its affiliates, Brandes Investment Partners, L.P. and its affiliates, Gabelli Funds, LLC and its affiliates (as of November 22, 2005), and The Goldman Sachs Group, Inc. and its affiliates (as of February 23, 2006). See page 20... -

Page 19

... AND COMPENSATION General Information Our Board currently has ten directors and the following four committees: (1) Audit and Finance, (2) Compensation, (3) Executive, and (4) Governance and Nominating. The members and function of each committee are described below. During fiscal year 2005, the Board... -

Page 20

... independent auditors. To this end, the Audit and Finance Committee meets in executive session with its own members, and may also meet separately with the Independent Accountants, the Company's internal auditors, General Counsel or members of management. The Board has determined that each member of... -

Page 21

...a $2,500 annual retainer. Mr. Cox, Chairman of the Board, received $180,000 for his service as Chairman in 2005, in addition to the applicable retainers and meeting fees described above. Non-Employee Directors Deferred Compensation Plan The Cincinnati Bell Inc. Deferred Compensation Plan for Outside... -

Page 22

... a timely basis in order to meet such requirements and to administer the plan in accordance with such requirements. Non-Employee Directors Stock Option Plan The Company grants its non-employee directors stock options to purchase common shares under the Cincinnati Bell Inc. 1997 Stock Option Plan for... -

Page 23

...plan generally will have ten years from the date of the grant of the option to elect to exercise the option. Other Compensation for Non-Employee Directors The Company also provides its non-employee directors who live in the Cincinnati area with certain telecommunications services. The average annual... -

Page 24

...of Business Conduct, Code of Ethics for Senior Financial Professionals and Code of Ethics for Directors are available on the Company's website, www.cincinnatibell.com, in the Corporate Governance Section of the Corporate Information webpage. ELECTION OF DIRECTORS (Item 1 on the Proxy Card) The Board... -

Page 25

... Computer Group of Digital Equipment Corporation from 1975 through 1993. He is a director of VA Software Corporation. Director since 2000. Age 59. Carl Redfield Mr. Sharrock has been a consultant since 1994. Prior to that time, he served as Executive Vice President and Chief Operating Officer of... -

Page 26

...Corp., The Timken Company, Touchstone Mutual Funds, Long Stanton Manufacturing Company and the Chairman of the Board of Trustees for the University of Cincinnati. Director since 1993. Age 58. Phillip R. Cox Mr. Morris has been the President and Chief Executive Officer of American Electric Power (an... -

Page 27

... President, Sales and Marketing of Ericsson Mobile Communications from 1990 through 1992; and as Vice President, Sales and Marketing of General Electric Company from 1988 through 1990. Director since 2002. Age 51. Mr. Mahoney is retired. He served as Chairman of the Board and Chief Executive Officer... -

Page 28

... a different Independent Accountant to audit the financial statements of the Company for the fiscal year ending December 31, 2006. One or more members of the firm of Deloitte & Touche LLP will attend the annual meeting, will have an opportunity to make a statement and will be available to answer... -

Page 29

... independence. Based on its review and discussions referred to in the preceding paragraph, the Audit and Finance Committee recommended to the Board that the audited financial statements for the Company's fiscal year ended December 31, 2005 be included in the Company's Annual Report on Form 10-K for... -

Page 30

...were for professional services rendered for the audits of the Company's employee benefit plans filed with the SEC and various accounting consultations. Tax Fees Tax Fees for the year ended December 31, 2004, were for consulting services related to the implications of changes in federal and state tax... -

Page 31

... and Finance Committee pre-approved every engagement of PricewaterhouseCoopers LLP through March 21, 2005 to perform audit or non-audit services on behalf of the Company or any of its subsidiaries. In addition, the Audit and Finance Committee pre-approved every engagement of Deloitte & Touche LLP to... -

Page 32

... and each executive officer named in the Summary Compensation Table on page 24, and (iii) all directors and executive officers of the Company as a group. Unless otherwise indicated, the address of each director and executive officer is c/o Cincinnati Bell at Cincinnati Bell's address. Common Shares... -

Page 33

... of the Board of Directors administers Cincinnati Bell's executive compensation program. The Compensation Committee, which is composed of non-employee directors, is responsible for recommending to the Board for approval all elements of compensation for the Company's Chief Executive Officer. The... -

Page 34

... executive officers should stay at the same level as 2005. Annual Incentive. The Cincinnati Bell Inc. Short Term Incentive Plan, in which all of the above-named executives participated, is one of the means by which the Compensation Committee encourages the Company's management to enhance shareholder... -

Page 35

... shares and stock options awarded in 2005 to Messrs. Cassidy, Ross, Dir, Callaghan and Wilson appear in the Summary Compensation Table on page 24 and/or the Long Term Incentive Plan - Awards in Last Fiscal Year table on page 28. Compensation of the Chief Executive Officer Based upon the Company... -

Page 36

..., he served as Senior Vice President, Finance and Accounting for Cincinnati Bell Telephone Company. Mr. Dir joined the Company as its Chief Operating Officer on July 11, 2005. Prior to that he was employed by T-Mobile. Mr. Wilson was named Vice President and General Counsel effective August 4, 2003... -

Page 37

... connection with the sale by the Company of the broadband business of BCSI Inc. (f/k/a Broadwing Communications Services Inc.). (k) Mr. Wilson's base salary for 2003 reflected a blend of his starting annual salary rate of $140,000 and, following his appointment as Vice President and General Counsel... -

Page 38

... to purchase common shares granted to the named executive officers of the Company during the fiscal year ended December 31, 2005: Number of Securities Underlying Options Granted (#) (a) % of Total Options Granted to Employees In Fiscal Year Potential Realizable Value At Assumed Annual Rates of Stock... -

Page 39

...following table shows aggregate option exercises for common shares in the last fiscal year by each of the named executive officers and fiscal year-end values of each such officer's unexercised options at December 31, 2005: Number of Securities Underlying Unexercised Options at FY-End (#) Exercisable... -

Page 40

... Year In 2005, as shown in the table below, the Company granted performance-based restricted share awards to the named executive officers. Number of Shares, Units or Other Rights (#) (a) Performance or Other Period Until Maturation or Payout Estimated Future Payouts under Non-Stock Price-Based Plans... -

Page 41

ends because of his retirement or disability). Also, in general, a named executive officer will become fully vested in all of his 2005 performance-based restricted shares if he dies during the 2005-2007 performance period or a change in control of the Company occurs during such period. The maximum ... -

Page 42

...and life insurance coverages. In addition, to the extent that Mr. Ross is deemed to have received an excess parachute payment by reason of a change in control, the Company will pay Mr. Ross an additional sum sufficient to pay (i) any taxes imposed under Section 4999 of the Internal Revenue Code plus... -

Page 43

... sum payment equal to two times his base salary rate and bonus target, plus certain continued medical, dental, vision and life insurance coverages. In addition, to the extent that Mr. Dir is deemed to have received an excess parachute payment by reason of a change in control, the Company will pay Mr... -

Page 44

...imposed under Section 4999 of the Code plus (ii) any federal, state and local taxes applicable to such additional sum. Executive Deferred Compensation Plan The Executive Deferred Compensation Plan permits, for any calendar year, each employee who has an annual base rate of pay and target bonus above... -

Page 45

... other named executives participated in the Executive Deferred Compensation Plan during 2005. Defined Benefit or Actuarial Plan Disclosure All of the named executive officers of the Company participated during 2005 in the Cincinnati Bell Management Pension Plan (the "Management Pension Plan"), which... -

Page 46

... years of service credited for the purposes of the plan. If Messrs. Cassidy, Ross, Dir, Callaghan and Wilson were to continue in employment and retire at the normal retirement age of 65, their estimated straight life annuity annual pension amounts under the Management Pension Plan (plus the Pension... -

Page 47

...Integrated Telecommunications Services Index will be more accessible to its shareholders and will provide a more meaningful benchmark for the Company's performance than previously used indices. Dec-00 Dec-01 Dec-02 Dec-03 Dec-04 Dec-05 Cincinnati Bell Inc...S&P 500® ...Custom Composite Index... -

Page 48

... Cornett reporting the grant of stock options which was filed on April 5, 2005. Shareholder Proposals for Next Year's Annual Meeting Shareholder proposals intended for inclusion in next year's Proxy Statement should be sent to Christopher J. Wilson, General Counsel and Secretary, Cincinnati Bell Inc... -

Page 49

...-management directors as a group, or the director who presides at meetings of the non-management directors. Cincinnati Bell has established procedures for such shareholder communications. Shareholders should send any communications to Christopher J. Wilson, General Counsel and Secretary, Cincinnati... -

Page 50

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 51

... the fiscal year ended December 31, 2005 ' TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 1-8519 CINCINNATI BELL INC. Ohio (State of Incorporation) Telephone-513-397-9900 31-1056105 (I.R.S. Employer... -

Page 52

... 11. Item 12. Item 13. Item 14. Directors and Executive Officers of the Registrant ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management ...Certain Relationships and Related Transactions ...Principal Accountant Fees and Services ...108 110 110 110 110 PART IV... -

Page 53

... III Communications Operations LLC) broadband products to business customers and purchase capacity on Broadwing's national network in order to sell long distance services, under the CBAD brand, to residential and business customers in the Greater Cincinnati area market. Although the Company operates... -

Page 54

...Internet access. Other services consist of inside wire installation for business enterprises and billing, clearinghouse and other ancillary services primarily for interexchange (long distance) carriers. The Local segment provides these services through the operations of Cincinnati Bell Telephone LLC... -

Page 55

... data communication services, such as mobile web browsing, internet access, email and picture messaging. As of December 31, 2005, the Company has transitioned over 80% of its customers to GSM and delivers over 90% of network minutes of use ("MOU's") via the GSM network. As a result of retiring... -

Page 56

..., who accounted for 18% of 2005 revenue, can purchase minutes at a per-minute-of-use rate and unlimited minutes for mobile-to-mobile calls for a flat, per day fee. Revenue from other wireless service providers for the purchase of roaming minutes for the carrier's own subscribers using minutes on CBW... -

Page 57

... Other segment produced operating income of $26.6 million, $18.0 million, and $6.5 million in 2005, 2004, and 2003, respectively. Cincinnati Bell Any Distance CBAD provides long distance services to businesses and residential customers in the Greater Cincinnati and Dayton, Ohio areas. At December 31... -

Page 58

... from indefeasible right of use agreements ("IRU's")), switched voice services, data and Internet services (including data collocation and managed services) and other services. BRCOM generally provided these transport and switched voice services over its national optical network, which comprised... -

Page 59

... distribute funds or assets to the Company. If the Company's subsidiaries were to be prohibited from paying dividends or making distributions to the Company, it would have a material adverse effect on the Company's liquidity and the trading price of the Cincinnati Bell common stock, preferred stock... -

Page 60

... business and future cash flows could be adversely affected. The Company operates in a highly competitive industry and its customers may not continue to purchase services, which could result in reduced revenue and loss of market share. The telecommunications industry is very competitive. Either new... -

Page 61

... strategies to retain access lines, the Company's traditional telephone business will be adversely affected. CBW is one of several active wireless service providers in the Cincinnati and/or Dayton, Ohio metropolitan market areas, including Cingular, Sprint Nextel, T-Mobile, Verizon, and Leap... -

Page 62

... FCC. For its GSM network, CBW uses spectrum licensed to the Company and to Cingular. Introduction of new wireless products and services, as well as maintenance of the existing wireless business, may require CBW to obtain additional spectrum in the Cincinnati or Dayton markets, either to supplement... -

Page 63

... revenue by serving customers in the Greater Cincinnati and Dayton, Ohio areas. An economic downturn or natural disaster occurring in this limited operating territory could have a disproportionate effect on the Company's business, financial condition, results of operations, and cash flows compared... -

Page 64

... investment returns less than those previously assumed and a decline in the value of plan assets used in pension and postretirement calculations, which the Company would be required to recognize over the next several years under generally accepted accounting principles. Should the securities markets... -

Page 65

...predetermined rate escalations. CBTS operates three data centers - two owned and one leased - in Ohio and Kentucky through which it provides 24-hour monitoring, redundant power, environmental controls, and high-speed, highly-available optical network connections to its customers. The Company's gross... -

Page 66

... for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Market Information The Company's common shares (symbol: CBB) are listed on the New York Stock Exchange and on the National Stock Exchange. As of February 28, 2006, there were 72,924 holders... -

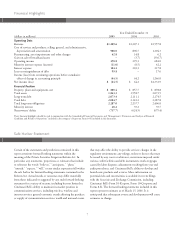

Page 67

... Financial Statements and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included in this document. (dollars in millions, except per share amounts) 2005 2004 2003 2002 2001 Operating Data Revenue ...Cost of services and products, selling, general, and... -

Page 68

...increasing competition The Company defended its core franchise through bundling, adding 27,000 net subscribers to its Custom ConnectionsSM "Super Bundle" which offers local, long distance, wireless, DSL, and the Company's value-added service package, Custom Connections®, on a single bill at a price... -

Page 69

The Company opened a new data center facility in 2005, increasing the Company's managed service and hardware revenues. Sales of information technology ("IT") and computer-related hardware totaled $80.2 million during 2005, which was a 55% increase over 2004 hardware sales. Results of Operations ... -

Page 70

...'s local telephone or wireless operating territories, the Company estimates that revenue in its HMS segment decreased approximately $33.4 million in 2004. Also, revenue in the Local segment declined $12.8 million during 2004 as data revenue growth from DSL transport and dial-up Internet access only... -

Page 71

... local voice telephone service, including enhanced custom calling features, and data services, which include dedicated network access, Gigabit Ethernet and Asynchronous Transfer Mode based data transport, and DSL and dial-up Internet access, to customers in southwestern Ohio, northern Kentucky... -

Page 72

...of access lines. The Company's Super Bundle offers local, long distance, wireless, DSL, and the Company's value-added service package, Custom Connections®, on a single bill at a price lower than the amount the customer would pay for all of the services individually. An aggressive marketing campaign... -

Page 73

... to use wireless communication ("wireless substitution") in lieu of the traditional local service. In March 2004, the Company expanded its product suite in Dayton, Ohio and began to mass market voice services to residential and small business customers. This helped to increase CLEC access lines by... -

Page 74

... wireless network in a licensed service territory, which surrounds Cincinnati and Dayton, Ohio and includes areas of northern Kentucky and southeastern Indiana. The segment offers service outside of its regional operating territory through wholesale and re-sale arrangements ("roaming agreements... -

Page 75

... voice communication, short message service ("SMS") or text messaging, and enhanced data communication services, such as mobile web browsing, internet access, email, and picture messaging. In the first quarter of 2005, the Company completed its upgrade to enhanced data rates for GSM evolution... -

Page 76

... territory. Equipment revenue increased by $3.0 million as the Company sold 41,000 more handsets during 2005 as compared to 2004 as 26,000 more TDMA customers migrated to the Company's GSM network. Costs and Expenses Cost of services and products consists largely of network operation costs, roaming... -

Page 77

... migrations to the new GSM network, average monthly prepaid customer churn increased to 6.1% in 2004 compared to 4.9% in 2003. Total wireless subscribers at December 31, 2004 were approximately 481,000, or approximately 14% of the population in CBW's licensed operating territory. Data revenue of $14... -

Page 78

...services and maintenance directly related to the sale of IT, data and telephony equipment. The CBTS business model links the capability to sell a wide range of equipment from various manufacturers along with the Company's technical and infrastructure capability to offer complete technology solutions... -

Page 79

... be used at customer facilities. Higher revenue for the sale of telephony and other equipment accounted for the remaining increase in 2005. The newly operational data centers and increased hardware sales directly contributed to an increase of $13.7 million in managed and data center services revenue... -

Page 80

... bundles are the primary reason for this growth. The Company's market share has increased as a function of the Local segment's lines in service for which a long distance carrier has been chosen for residential and business access lines. CBAD's residential and business market share in Cincinnati... -

Page 81

... (including data collocation and managed services) and other services. These transport and switched voice services were generally provided over the Broadband segment's national optical network, which comprised approximately 18,700 route miles of fiberoptic transmission facilities. $ Change 2005 vs... -

Page 82

... the sale of substantially all of the Company's broadband assets. Costs and Expenses Cost of services and products in 2003 primarily reflects access charges paid to local exchange carriers and other providers, transmission lease payments to other carriers and costs incurred for network construction... -

Page 83

... (f/k/a Broadwing Communications Inc.), provided long haul voice, data, and Internet service over an 18,700 mile fiber optic network. From the acquisition of BRCOM through June 2003, the Company used a total of approximately $2.3 billion of both cash flow from its other businesses and borrowings... -

Page 84

..., after deducting the initial purchasers' discounts, fees, and expenses, totaled $528.2 million. The Company used the net proceeds to purchase all of the Company's then outstanding Convertible Subordinated Notes due 2009, which bore interest at a rate of 9%, at a discounted price equal to 97% of... -

Page 85

...the refinancing plan discussed above, during the fourth quarter of 2005, the Company made a scheduled payment of $20 million to extinguish certain outstanding notes of Cincinnati Bell Telephone. On December 31, 2005, the Company paid the first of its $1 million quarterly amortization payments on its... -

Page 86

... of billing, customer service and other services, which remains in effect until June 30, 2008. The contract states that Convergys will be the primary provider of certain data processing, professional and consulting and technical support services for the Company within CBT's operating territory. In... -

Page 87

... order dated October 29, 2003, Local 144 Nursing Home Pension Fund, Paul J. Brunner and Joseph Lask were named lead plaintiffs in a putative consolidated class action. On December 1, 2003, lead plaintiffs filed their amended consolidated complaint on behalf of purchasers of the Company's securities... -

Page 88

... Cincinnati Bell Wireless Company and Cincinnati Bell Wireless, LLC was filed in Hamilton County, Ohio. The complaint alleges that the plaintiff and similarly-situated customers were wrongfully assessed roaming charges for wireless phone calls made or received within the Company's Home Service Area... -

Page 89

... business, the Company makes certain indemnities, commitments and guarantees under which it may be required to make payments in relation to certain transactions. These include (a) intellectual property indemnities to customers in connection with the use, sales and/or license of products and services... -

Page 90

... funding the maintenance and strategic expansion of the local and wireless networks; interest and principal payments on the Company's debt; dividends on the 6 3â„ 4% Cumulative Convertible Preferred Stock; and working capital. 2004 Compared to 2003 In 2004, the Company generated cash from operating... -

Page 91

... is not recognized until the service is provided. Postpaid wireless, long distance, switched access, data center management services, reciprocal compensation, and data and Internet product services are billed monthly in arrears. The Company bills service revenue in regular monthly cycles, which are... -

Page 92

...2005. Indefinite-lived intangible assets consist primarily of Federal Communications Commission ("FCC") licenses for spectrum of the Wireless segment. The Company may renew the wireless licenses in a routine manner every ten years for a nominal fee, provided the Company continues to meet the service... -

Page 93

... redeploying spectrum from the Company's legacy TDMA wireless network to its GSM network to meet unexpected increasing demand for its GSM services, the Company made the decision in the first quarter of 2005 to retire certain TDMA assets in order to optimize its TDMA network performance. As a result... -

Page 94

...31, 2005. If technological change were to occur more rapidly than expected, it may have the effect of shortening the estimated depreciable life of other network and operating assets that the Company employs. This could have a substantial impact on the consolidated depreciation expense and net income... -

Page 95

... pension plans: one for eligible management employees, one for non-management employees and one supplemental, nonqualified, unfunded plan for certain senior executives. The Company also provides health care and group life insurance benefits for eligible retirees. The key assumptions used to account... -

Page 96

... no caps. The accounting using this assumption remained in effect through May 2005. In May 2005, the Company reached an agreement with the union for bargained-for employees as to the terms of a new labor contract. Employees retiring under the new agreement are provided Company-sponsored healthcare... -

Page 97

... as cable modem broadband providers and Voice over Internet Protocol ("VoIP") providers. While Cincinnati Bell has expanded beyond its incumbent local exchange operations by offering wireless, long distance, broadband service, Internet access and out-of-territory competitive local exchange services... -

Page 98

...Internet Protocol (IP) are subject to access charges. It has ruled that peer-to-peer Internet voice services that do not use the public switched telephone network ("PSTN") are not subject to access charges. Separately, it has ruled that services that originate and terminate on the PSTN but employ IP... -

Page 99

...regulated service and has left each carrier to negotiate new pricing arrangements under commercial agreements. The Local segment has entered into such an agreement; however, it does not expect the profitability of its Dayton local operations to change substantially because the segment had planned to... -

Page 100

... services; changes in competition in markets in which the Company operates; pressures on the pricing of the Company's products and services; advances in telecommunications technology; the ability to generate sufficient cash flow to fund the Company's business plan and maintain its networks... -

Page 101

... to update any forward-looking statements, whether as a result of new information, future events or otherwise. Item 7A. Quantitative and Qualitative Disclosures about Market Risk Interest Rate Risk Management - The Company's objective in managing its exposure to interest rate changes is to limit... -

Page 102

The following table sets forth the face amounts, maturity dates and average interest rates for the fixed- and variable-rate debt held by the Company at December 31, 2005 (excluding capital leases and net unamortized premiums); the debt amounts are not effected for the hedging impact of the interest ... -

Page 103

... Financial Statements Page Consolidated Financial Statements: Management's Report on Internal Control over Financial Reporting ...Reports of Independent Registered Public Accounting Firms ...Consolidated Statements of Operations ...Consolidated Balance Sheets ...Consolidated Statements of... -

Page 104

... public accounting firm, Deloitte & Touche LLP, has issued an audit report on management's assessment of the Company's internal control over financial reporting. This report is included on page 55. March 14, 2006 /s/ John F. Cassidy John F. Cassidy President and Chief Executive Officer /s/ Brian... -

Page 105

... REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareowners of Cincinnati Bell Inc. We have audited management's assessment, included in the accompanying Management's Report on Internal Control over Financial Reporting that Cincinnati Bell Inc. and subsidiaries (the "Company... -

Page 106

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareowners of Cincinnati Bell Inc. In our opinion, the accompanying consolidated balance sheet as of December 31, 2004, and the related statements of operations, shareowners' equity (deficit) and comprehensive ... -

Page 107

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareowners of Cincinnati Bell Inc. We have audited the accompanying consolidated balance sheet of Cincinnati Bell Inc. and subsidiaries (the "Company") as of December 31, 2005, and the related consolidated ... -

Page 108

Cincinnati Bell Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (Millions of Dollars, Except Per Share Amounts) Year Ended December 31, 2005 2004 2003 Revenue Services ...Products ...Total revenue ...Costs and expenses Cost of services, excluding depreciation ...Cost of products sold, excluding ... -

Page 109

Cincinnati Bell Inc. CONSOLIDATED BALANCE SHEETS (Millions of Dollars, Except Share Amounts) As of December 31, 2005 2004 Assets Current assets Cash and cash equivalents ...Receivables, less allowances of $14.3 and $14.5 ...Materials and supplies ...Deferred income tax benefits, net ...Prepaid ... -

Page 110

... income tax expense (benefit) ...Tax benefits from employee stock option plans ...Other, net ...Changes in operating assets and liabilities (Increase) decrease in receivables ...(Increase) decrease in prepaid expenses and other current assets ...Increase (decrease) in accounts payable ...Decrease in... -

Page 111

... ...Balance at December 31, 2004 Net loss ...Additional minimum pension liability adjustment, net of taxes of $24.6 ...Comprehensive loss Shares issued under employee plans and other ...Restricted stock grant and amortization ...Dividends on 6 3â„ 4% preferred stock ...Balance at December 31, 2005... -

Page 112

... of the sale. The Company generates substantially all of its revenue by serving customers in the Greater Cincinnati and Dayton, Ohio areas. An economic downturn or natural disaster occurring in this limited operating territory could have a disproportionate effect on the Company's business, financial... -

Page 113

...-lived intangible assets consist of Federal Communications Commission ("FCC") licenses for spectrum of the Wireless segment. The Company may renew the wireless licenses in a routine manner every ten years for a nominal fee, provided the Company continues to meet the service and geographic coverage... -

Page 114

... reporting period. Cincinnati Bell Telephone Company LLC ("CBT") advanced billings for customer connection and activation are deferred and amortized into revenue on a straight-line basis over the average customer life. The associated connection and activation costs, to the extent of the upfront fees... -

Page 115

... per share amounts) Year Ended December 31, 2005 2004 2003 Net income (loss) as reported ...Add: Stock-based compensation expense included in reported net income, net of related tax benefits ...Deduct: Stock-based employee compensation expense determined under fair value method, net of related tax... -

Page 116

.... SFAS 123(R) requires all share-based payments to employees, including grants of employee stock options, to be valued at fair value on the date of grant and to be expensed over the applicable vesting period. In addition, companies must also recognize compensation expense related to any awards that... -

Page 117

... periods: Year Ended December 31, (dollars in millions, except per share amounts) 2005 2004 2003 Numerator: Income (loss) before cumulative effect of change in accounting principle ...Preferred stock dividends ...Numerator for basic EPS ...Preferred stock dividends ...Interest expense, net of tax... -

Page 118

... Company adopted a restructuring plan which included initiatives to consolidate data centers, reduce the Company's expense structure, exit the network construction business, eliminate other non-strategic operations and merge the digital subscriber line ("DSL") and certain dial-up Internet operations... -

Page 119

... the fourth quarter of 2003, the Company shortened the estimated remaining economic useful life of its legacy TDMA wireless network to December 31, 2006 due to the expected migration of its TDMA customer base to its Global System for Mobile Communications ("GSM") network. In 2003, the change in... -

Page 120

... between Cingular Wireless and AT&T Wireless, consummated on October 26, 2004, the Company's roaming and trade name agreements with AT&T Wireless were no longer operative. Accordingly, the remaining estimated useful lives of these assets were shortened effective July 1, 2004. This change resulted in... -

Page 121

... ...Various Cincinnati Bell Telephone notes ...Capital lease obligations ...Other short-term debt ...Current portion of long-term debt ...Long-term debt, less current portion: Credit facility, repaid in February 2005 ...Credit facility, tranche B term loan ...16% Senior Subordinated Discount Notes... -

Page 122

... of credit are permitted at any time. The average interest rate charged on borrowings under the Corporate credit facility was 5.6% in 2005. Under the Corporate credit facility, the Company pays commitment fees to the lenders on a quarterly basis at an annual rate equal to .50% of the unused amount... -

Page 123

... of Cincinnati Bell common stock at $3.00 each, which expire in March 2013. Of the total gross proceeds received, $47.5 million was allocated to the fair value of the warrants using the BlackScholes option-pricing model and was recorded as a discount on the 16% Notes. On August 31, 2005, the Company... -

Page 124

.... The Company used $524.6 million of the net proceeds to purchase all of the Company's then outstanding Convertible Subordinated Notes due 2009, which bore interest at a rate of 9%, at a discounted price equal to 97% of their accreted value. The remaining proceeds were used to pay fees related to... -

Page 125

... are not permitted to enter into an agreement that would limit their ability to make dividend payments to the parent; issuance of indebtedness; asset dispositions; transactions with affiliates; liens; investments; issuances and sales of capital stock of subsidiaries; and redemption of debt that... -

Page 126

... and equipment and an offsetting amount recorded as a liability discounted to the present value. The Company had $22.2 million in total indebtedness relating to capitalized leases as of December 31, 2005, $17.3 million of which was considered long-term. The underlying leased assets generally secure... -

Page 127

... annual interest credits determine the pension benefit. Benefits for the supplemental plan are based on eligible pay, adjusted for age and service upon retirement. The Company funds both the management and nonmanagement plans in an irrevocable trust through contributions, which are determined using... -

Page 128

... Company funds certain group life insurance benefits through Retirement Funding Accounts and funds health care benefits and other group life insurance benefits using Voluntary Employee Benefit Association ("VEBA") trusts. It is the Company's practice to fund amounts as deemed appropriate from time... -

Page 129

Components of Net Periodic Cost The following information relates to all Company noncontributory defined benefit pension plans, postretirement health care, and life insurance benefit plans. Pension and postretirement benefit costs for these plans were comprised of: Pension Benefits 2005 2004 2003 ... -

Page 130

... benefits" in the Consolidated Balance Sheets, except for the current portion of $8.4 million at both December 31, 2005 and 2004, which is presented in "Accrued payroll and benefits." As of December 31, 2005 and 2004, the Company's accumulated benefit obligation ("ABO") related to its pension plans... -

Page 131

... assets included $13.2 million in cash to be used for group health benefits under postretirement plans at December 31, 2004. The Company expects to make cash payments related to its pension plans and postretirement health plans in 2006 of $2.4 million and $10.2 million, respectively. The following... -

Page 132

... used in accounting for the pension and postretirement benefit cost: Pension Benefits 2005 2004 2003 Postretirement and Other Benefits 2005 2004 2003 Discount rate ...Expected long-term rate of return on pension and health plan assets ...Expected long-term rate of return on group life plan... -

Page 133

... compensation arrangements for a total cost of $145.5 million at December 31, 2005 and $145.4 million at December 31, 2004. Preferred Share Purchase Rights Plan In 1997, the Company's Board of Directors adopted a Share Purchase Rights Plan by granting a dividend of one preferred share purchase... -

Page 134

... of billing, customer service and other services, which remains in effect until June 30, 2008. The contract states that Convergys will be the primary provider of certain data processing, professional and consulting and technical support services for the Company within CBT's operating territory. In... -

Page 135

... of Ohio. Fidelity Management Investment Trust Company was also named as a defendant in these actions. These cases, which purport to be brought on behalf of the Cincinnati Bell Inc. Savings and Security Plan, the Broadwing Retirement Savings Plan, and a class of participants in the Plans, generally... -

Page 136

... Cincinnati Bell Wireless Company and Cincinnati Bell Wireless, LLC was filed in Hamilton County, Ohio. The complaint alleges that the plaintiff and similarly-situated customers were wrongfully assessed roaming charges for wireless phone calls made or received within the Company's Home Service Area... -

Page 137

... the Company decreased the liability related to the indemnity obligations to $4.1 million due to the expiration of the general representations and warranties and no broker warranties, and recorded $3.7 million as a gain on sale of broadband assets in the Consolidated Statement of Operations. In 2005... -

Page 138

... rate for each year: Year Ended December 31, 2005 2004 2003 U.S. federal statutory rate ...State and local income taxes, net of federal income tax benefit ...Change in valuation allowance, net of federal income tax expense ...State law changes ...Dividends on 12 1â„ 2% exchangeable preferred stock... -

Page 139

... net operating loss carryforwards against future state taxable income. The Company expects this will result in a one-time income tax charge of approximately $4 million in the first quarter of 2006. 13. Stock-Based Compensation Plans During 2005 and in prior years, certain employees and directors... -

Page 140

... in 2005 and $0.3 million of expense in both 2004 and 2003 related to restricted stock compensation. In December 2003, the Company announced an additional stock option grant. Each management employee was granted 1,000 options and each hourly employee was granted 300 options to purchase common shares... -

Page 141

... 2006 purchase of Cingular's interest). This segment provides advanced, digital voice and data communications services and sales of related communications equipment to customers in the Greater Cincinnati and Dayton, Ohio operating areas. The Hardware and Managed Services segment provides data center... -

Page 142

... and the relative size of the segment. The Company's business segment information is as follows: (dollars in millions) Year Ended December 31, 2005 2004 2003 Revenue Local ...Wireless ...Hardware and managed services ...Other ...Broadband ...Intersegment ...Total revenue ...Intersegment revenue... -

Page 143

...) Year Ended December 31, 2005 2004 2003 Service revenue Wireline ...Wireless ...Managed and data center services ...Telephony installation and maintenance ...Other ...Broadband ...Total service revenue ...Product revenue Handsets and accessories ...IT and computer-related equipment ...Telephony... -

Page 144

...customers. The Company is committed for four years from the date of the sale to purchase capacity on the buyer's national network in order to sell long distance services under the CBAD brand to residential and business customers in the Greater Cincinnati and Dayton area markets, subject to an annual... -

Page 145

... Chief Executive Officer, were required to remain with the Company for 180 days following the completion of the success plan. The charge included $0.8 million of non-cash expenses related to the accelerated vesting of stock options. 18. Supplemental Guarantor Information - Cincinnati Bell Telephone... -

Page 146

...effect of change in accounting principle ...Income tax expense (benefit) ...Income (loss) before cumulative effect of change in accounting principle ...Cumulative effect of change in accounting principle, net of tax ...Net income (loss) ...Preferred stock dividends ...Net income (loss) applicable to... -

Page 147

... ...Total current assets ...Property, plant and equipment, net ...Goodwill and licenses, net ...Investments in and advances to subsidiaries ...Other noncurrent assets ...Total assets ...Current portion of long-term debt ...Accounts payable ...Other current liabilities ...Total current liabilities... -

Page 148

... Statements of Cash Flows Parent (Guarantor) Year ended December 31, 2005 Other CBT (Non-guarantors) Eliminations (dollars in millions) Total Cash flows provided by (used in) operating activities ...Capital expenditures ...Other investing activities ...Cash flows used in investing activities... -

Page 149

..., Cincinnati Bell Wireless Company, Cincinnati Bell Wireless Holdings LLC, BCSIVA Inc., BRCOM Inc., Cincinnati Bell Technology Solutions Inc., and IXC Internet Services Inc. In the fourth quarter of 2005, Cincinnati Bell Public Communications merged into the Parent Company. The financial information... -

Page 150

The following information sets forth the condensed consolidating balance sheets of the Company as of December 31, 2005 and 2004 and the condensed consolidating statements of operations and cash flows for the three years ended December 31, 2005, 2004, and 2003 of (1) the Parent Company, as the issuer... -

Page 151

...effect of change in accounting principle ...Income tax expense (benefit) ...Income (loss) before cumulative effect of change in accounting principle ...Cumulative effect of change in accounting principle, net of tax ...Net income (loss) ...Preferred stock dividends ...Net income (loss) applicable to... -

Page 152

... ...Total current assets ...Property, plant and equipment, net ...Goodwill and licenses, net ...Investments in and advances to subsidiaries ...Other noncurrent assets ...Total assets ...Current portion of long-term debt ...Accounts payable ...Other current liabilities ...Total current liabilities... -

Page 153

... Statements of Cash Flows Year ended December 31, 2005 (dollars in millions) Parent (Issuer) Guarantors Non-guarantors Eliminations Total Cash flows provided by (used in) operating activities ...Capital expenditures ...Other investing activities ...Cash flows used in investing activities... -

Page 154

... flows provided by (used in) operating activities ...Capital expenditures ...Proceeds from sale of broadband assets ...Other investing activities ...Cash flows provided by (used in) investing activities ...Capital contributions and dividends to Parent, net ...Issuance of long-term debt ...Repayment... -

Page 155

... million, respectively, related to the roaming and trade name agreements which were no longer operative as a result of the merger between Cingular Wireless and AT&T Wireless. In the first, third and fourth quarters of 2004, the Company retired certain assets and recorded asset impairment charges of... -

Page 156

...83.2 million for its 19.9% interest in CBW. As a result, CBW is now a wholly-owned subsidiary of the Company. The Company funded the purchase with its Corporate credit facility. The Company is accounting for acquisition of Cingular's 19.9% interest in CBW as a step acquisition. The allocation of the... -

Page 157

... with generally accepted accounting principles. Cincinnati Bell Inc.'s management, with the participation of the Chief Executive Officer and Chief Financial Officer, have evaluated any changes in the Company's internal control over financial reporting that occurred during the fourth quarter of 2005... -

Page 158

... Operating Officer Chief Financial Officer Senior Vice President, Corporate Development Vice President, Internal Controls Vice President, General Counsel, and Secretary Vice President, Human Resources and Administration Vice President, Investor Relations and Corporate Communications Vice President... -

Page 159

... of the Board of Directors. JOHN F. CASSIDY, President and Chief Executive Officer since July 2003; Director of the Company since September 2002; President and Chief Operating Officer of Cincinnati Bell Telephone since May 2001; President of Cincinnati Bell Wireless since 1997; Senior Vice President... -

Page 160

...2005. Awards were granted under various incentive plans approved by Cincinnati Bell Inc. shareholders. (2) The shares to be issued relate to deferred compensation in the form of previously received special awards and annual awards to non-employee directors pursuant to the "Deferred Compensation Plan... -

Page 161

... dated as of January 10, 2005 to the Indenture dated October 27, 1993 by and among Cincinnati Bell Telephone Company, as Issuer, Cincinnati Bell Inc. as Guarantor, and The Bank of New York, as Trustee (Exhibit 4(c)(ii)(3) to Annual Report on Form 10-K for the year ended December 31, 2004, File... -

Page 162

... L.P., and any other affiliate purchasers of Senior Subordinated Notes due 2009 (Exhibit 4(c)(viii)(4) to Annual Report on Form 10-K for the year ended December 31, 2004, File No. 1-8519). Fourth Amendment to Purchase Agreement, dated January 31, 2005, by and among Cincinnati Bell Inc., GS Mezzanine... -

Page 163

...). Cincinnati Bell Inc. 1989 Stock Option Plan (Exhibit (10)(iii)(A)(14) to Annual Report on Form 10-K for 1989, File No. 1-8519). Employment Agreement effective December 4, 2001 between the Company and Michael W. Callaghan (Exhibit (10)(iii)(A)(10) to Annual Report on Form 10-K for the year ended... -

Page 164

... the Company and Brian A. Ross (Exhibit 10.2 to Current Report on Form 8-K, date of Report July 29, 2005, File No. 1-8519). Code of Ethics for Senior Financial Officers, as adopted pursuant to Section 406 of Regulation S-K (Exhibit (10)(iii)(A)(15) to Annual Report on Form 10-K for the year ended... -

Page 165

...-Oxley Act of 2002. Filed herewith. Management contract or compensatory plan required to be filed as an exhibit pursuant to Item 14(c) of Form 10-K. The Company's reports on Form 10-K, 10-Q, and 8-K are available free of charge at the following website: http://www.cincinnatibell.com. Upon request... -

Page 166

Schedule II CINCINNATI BELL INC. VALUATION AND QUALIFYING ACCOUNTS (dollars in millions) Beginning of Period Charge (Benefit) to Expenses To (from) Other Accounts Deductions End of Period Allowance for Doubtful Accounts Year 2005 ...$ Year 2004 ...$ Year 2003 ...$ 14.5 20.2 53.0 $ $ $ 14.3 15.9 ... -

Page 167

..., thereunto duly authorized. CINCINNATI BELL INC. By /s/ Brian A. Ross Brian A. Ross Chief Financial Officer By /s/ Kurt A. Freyberger Kurt A. Freyberger Chief Accounting Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following... -

Page 168

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 169

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 170

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 171

... 4th Street, Cincinnati, Ohio 45202 Investor Relations Contact Tony Schulte Vice President, Investor Relations and Corporate Communications (513) 397-9540 Transfer Agent and Registrar Questions regarding registered shareholder accounts or the Stock Purchase Plan should be directed to Cincinnati Bell... -

Page 172

201 East Fourth Street P.O. Box 2301 Cincinnati, Ohio 45202 513.397.9900 www.cincinnatibell.com